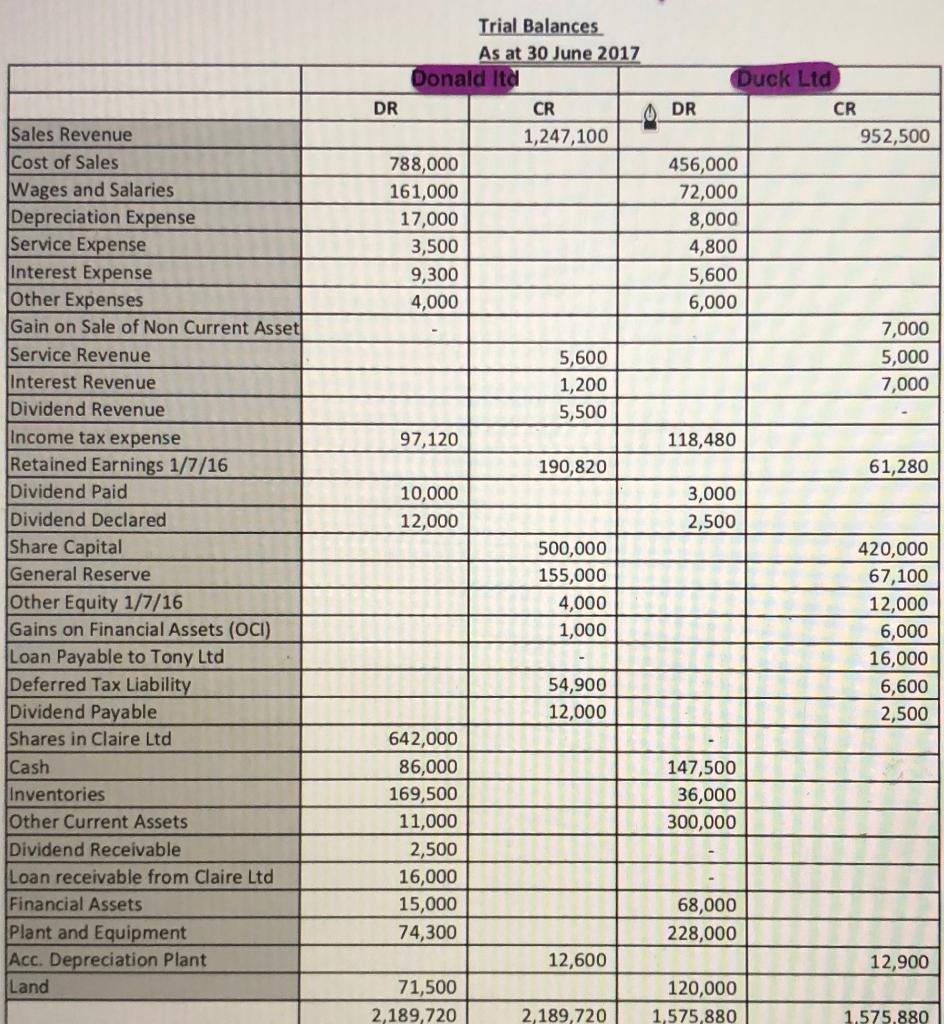

On 1 July 2013 Donald Ltd acquired all of the share capital (cum div) of Duck Limited for a consideration of $600,000 cash and a

On 1 July 2013 Donald Ltd acquired all of the share capital (cum div) of Duck Limited for a consideration of $600,000 cash and a brand that was held in their accounts at a fair value of $50,000. Duck Ltd reported a dividend payable of $8,000 at 1 July 2013.

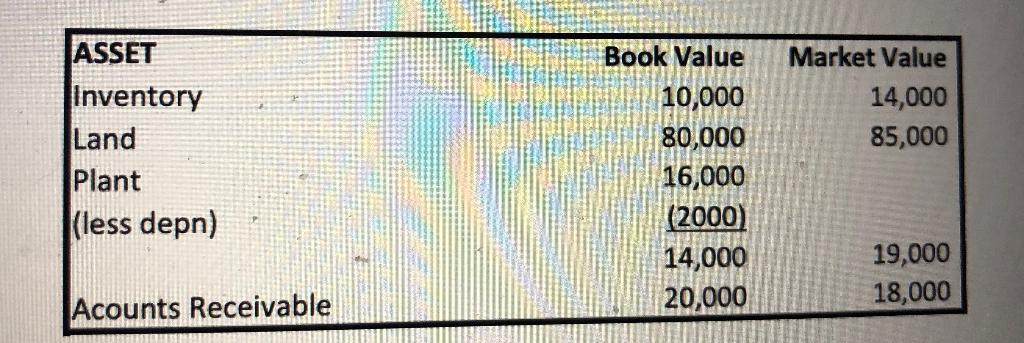

At that date all the identifiable assets and liabilities were recorded at fair value with the exception of:

The inventory was all sold by 30/6/14. The remaining useful life of the plant is 5 years. The accounts receivable were collected by 30/6/14 for $18,000.

The land was sold on 30/12/16 for $90,000. The plant was on hand still at 30/6/17.

At the date of acquisition the equity of Duck Ltd consisted of:

Share capital 420000

General reserve 90000

Retained earnings 70000

Assume a tax rate of 30%.

Required

A. Prepare the acquisition analysis at 1 July 2013.

B. Prepare the BCVR and pre-acquisition journal entries at 1 July 2013.

C. Prepare the BCVR and pre-acquisition journal entries at 30 June 2017.

ASSET Inventory Land Plant (less depn) Book Value Market Value 10,000 14,000 85,000 80,000 16,000 (2000) 14,000 19,000 Acounts Receivable 20,000 18,000

Step by Step Solution

3.33 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Step 1 Acquis...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started