Answered step by step

Verified Expert Solution

Question

1 Approved Answer

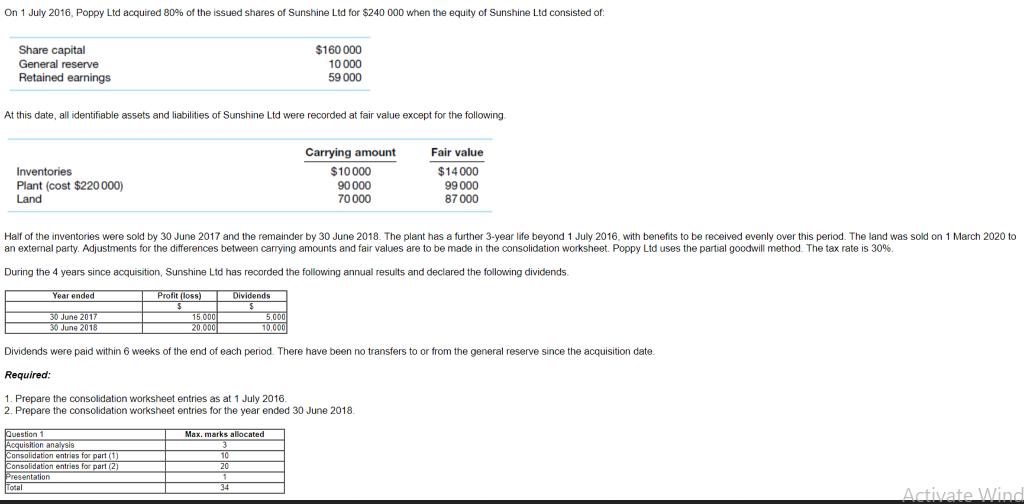

On 1 July 2016, Poppy Ltd acquired 80% of the issued shares of Sunshine Ltd for $240 000 when the equity of Sunshine Ltd

On 1 July 2016, Poppy Ltd acquired 80% of the issued shares of Sunshine Ltd for $240 000 when the equity of Sunshine Ltd consisted of: Share capital General reserve Retained earnings At this date, all identifiable assets and liabilities of Sunshine Ltd were recorded at fair value except for the following Inventories Plant (cost $220 000) Land Year ended 30 June 2017 30 June 2018 Half of the inventories were sold by 30 June 2017 and the remainder by 30 June 2018. The plant has a further 3-year life beyond 1 July 2016, with benefits to be received evenly over this period. The land was sold on 1 March 2020 to an external party. Adjustments for the differences between carrying amounts and fair values are to be made in the consolidation worksheet. Poppy Ltd uses the partial goodwill method. The tax rate is 30%. During the 4 years since acquisition, Sunshine Ltd has recorded the following annual results and declared the following dividends. Profit (loss) $ 15,000 20,000 Question 1 Acquisition analysis Consolidation entries for part (1) Consolidation entries for part (2) Presentation Total Dividends $ $160 000 10 000 59 000 5,000 10.000 Carrying amount $10000 90 000 70 000 Dividends were paid within 6 weeks of the end of each period. There have been no transfers to or from the general reserve since the acquisition date. Required: 1. Prepare the consolidation worksheet entries as at 1 July 2016. 2. Prepare the consolidation worksheet entries for the year ended 30 June 2018 Max. marks allocated 3 10 20 1 34 Fair value $14000 99 000 87 000 Activate Wind

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To prepare the consolidation worksheet entries for Poppy Ltds acquisition of Sunshine Ltd on 1st July 2016 and for the year ended 30th June 2018 youll need to follow the steps for consolidation Poppy ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started