On 1 July 2020, a taxpayer that is not a small business entity acquired a new depreciating asset at a cost of $3,000,000. The

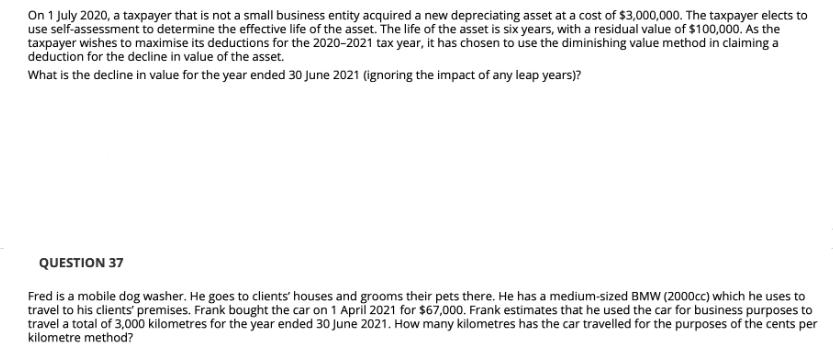

On 1 July 2020, a taxpayer that is not a small business entity acquired a new depreciating asset at a cost of $3,000,000. The taxpayer elects to use self-assessment to determine the effective life of the asset. The life of the asset is six years, with a residual value of $100,000. As the taxpayer wishes to maximise its deductions for the 2020-2021 tax year, it has chosen to use the diminishing value method in claiming a deduction for the decline in value of the asset. What is the decline in value for the year ended 30 June 2021 (ignoring the impact of any leap years)? QUESTION 37 Fred is a mobile dog washer. He goes to clients' houses and grooms their pets there. He has a medium-sized BMW (2000cc) which he uses to travel to his clients' premises. Frank bought the car on 1 April 2021 for $67,000. Frank estimates that he used the car for business purposes to travel a total of 3,000 kilometres for the year ended 30 June 2021. How many kilometres has the car travelled for the purposes of the cents per kilometre method?

Step by Step Solution

3.33 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the decline in value for the year ended 30 June 2021 we can use the diminishing value m...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started