Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 1 January 2023; Allan and Shem entered into a joint venture to buy and sell goods. It was agreed that Allan should receive

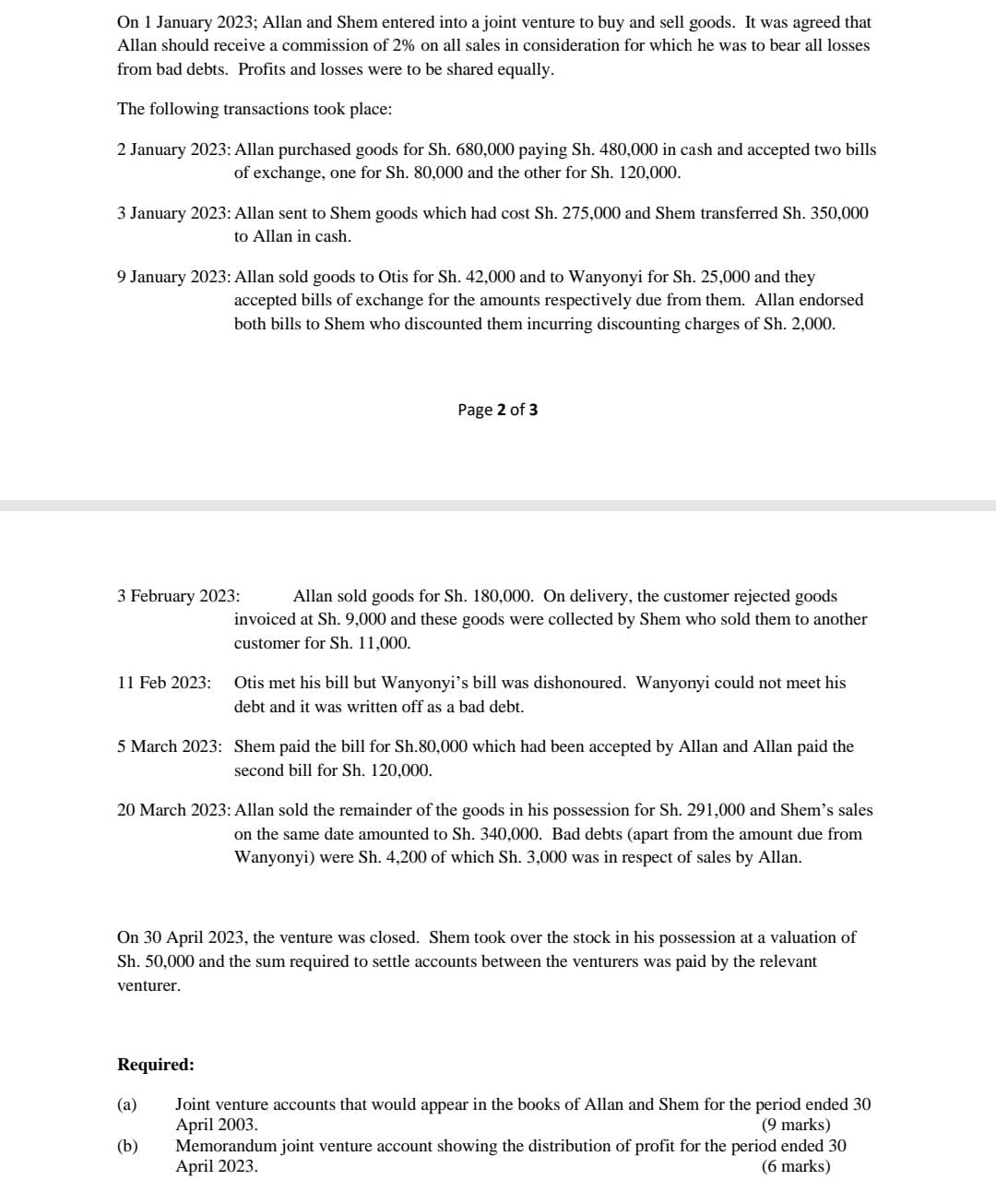

On 1 January 2023; Allan and Shem entered into a joint venture to buy and sell goods. It was agreed that Allan should receive a commission of 2% on all sales in consideration for which he was to bear all losses from bad debts. Profits and losses were to be shared equally. The following transactions took place: 2 January 2023: Allan purchased goods for Sh. 680,000 paying Sh. 480,000 in cash and accepted two bills of exchange, one for Sh. 80,000 and the other for Sh. 120,000. 3 January 2023: Allan sent to Shem goods which had cost Sh. 275,000 and Shem transferred Sh. 350,000 to Allan in cash. 9 January 2023: Allan sold goods to Otis for Sh. 42,000 and to Wanyonyi for Sh. 25,000 and they accepted bills of exchange for the amounts respectively due from them. Allan endorsed both bills to Shem who discounted them incurring discounting charges of Sh. 2,000. Page 2 of 3 3 February 2023: Allan sold goods for Sh. 180,000. On delivery, the customer rejected goods invoiced at Sh. 9,000 and these goods were collected by Shem who sold them to another customer for Sh. 11,000. 11 Feb 2023: Otis met his bill but Wanyonyi's bill was dishonoured. Wanyonyi could not meet his debt and it was written off as a bad debt. 5 March 2023: Shem paid the bill for Sh.80,000 which had been accepted by Allan and Allan paid the second bill for Sh. 120,000. 20 March 2023: Allan sold the remainder of the goods in his possession for Sh. 291,000 and Shem's sales on the same date amounted to Sh. 340,000. Bad debts (apart from the amount due from Wanyonyi) were Sh. 4,200 of which Sh. 3,000 was in respect of sales by Allan. On 30 April 2023, the venture was closed. Shem took over the stock in his possession at a valuation of Sh. 50,000 and the sum required to settle accounts between the venturers was paid by the relevant venturer. Required: (a) (b) Joint venture accounts that would appear in the books of Allan and Shem for the period ended 30 April 2003. (9 marks) Memorandum joint venture account showing the distribution of profit for the period ended 30 April 2023. (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started