Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 1 January 2022, Fortune Kiwi Ltd invested in a short-term bonds for liquidity purposes for cash consideration of $1,000,000 including transaction costs. Fortune

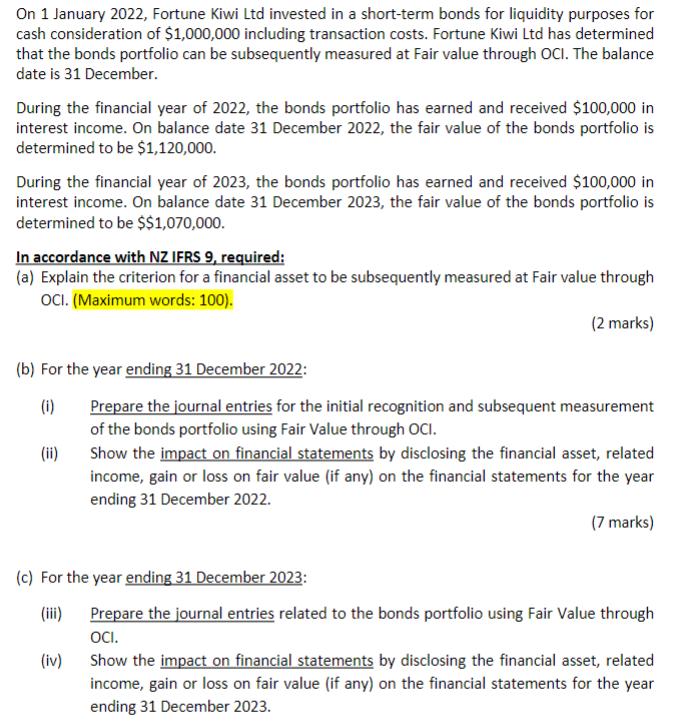

On 1 January 2022, Fortune Kiwi Ltd invested in a short-term bonds for liquidity purposes for cash consideration of $1,000,000 including transaction costs. Fortune Kiwi Ltd has determined that the bonds portfolio can be subsequently measured at Fair value through OCI. The balance date is 31 December. During the financial year of 2022, the bonds portfolio has earned and received $100,000 in interest income. On balance date 31 December 2022, the fair value of the bonds portfolio is determined to be $1,120,000. During the financial year of 2023, the bonds portfolio has earned and received $100,000 in interest income. On balance date 31 December 2023, the fair value of the bonds portfolio is determined to be $$1,070,000. In accordance with NZ IFRS 9, required: (a) Explain the criterion for a financial asset to be subsequently measured at Fair value through OCI. (Maximum words: 100). (2 marks) (b) For the year ending 31 December 2022: (1) Prepare the journal entries for the initial recognition and subsequent measurement of the bonds portfolio using Fair Value through OCI. (iv) Show the impact on financial statements by disclosing the financial asset, related income, gain or loss on fair value (if any) on the financial statements for the year ending 31 December 2022. (c) For the year ending 31 December 2023: (7 marks) Prepare the journal entries related to the bonds portfolio using Fair Value through OCI. Show the impact on financial statements by disclosing the financial asset, related income, gain or loss on fair value (if any) on the financial statements for the year ending 31 December 2023.

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a The criterion for a financial asset to be subsequently measured at Fair value through OCI is that ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started