Answered step by step

Verified Expert Solution

Question

1 Approved Answer

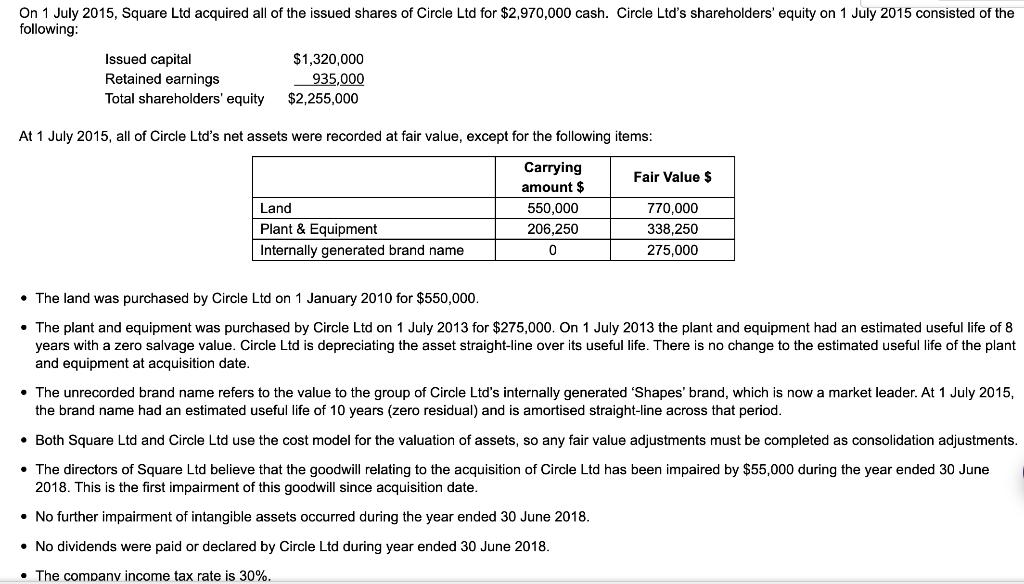

On 1 July 2015, Square Ltd acquired all of the issued shares of Circle Ltd for $2,970,000 cash. Circle Ltd's shareholders' equity on 1

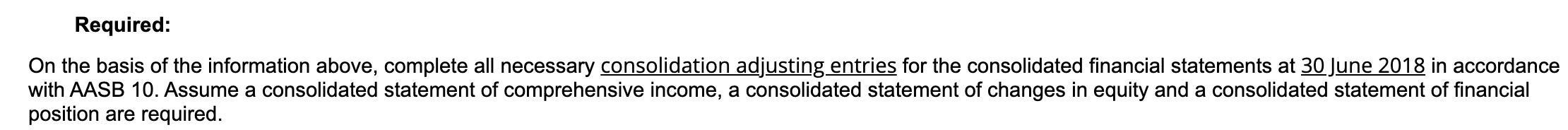

On 1 July 2015, Square Ltd acquired all of the issued shares of Circle Ltd for $2,970,000 cash. Circle Ltd's shareholders' equity on 1 July 2015 consisted of the following: Issued capital Retained earnings Total shareholders' equity $1,320,000 935,000 $2,255,000 At 1 July 2015, all of Circle Ltd's net assets were recorded at fair value, except for the following items: Carrying amount $ Land Plant & Equipment Internally generated brand name 550,000 206,250 0 Fair Value $ 770,000 338,250 275,000 The land was purchased by Circle Ltd on 1 January 2010 for $550,000. The plant and equipment was purchased by Circle Ltd on 1 July 2013 for $275,000. On 1 July 2013 the plant and equipment had an estimated useful life of 8 years with a zero salvage value. Circle Ltd is depreciating the asset straight-line over its useful life. There is no change to the estimated useful life of the plant and equipment at acquisition date. The unrecorded brand name refers to the value to the group of Circle Ltd's internally generated 'Shapes' brand, which is now market leader. At 1 July 2015, the brand name had an estimated useful life of 10 years (zero residual) and is amortised straight-line across that period. Both Square Ltd and Circle Ltd use the cost model for the valuation of assets, so any fair value adjustments must be completed as consolidation adjustments. The directors of Square Ltd believe that the goodwill relating to the acquisition of Circle Ltd has been impaired by $55,000 during the year ended 30 June 2018. This is the first impairment of this goodwill since acquisition date. No further impairment of intangible assets occurred during the year ended 30 June 2018. No dividends were paid or declared by Circle Ltd during year ended 30 June 2018. The company income tax rate is 30%. Required: On the basis of the information above, complete all necessary consolidation adjusting entries for the consolidated financial statements at 30 June 2018 in accordance with AASB 10. Assume a consolidated statement of comprehensive income, a consolidated statement of changes in equity and a consolidated statement of financial position are required.

Step by Step Solution

★★★★★

3.49 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Consolidation Adjusting Entries at 30 June 2018 1 Goodwill Impairment In accordance with AASB 10 an impairment loss of 55000 on the goodwill relating to the acquisition of Circle Ltd must be recognised in the consolidated financial statements at 30 June 2018 The entry to record the impairment loss is as follows Dr Impairment Loss on Goodwill 55000 Cr Goodwill 55000 2 Revaluation of Land As the land was purchased by Circle Ltd on 1 January 2010 for 550000 the carrying amount of 206250 must be revalued to its fair value of 275000 The entry to record the revaluation is as follows Dr Land 68750 Cr Revaluation Reserve 68750 3 Revaluation of Plant and Equipment As the plant and equipment was purchased by Circle Ltd on 1 July 2013 for 275000 the carrying amount of 275000 must be revalued to its fair value of 275000 The entry to record the revaluation is as follows Dr Plant and Equipment 0 Cr Revaluation Reserve 0 4 Amortisation of Internally Generated Brand Name In accordance with AASB 10 the unrecorded brand name must be amortised over its estimated useful life of 10 years with a zero residual value A portion of the amortisation must be recognised in the consolidated financial statements at 30 June 2018 The entry to record the amortisation is as follows Dr Amortisation Expense 27500 Cr Internally Generated Brand Name 27500 5 Acquisition of Circle Ltd In accordance with AASB 10 the acquisition of Circle Ltd must be recognised in the consolidated financial statements at 30 June 2018 The entry to record the acquisition is as follows Dr Cash 2970000 Cr Equity of Circle Ltd 2970000 These entries will result in the recognition of the following amounts in the consolidated statement of financial position at 30 June 2018 Assets Cash 2970000 Land 275000 Plant and Equipment 275000 Internally Generated Brand Name 338250 Liabilities Equity Share Capital 1320000 Retained Earnings 935000 Revaluation Reserve 68750 Goodwill 55000 Impairment Loss on Goodwill 55000 Total Equity 2393750 discuss The above entries are necessary for the consolidation of Square Ltd and Circle Ltd in accordance with AASB 10 The entries detail the acquisition of Circle Ltd by Square Ltd the impairment of the goodwill relating to the acquisition the revaluations of the land and plant and equipment and the amortisation of the internally generated brand name These entries must be recognised in the consolidated financial statements at 30 June 2018 in order to accurately reflect the financial position of the group The entry to record the acquisition of Circle Ltd recognises the cash paid by Square Ltd to acquire all the issued shares of Circle Ltd for 2970000 The other entries recognise ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started