Answered step by step

Verified Expert Solution

Question

1 Approved Answer

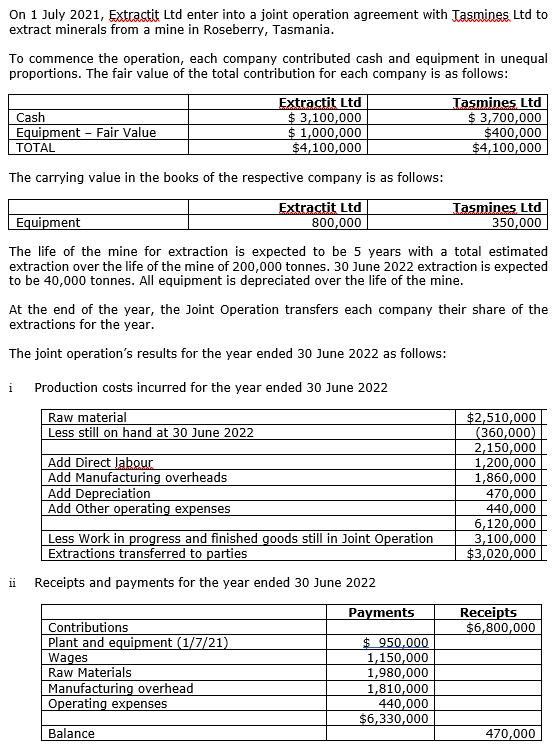

On 1 July 2021, Extractit Ltd enter into a joint operation agreement with Tasmines Ltd to extract minerals from a mine in Roseberry, Tasmania.

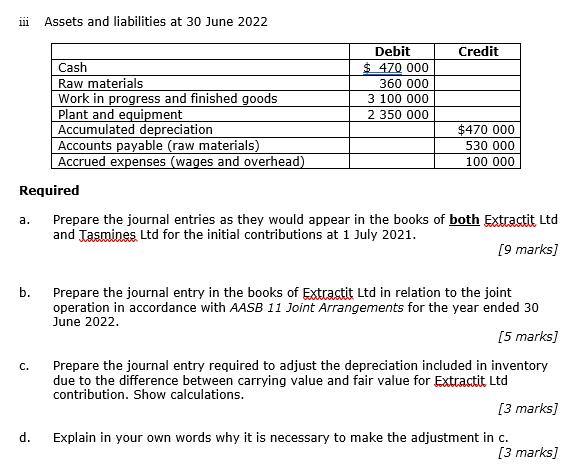

On 1 July 2021, Extractit Ltd enter into a joint operation agreement with Tasmines Ltd to extract minerals from a mine in Roseberry, Tasmania. To commence the operation, each company contributed cash and equipment in unequal proportions. The fair value of the total contribution for each company is as follows: Extractit Ltd $ 3,100,000 $ 1,000,000 $4,100,000 Tasmines Ltd $3,700,000 $400,000 $4,100,000 Cash Equipment - Fair Value TOTAL The carrying value in the books of the respective company is as follows: Equipment Extractit Ltd 800,000 Tasmines Ltd 350,000 The life of the mine for extraction is expected to be 5 years with a total estimated extraction over the life of the mine of 200,000 tonnes. 30 June 2022 extraction is expected to be 40,000 tonnes. All equipment is depreciated over the life of the mine. At the end of the year, the Joint Operation transfers each company their share of the extractions for the year. The joint operation's results for the year ended 30 June 2022 as follows: i Production costs incurred for the year ended 30 June 2022 Raw material Less still on hand at 30 June 2022 $2,510,000 (360,000) 2,150,000 1,200,000 1,860,000 470,000 440,000 6,120,000 3,100,000 $3,020,000 Add Direct labour Add Manufacturing overheads Add Depreciation Add Other operating expenses Less Work in progress and finished goods still in Joint Operation Extractions transferred to parties Receipts and payments for the year ended 30 June 2022 Receipts $6,800,000 Payments Contributions Plant and equipment (1/7/21) Wages Raw Materials Manufacturing overhead Operating expenses $950,000 1,150,000 1,980,000 1,810,000 440,000 $6,330,000 Balance 470,000 111 Assets and liabilities at 30 June 2022 Debit Credit Cash $ 470 000 Raw materials Work in progress and finished goods Plant and equipment Accumulated depreciation Accounts payable (raw materials) Accrued expenses (wages and overhead) 360 000 3 100 000 2 350 000 $470 000 530 000 100 000 Required Prepare the journal entries as they would appear in the books of both Extractit Ltd and Tasmines Ltd for the initial contributions at 1 July 2021. . [9 marks] b. Prepare the journal entry in the books of Extractit Ltd in relation to the joint operation in accordance with AASB 11 Joint Arrangements for the year ended 30 June 2022. [5 marks) . Prepare the journal entry required to adjust the depreciation included in inventory due to the difference between carrying value and fair value for Extractit Ltd contribution. Show calculations. [3 marks] d. Explain in your own words why necessary to ake the adjustment in c. [3 marks]

Step by Step Solution

★★★★★

3.45 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

a Joint Venture Account Journal Cash Account Extract 3100000 Cash Account Tasmines 3700000 Joint ven...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started