On 1 January Mr G started a small business buying and selling a special yarn. He invested his savings of 40,000 in the business and,

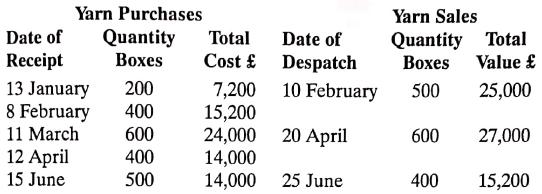

On 1 January Mr G started a small business buying and selling a special yarn. He invested his savings of £40,000 in the business and, during the next six months, the following transactions occurred:

The yarn is stored in premises Mr G has rented and the closing stock of yarn, counted on 30 June, was 500 boxes. Other expenses incurred, and paid in cash, during the six month period amounted to £2,300.

Required:

a. Calculate the value of the material issues during the six month period, and the value of the closing stock at the end of June, using the following methods of pricing:

i. first in, first out,

ii. last in, first out, and

iii. weighted average (calculations to two decimal places only).

b. Calculate and discuss the effect each of the three methods of material pricing will have on the reported profit of the business and examine the performance of the business during the first six-month period.

Yarn Purchases Yarn Sales Quantity Quantity Total Boxes Value Date of Total Date of Receipt es Cost Despatch 13 January 8 February 11 March 200 7,200 10 February 15,200 24,000 20 April 14,000 14,000 500 25,000 400 600 600 27,000 12 April 400 15 June 500 25 June 400 15,200

Step by Step Solution

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

You can ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started