Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 1 January, Laja Bhd owes the Arbor Bank Bhd RM350,000 which is due on December 31. Since Laja seems unable to repay the

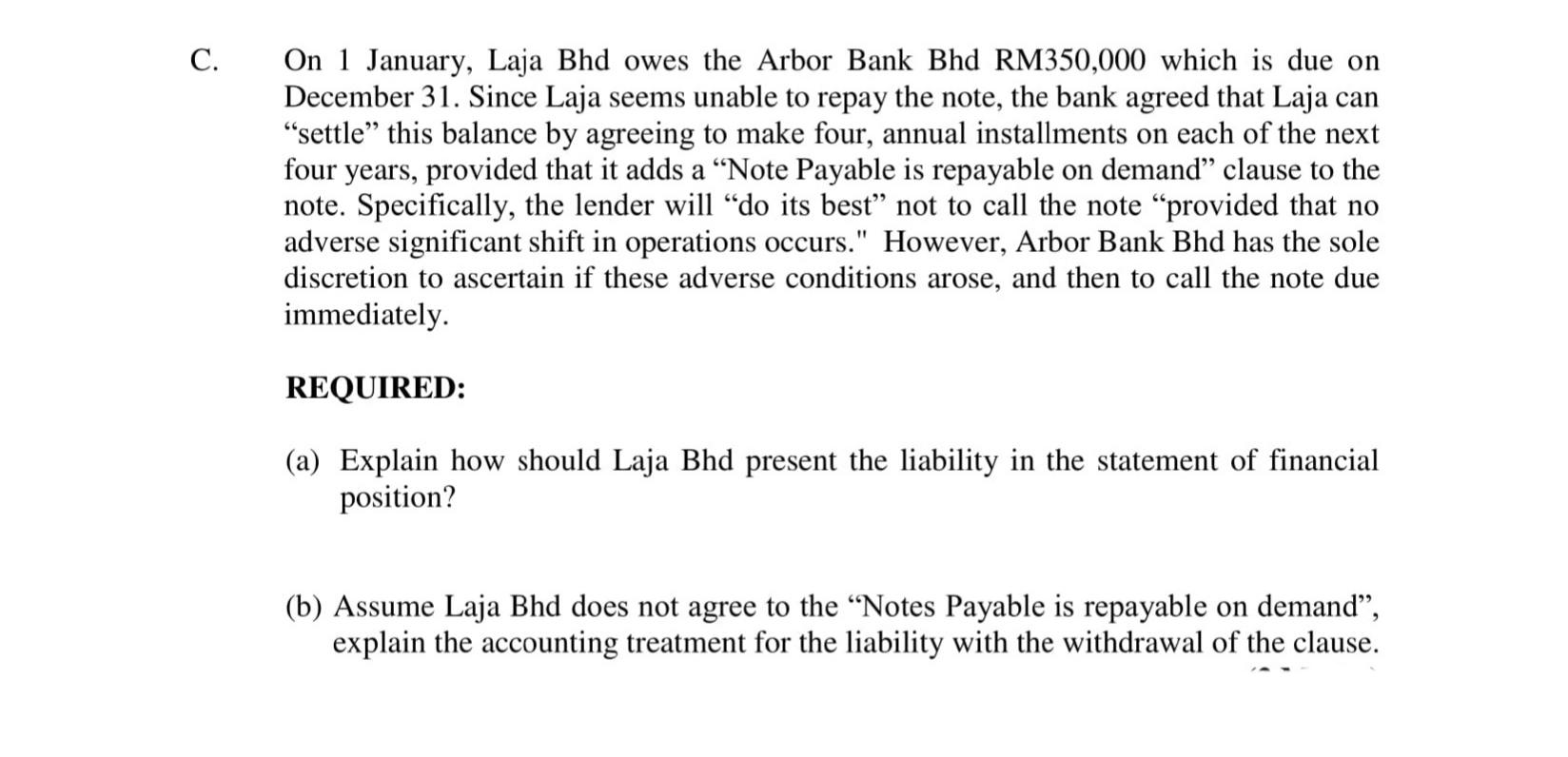

On 1 January, Laja Bhd owes the Arbor Bank Bhd RM350,000 which is due on December 31. Since Laja seems unable to repay the note, the bank agreed that Laja can "settle" this balance by agreeing to make four, annual installments on each of the next four years, provided that it adds a "Note Payable is repayable on demand" clause to the note. Specifically, the lender will "do its best" not to call the note "provided that no adverse significant shift in operations occurs." However, Arbor Bank Bhd has the sole discretion to ascertain if these adverse conditions arose, and then to call the note due immediately. C. REQUIRED: (a) Explain how should Laja Bhd present the liability in the statement of financial position? (b) Assume Laja Bhd does not agree to the "Notes Payable is repayable on demand", explain the accounting treatment for the liability with the withdrawal of the clause.

Step by Step Solution

★★★★★

3.50 Rating (143 Votes )

There are 3 Steps involved in it

Step: 1

Step 1 Notes payable is the liability on the company now it depends upon the time regarding ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started