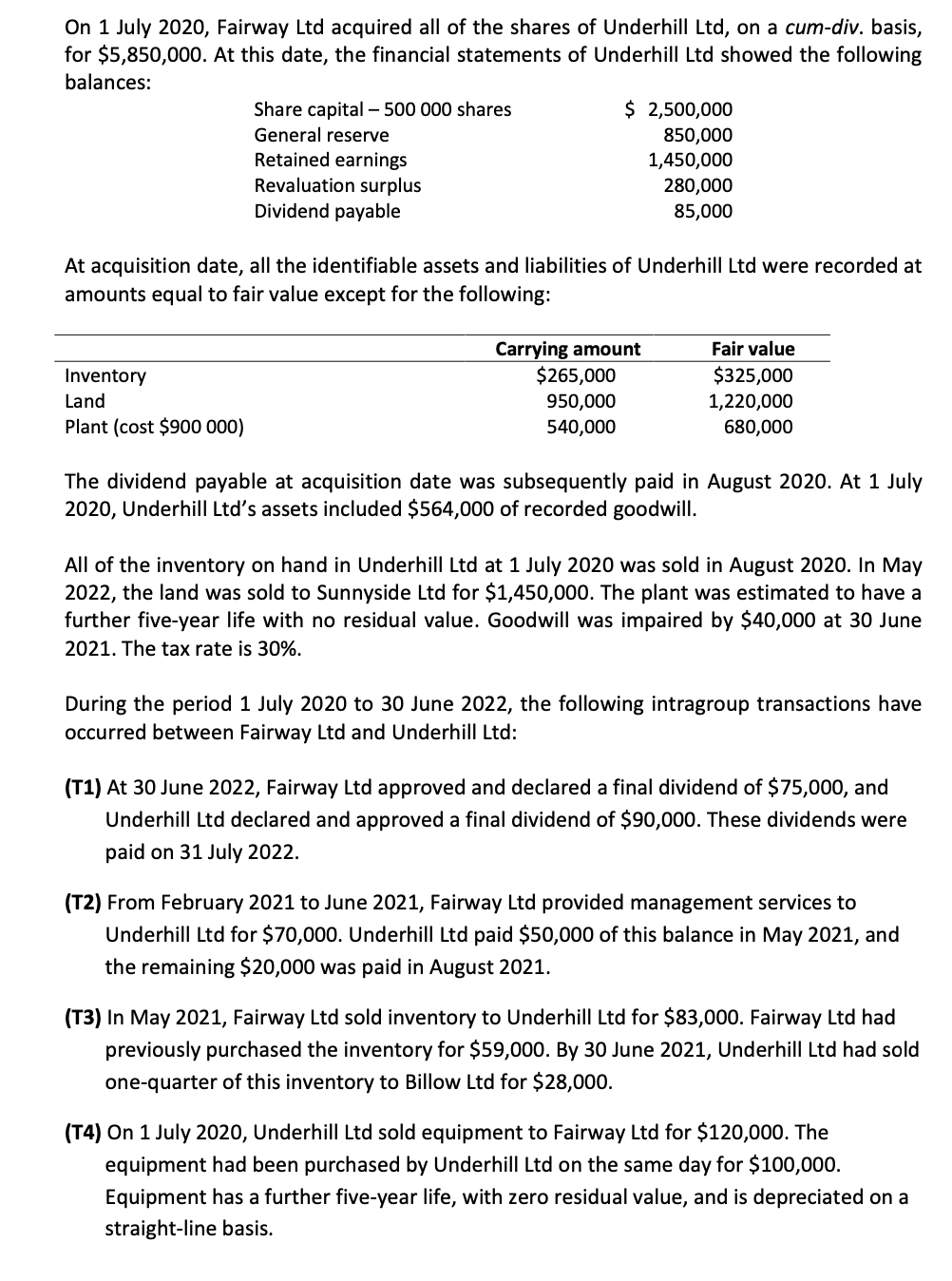

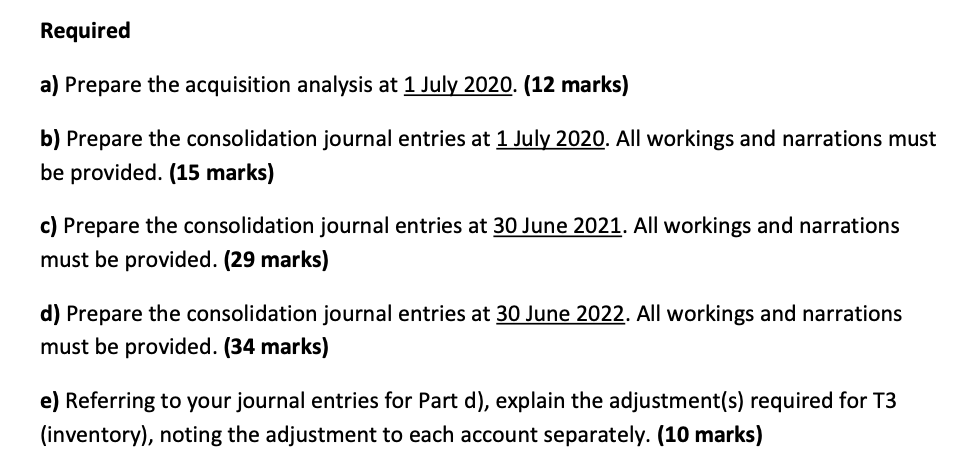

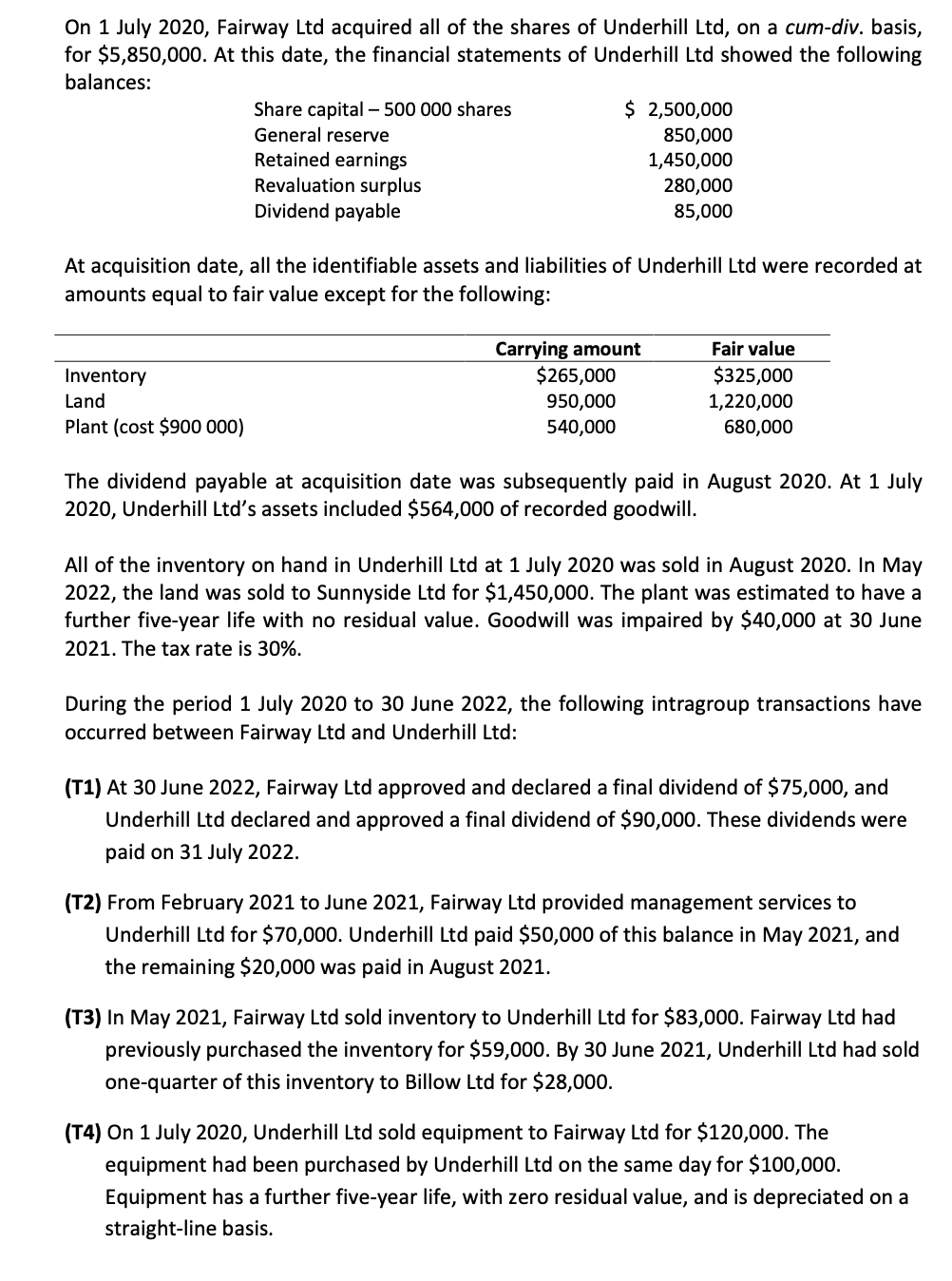

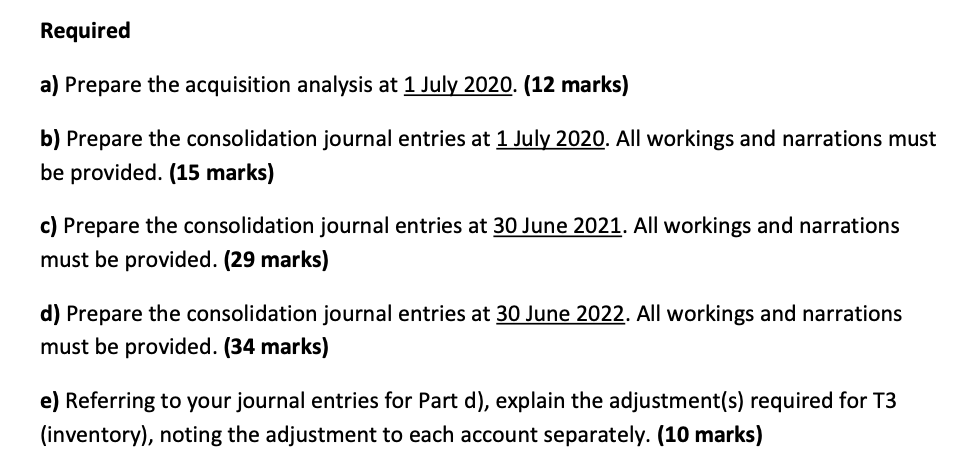

On 1 July 2020, Fairway Ltd acquired all of the shares of Underhill Ltd, on a cum-div. basis, for $5,850,000. At this date, the financial statements of Underhill Ltd showed the following balances: Share capital - 500 000 shares $ 2,500,000 General reserve 850,000 Retained earnings 1,450,000 Revaluation surplus 280,000 Dividend payable 85,000 At acquisition date, all the identifiable assets and liabilities of Underhill Ltd were recorded at amounts equal to fair value except for the following: Inventory Land Plant (cost $900 000) Carrying amount $265,000 950,000 540,000 Fair value $325,000 1,220,000 680,000 The dividend payable at acquisition date was subsequently paid in August 2020. At 1 July 2020, Underhill Ltd's assets included $564,000 of recorded goodwill. All of the inventory on hand in Underhill Ltd at 1 July 2020 was sold in August 2020. In May 2022, the land was sold to Sunnyside Ltd for $1,450,000. The plant was estimated to have a further five-year life with no residual value. Goodwill was impaired by $40,000 at 30 June 2021. The tax rate is 30%. During the period 1 July 2020 to 30 June 2022, the following intragroup transactions have occurred between Fairway Ltd and Underhill Ltd: (T1) At 30 June 2022, Fairway Ltd approved and declared a final dividend of $75,000, and Underhill Ltd declared and approved a final dividend of $90,000. These dividends were paid on 31 July 2022. (T2) From February 2021 to June 2021, Fairway Ltd provided management services to Underhill Ltd for $70,000. Underhill Ltd paid $50,000 of this balance in May 2021, and the remaining $20,000 was paid in August 2021. (T3) In May 2021, Fairway Ltd sold inventory to Underhill Ltd for $83,000. Fairway Ltd had previously purchased the inventory for $59,000. By 30 June 2021, Underhill Ltd had sold one-quarter of this inventory to Billow Ltd for $28,000. (T4) On 1 July 2020, Underhill Ltd sold equipment to Fairway Ltd for $120,000. The equipment had been purchased by Underhill Ltd on the same day for $100,000. Equipment has a further five-year life, with zero residual value, and is depreciated on a straight-line basis. Required a) Prepare the acquisition analysis at 1 July 2020. (12 marks) b) Prepare the consolidation journal entries at 1 July 2020. All workings and narrations must be provided. (15 marks) c) Prepare the consolidation journal entries at 30 June 2021. All workings and narrations must be provided. (29 marks) d) Prepare the consolidation journal entries at 30 June 2022. All workings and narrations must be provided. (34 marks) e) Referring to your journal entries for Part d), explain the adjustment(s) required for T3 (inventory), noting the adjustment to each account separately. (10 marks) On 1 July 2020, Fairway Ltd acquired all of the shares of Underhill Ltd, on a cum-div. basis, for $5,850,000. At this date, the financial statements of Underhill Ltd showed the following balances: Share capital - 500 000 shares $ 2,500,000 General reserve 850,000 Retained earnings 1,450,000 Revaluation surplus 280,000 Dividend payable 85,000 At acquisition date, all the identifiable assets and liabilities of Underhill Ltd were recorded at amounts equal to fair value except for the following: Inventory Land Plant (cost $900 000) Carrying amount $265,000 950,000 540,000 Fair value $325,000 1,220,000 680,000 The dividend payable at acquisition date was subsequently paid in August 2020. At 1 July 2020, Underhill Ltd's assets included $564,000 of recorded goodwill. All of the inventory on hand in Underhill Ltd at 1 July 2020 was sold in August 2020. In May 2022, the land was sold to Sunnyside Ltd for $1,450,000. The plant was estimated to have a further five-year life with no residual value. Goodwill was impaired by $40,000 at 30 June 2021. The tax rate is 30%. During the period 1 July 2020 to 30 June 2022, the following intragroup transactions have occurred between Fairway Ltd and Underhill Ltd: (T1) At 30 June 2022, Fairway Ltd approved and declared a final dividend of $75,000, and Underhill Ltd declared and approved a final dividend of $90,000. These dividends were paid on 31 July 2022. (T2) From February 2021 to June 2021, Fairway Ltd provided management services to Underhill Ltd for $70,000. Underhill Ltd paid $50,000 of this balance in May 2021, and the remaining $20,000 was paid in August 2021. (T3) In May 2021, Fairway Ltd sold inventory to Underhill Ltd for $83,000. Fairway Ltd had previously purchased the inventory for $59,000. By 30 June 2021, Underhill Ltd had sold one-quarter of this inventory to Billow Ltd for $28,000. (T4) On 1 July 2020, Underhill Ltd sold equipment to Fairway Ltd for $120,000. The equipment had been purchased by Underhill Ltd on the same day for $100,000. Equipment has a further five-year life, with zero residual value, and is depreciated on a straight-line basis. Required a) Prepare the acquisition analysis at 1 July 2020. (12 marks) b) Prepare the consolidation journal entries at 1 July 2020. All workings and narrations must be provided. (15 marks) c) Prepare the consolidation journal entries at 30 June 2021. All workings and narrations must be provided. (29 marks) d) Prepare the consolidation journal entries at 30 June 2022. All workings and narrations must be provided. (34 marks) e) Referring to your journal entries for Part d), explain the adjustment(s) required for T3 (inventory), noting the adjustment to each account separately. (10 marks)