Question

On 1 July 2013 Daffy Ltd acquired all of the share capital (cum div)of Duck Limited for a consideration of $600,000 cash and a brand

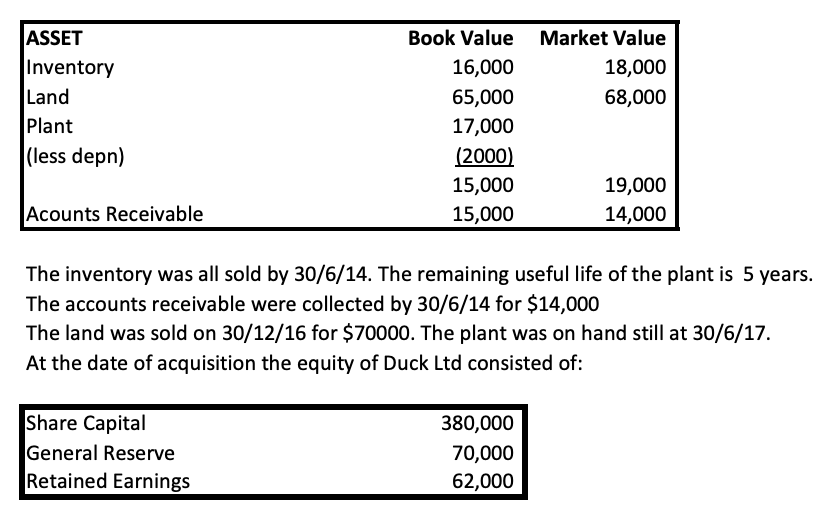

On 1 July 2013 Daffy Ltd acquired all of the share capital (cum div)of Duck Limited for a consideration of $600,000 cash and a brand that was held in their accounts at a book value of $10,000 but now had a fair value of $24,000. At the date of acquisition Duck's accounts showed a dividend payable of $10,000. At that date all the identifiable assets and liabilities were recorded at fair value with the exception of:

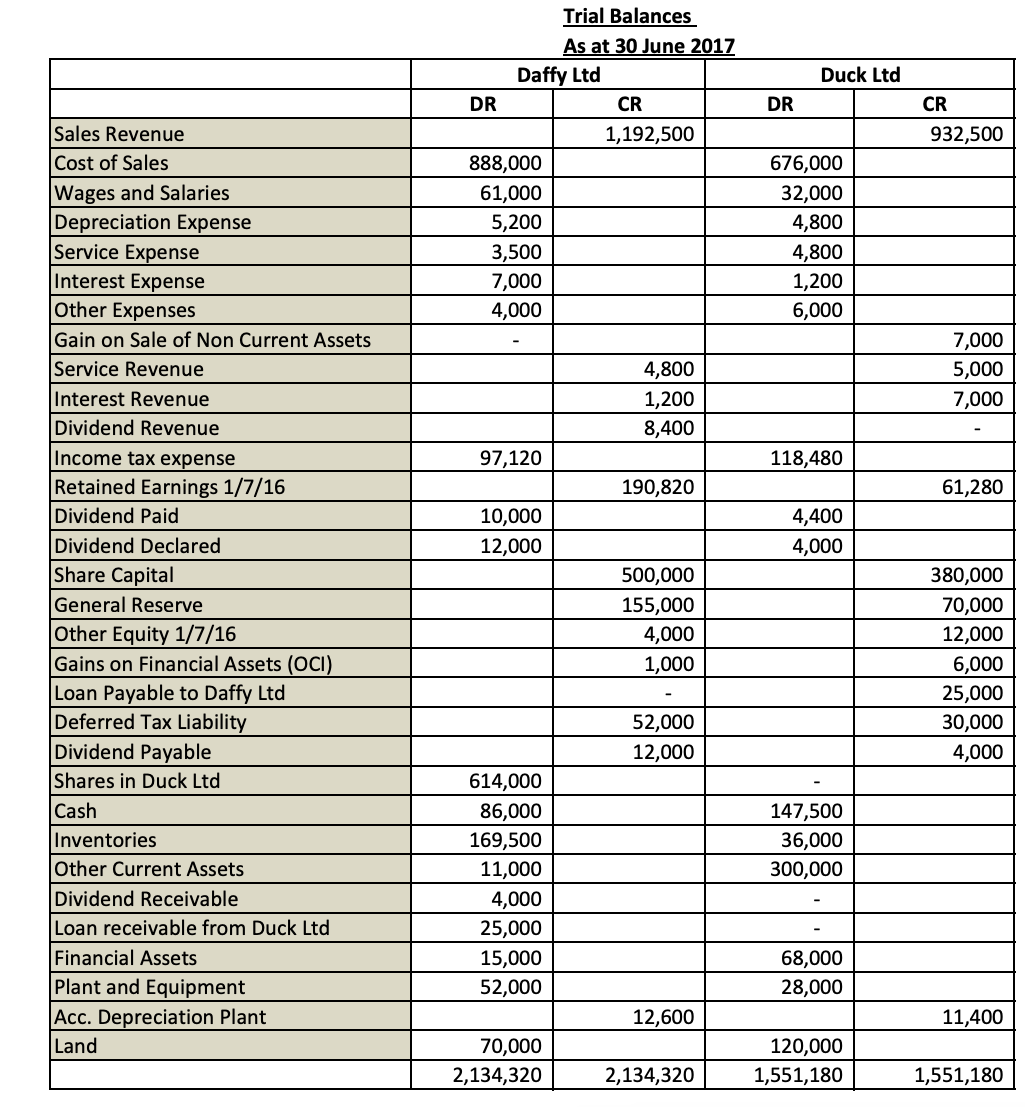

Information from the trial balances of Duck Ltd and Daffy Ltd at 30 June 2017 is presented overleaf.

Additional Information

1. On 1 Jan 2017 Daffy Ltd sold inventory to Duck Ltd costing $70,000 for $80,000. Half of this inventory was sold to outside parties by 30/6/17.

2. On 1 Jan 2016 Daffy Ltd sold inventory costing $12000 to Duck Ltd for $15,000. Duck Ltd treats the item as equipment and depreciates it at 10% per annum.

3.On 1 July 2016 Daffy sold plant to Duck for $21,000. The plant had cost Daffy $24,000 on 1 July 2014 and it was being depreciated at 10% per annum. Duck regards the plant as inventory. The inventory was all sold by 30th July 2016.

4. At 1 July 2016 Daffy Ltd held inventory that it had purchased from Duck Ltd on 1 June 2016 at a profit of $5000. All inventory was sold by 30 June 2017

5. Duck Ltd accrues dividends from Daffy Ltd once they are declared.

6. Duck Ltd has earned $1600 in interest revenue in the 2017 financial year from Daffy Ltd.

7. Duck Ltd has earned $3500 in service revenue in the 2017 financial year from Daffy Ltd.

8. Assume a tax rate of 30%.

REQUIRED:

A. Prepare the consolidation worksheet for the preparation of the consolidated financial statements for the period ended 30 June 2017.

B. Prepare the consolidated statement of profit or loss and other comprehensive income, the consolidated balance sheet and the consolidated statement of changes in equity for the period ended 30 June 2017.

The inventory was all sold by 30/6/14. The remaining useful life of the plant is 5 years. The accounts receivable were collected by 30/6/14 for $14,000 The land was sold on 30/12/16 for $70000. The plant was on hand still at 30/6/17. At the date of acquisition the equity of Duck Ltd consisted of: TrialBalances As at 30 June 2017 \begin{tabular}{|c|c|c|c|c|} \hline & \multicolumn{2}{|c|}{ Daffy Ltd } & \multicolumn{2}{|c|}{ Duck Ltd } \\ \hline & DR & CR & DR & CR \\ \hline Sales Revenue & & 1,192,500 & & 932,500 \\ \hline Cost of Sales & 888,000 & & 676,000 & \\ \hline Wages and Salaries & 61,000 & & 32,000 & \\ \hline Depreciation Expense & 5,200 & & 4,800 & \\ \hline Service Expense & 3,500 & & 4,800 & \\ \hline Interest Expense & 7,000 & & 1,200 & \\ \hline Other Expenses & 4,000 & & 6,000 & \\ \hline Gain on Sale of Non Current Assets & - & & & 7,000 \\ \hline Service Revenue & & 4,800 & & 5,000 \\ \hline Interest Revenue & & 1,200 & & 7,000 \\ \hline Dividend Revenue & & 8,400 & & - \\ \hline Income tax expense & 97,120 & & 118,480 & \\ \hline Retained Earnings 1/7/16 & & 190,820 & & 61,280 \\ \hline Dividend Paid & 10,000 & & 4,400 & \\ \hline Dividend Declared & 12,000 & & 4,000 & \\ \hline Share Capital & & 500,000 & & 380,000 \\ \hline General Reserve & & 155,000 & & 70,000 \\ \hline Other Equity 1/7/16 & & 4,000 & & 12,000 \\ \hline Gains on Financial Assets (OCI) & & 1,000 & & 6,000 \\ \hline Loan Payable to Daffy Ltd & & - & & 25,000 \\ \hline Deferred Tax Liability & & 52,000 & & 30,000 \\ \hline Dividend Payable & & 12,000 & & 4,000 \\ \hline Shares in Duck Ltd & 614,000 & & - & \\ \hline Cash & 86,000 & & 147,500 & \\ \hline Inventories & 169,500 & & 36,000 & \\ \hline Other Current Assets & 11,000 & & 300,000 & \\ \hline Dividend Receivable & 4,000 & & - & \\ \hline Loan receivable from Duck Ltd & 25,000 & & - & \\ \hline Financial Assets & 15,000 & & 68,000 & \\ \hline Plant and Equipment & 52,000 & & 28,000 & \\ \hline Acc. Depreciation Plant & & 12,600 & & 11,400 \\ \hline Land & 70,000 & & 120,000 & \\ \hline & 2,134,320 & 2,134,320 & 1,551,180 & 1,551,180 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started