Question

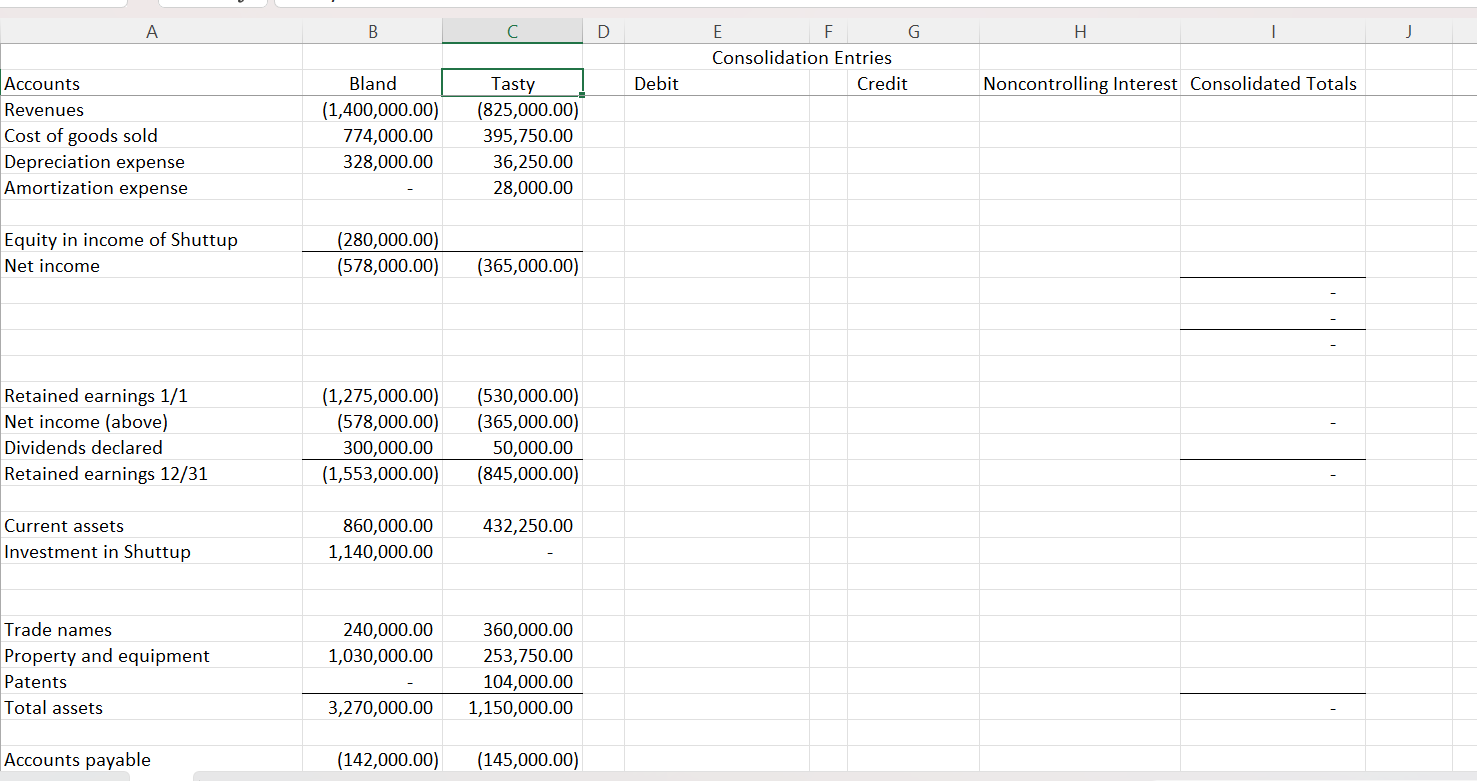

On 1 January 2023, Bland Company acquired 75% of the outstanding common stock of Tasty, Inc, in exchange for $843,750 cash. As of the acquisition

On 1 January 2023, Bland Company acquired 75% of the outstanding common stock of Tasty, Inc, in exchange for $843,750 cash. As of the acquisition date, Bland estimated Tastys total fair value to be $1,125,000, which includes the noncontrolling interest. Tastys book value at the time of acquisition was $690,000.

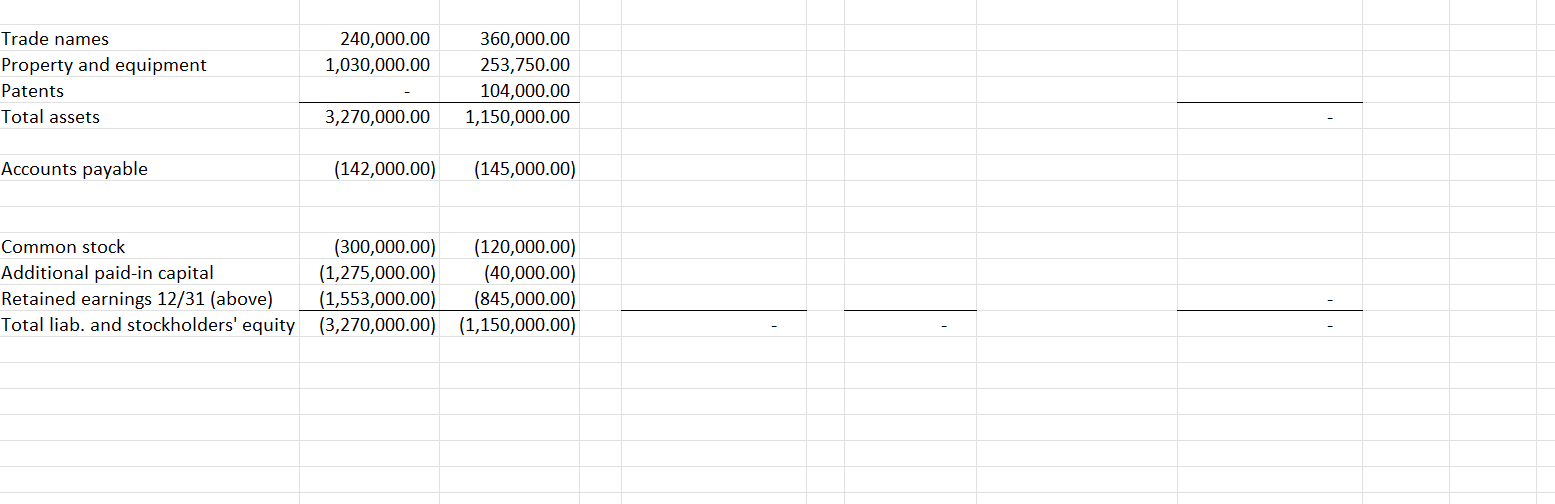

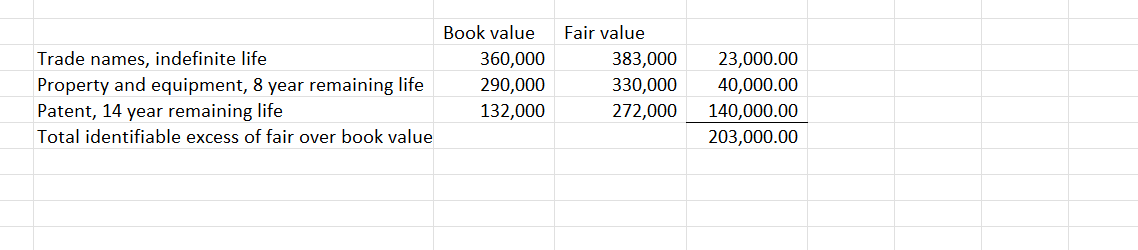

Three items on Tastys books were identified to have fair values different from their book values. The amounts are on the spreadsheet along with 31 December 2023 balances for both companies.

Bland uses the equity method to account for its investment in Tasty. There were no intra-entity receivables or payables outstanding at year-end.

Required: Prepare the consolidation worksheet for Bland and Tasty for 2023 in the spreadsheet. Use formulas as much as possible. Include the following:

- Reconciliation of fair value to book value acquired

- Amortization schedule for undervalued assets

- All required consolidation entries in general journal format. You may enter these starting on row 38 below the account balances. Identify each entry using the letter system we have used in class.

- The complete consolidation worksheet, including the noncontrolling interest. Again, identify entries S, A, I, D, E, and any others necessary in columns D and F.

\begin{tabular}{|l|r|r|r||||||} \hline & Book value & Fair value & \\ \hline Trade names, indefinite life & 360,000 & 383,000 & 23,000.00 \\ \hline Property and equipment, 8 year remaining life & 290,000 & 330,000 & 40,000.00 \\ \hline Patent, 14 year remaining life & 132,000 & 272,000 & 140,000.00 \\ \hline Total identifiable excess of fair over book value & & & 203,000.00 \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} \begin{tabular}{|l|r|r|r||||||} \hline & Book value & Fair value & \\ \hline Trade names, indefinite life & 360,000 & 383,000 & 23,000.00 \\ \hline Property and equipment, 8 year remaining life & 290,000 & 330,000 & 40,000.00 \\ \hline Patent, 14 year remaining life & 132,000 & 272,000 & 140,000.00 \\ \hline Total identifiable excess of fair over book value & & & 203,000.00 \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular}

\begin{tabular}{|l|r|r|r||||||} \hline & Book value & Fair value & \\ \hline Trade names, indefinite life & 360,000 & 383,000 & 23,000.00 \\ \hline Property and equipment, 8 year remaining life & 290,000 & 330,000 & 40,000.00 \\ \hline Patent, 14 year remaining life & 132,000 & 272,000 & 140,000.00 \\ \hline Total identifiable excess of fair over book value & & & 203,000.00 \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} \begin{tabular}{|l|r|r|r||||||} \hline & Book value & Fair value & \\ \hline Trade names, indefinite life & 360,000 & 383,000 & 23,000.00 \\ \hline Property and equipment, 8 year remaining life & 290,000 & 330,000 & 40,000.00 \\ \hline Patent, 14 year remaining life & 132,000 & 272,000 & 140,000.00 \\ \hline Total identifiable excess of fair over book value & & & 203,000.00 \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started