Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 1 July 2016, Faith Ltd acquired an item of plant for $31,864. On the same date, Faith Ltd entered into a three-year lease

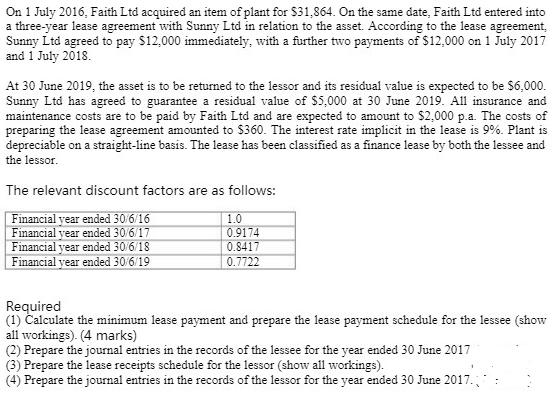

On 1 July 2016, Faith Ltd acquired an item of plant for $31,864. On the same date, Faith Ltd entered into a three-year lease agreement with Sunny Ltd in relation to the asset. According to the lease agreement, Sunny Ltd agreed to pay $12,000 immediately, with a further two payments of $12,000 on 1 July 2017 and 1 July 2018. At 30 June 2019, the asset is to be returned to the lessor and its residual value is expected to be $6,000. Sunny Ltd has agreed to guarantee a residual value of $5,000 at 30 June 2019. All insurance and maintenance costs are to be paid by Faith Ltd and are expected to amount to $2,000 p.a. The costs of preparing the lease agreement amounted to $360. The interest rate implicit in the lease is 9%. Plant is depreciable on a straight-line basis. The lease has been classified as a finance lease by both the lessee and the lessor. The relevant discount factors are as follows: Financial year ended 30/6/16 Financial year ended 30/6/17 Financial year ended 30/6/18 Financial year ended 30/6/19 1.0 0.9174 0.8417 0.7722 Required (1) Calculate the minimum lease payment and prepare the lease payment schedule for the lessee (show all workings). (4 marks) (2) Prepare the journal entries in the records of the lessee for the year ended 30 June 2017 (3) Prepare the lease receipts schedule for the lessor (show all workings). (4) Prepare the journal entries in the records of the lessor for the year ended 30 June 2017.,

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started