Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 1 January 2022, A Co purchased 90% of the equity of B Co from B's existing owners. The following transactions arose on or

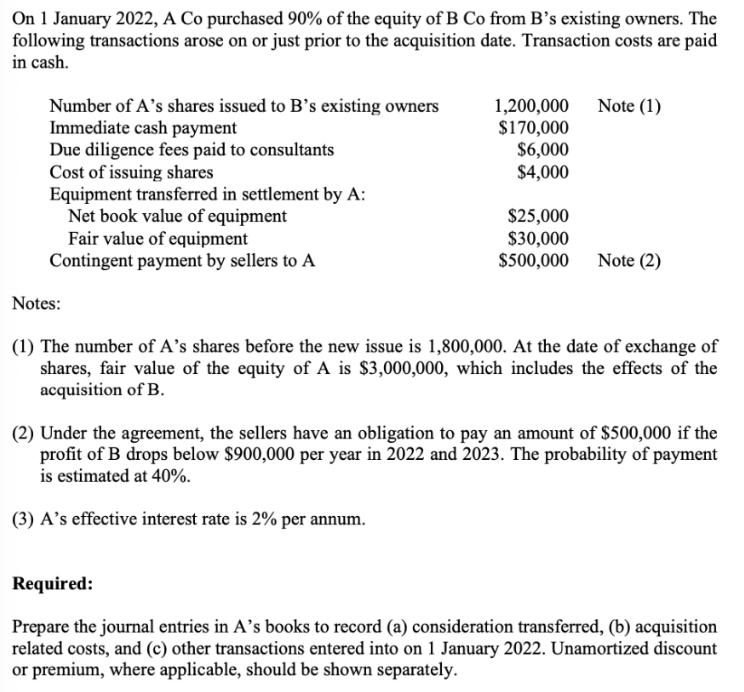

On 1 January 2022, A Co purchased 90% of the equity of B Co from B's existing owners. The following transactions arose on or just prior to the acquisition date. Transaction costs are paid in cash. Number of A's shares issued to B's existing owners Immediate cash payment Due diligence fees paid to consultants Cost of issuing shares Equipment transferred in settlement by A: Net book value of equipment Fair value of equipment Contingent payment by sellers to A Notes: 1,200,000 Note (1) $170,000 $6,000 $4,000 $25,000 $30,000 $500,000 Note (2) (1) The number of A's shares before the new issue is 1,800,000. At the date of exchange of shares, fair value of the equity of A is $3,000,000, which includes the effects of the acquisition of B. (2) Under the agreement, the sellers have an obligation to pay an amount of $500,000 if the profit of B drops below $900,000 per year in 2022 and 2023. The probability of payment is estimated at 40%. (3) A's effective interest rate is 2% per annum. Required: Prepare the journal entries in A's books to record (a) consideration transferred, (b) acquisition related costs, and (c) other transactions entered into on 1 January 2022. Unamortized discount or premium, where applicable, should be shown separately.

Step by Step Solution

★★★★★

3.44 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

Answer a Consideration transferred 1 Dr Equipment 25000 2 Dr Investment in B C...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started