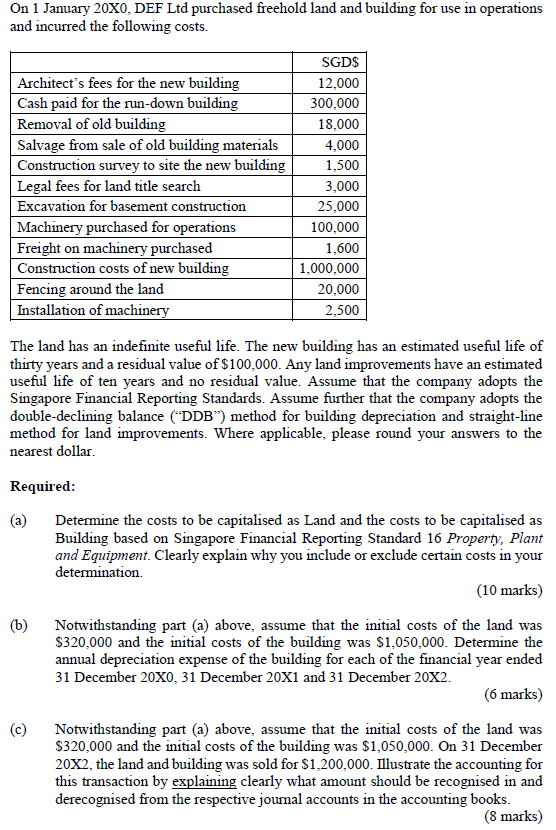

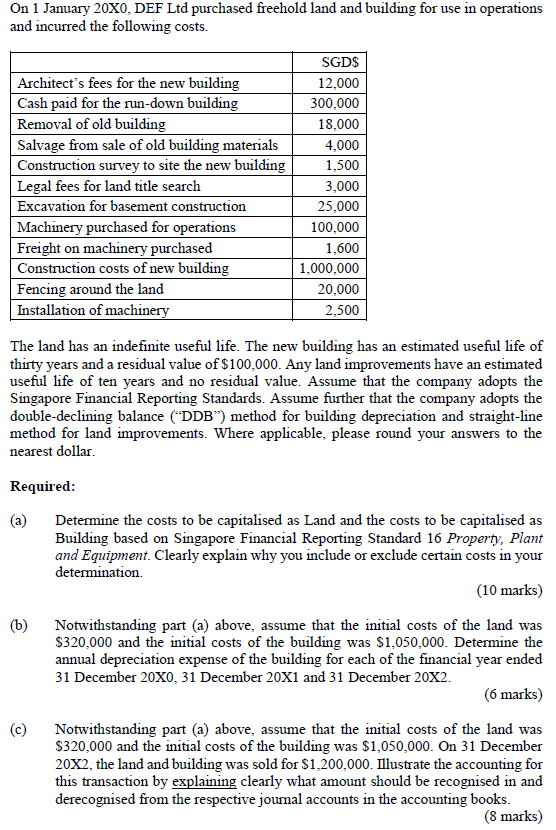

On 1 January 20X0, DEF Ltd purchased freehold land and building for use in operations and incurred the following costs. Architect's fees for the new building Cash paid for the run-down building Removal of old building Salvage from sale of old building materials Construction survey to site the new building Legal fees for land title search Excavation for basement construction Machinery purchased for operations Freight on machinery purchased Construction costs of new building Fencing around the land Installation of machinery SGD$ 12,000 300,000 18,000 4,000 1,500 3,000 25,000 100,000 1,600 1,000,000 20,000 2,500 The land has an indefinite useful life. The new building has an estimated useful life of thirty years and a residual value of $100,000. Any land improvements have an estimated useful life of ten years and no residual value. Assume that the company adopts the Singapore Financial Reporting Standards. Assume further that the company adopts the double-declining balance (DDB) method for building depreciation and straight-line method for land improvements. Where applicable, please round your answers to the nearest dollar. Required: (a) (b) Determine the costs to be capitalised as Land and the costs to be capitalised as Building based on Singapore Financial Reporting Standard 16 Property, Plant and Equipment. Clearly explain why you include or exclude certain costs in your determination (10 marks) Notwithstanding part (a) above, assume that the initial costs of the land was $320,000 and the initial costs of the building was $1,050,000. Determine the annual depreciation expense of the building for each of the financial year ended 31 December 20X0, 31 December 20X1 and 31 December 20X2. (6 marks) Notwithstanding part (a) above, assume that the initial costs of the land was $320,000 and the initial costs of the building was $1,050,000. On 31 December 20X2, the land and building was sold for $1,200,000. Tllustrate the accounting for this transaction by explaining clearly what amount should be recognised in and derecognised from the respective journal accounts in the accounting books. (8 marks)