Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 1 July 2021, Safe Ltd acquired 100% of the shares of Mission Ltd for $500,000. On 1 July 2021, the equity of Mission

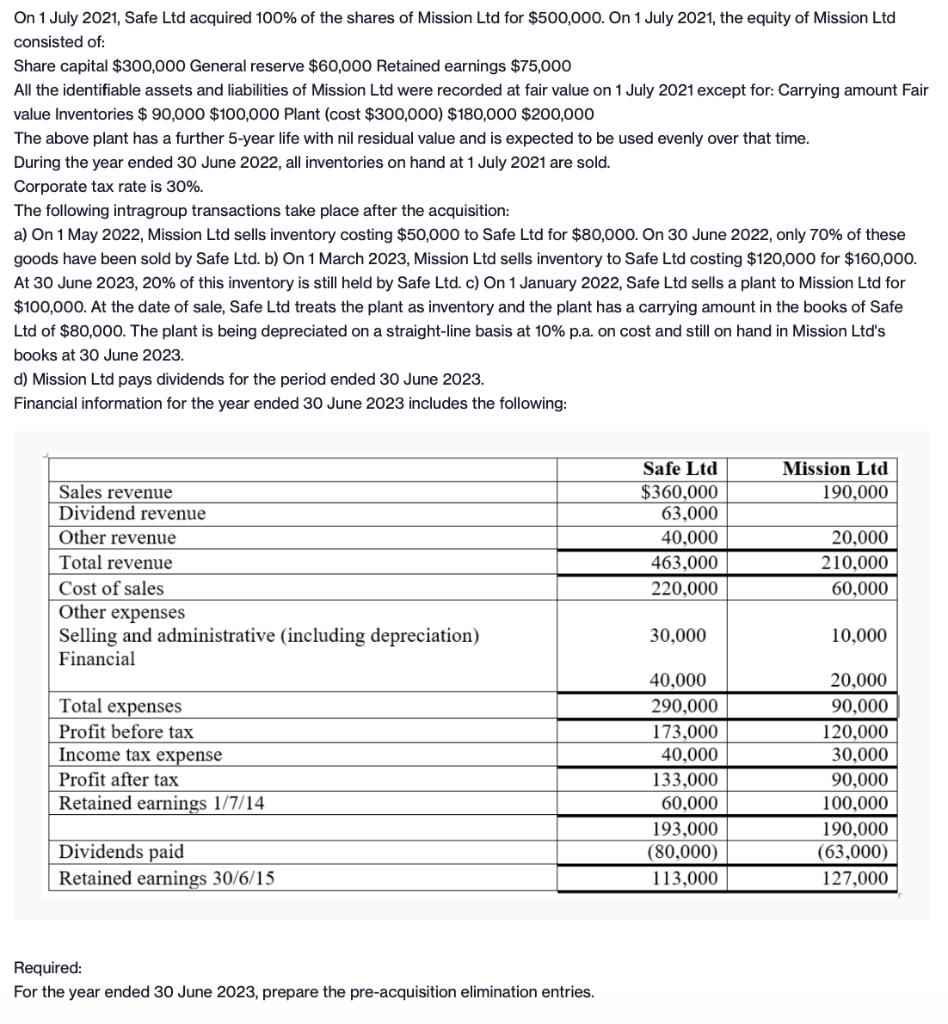

On 1 July 2021, Safe Ltd acquired 100% of the shares of Mission Ltd for $500,000. On 1 July 2021, the equity of Mission Ltd consisted of: Share capital $300,000 General reserve $60,000 Retained earnings $75,000 All the identifiable assets and liabilities of Mission Ltd were recorded at fair value on 1 July 2021 except for: Carrying amount Fair value Inventories $ 90,000 $100,000 Plant (cost $300,000) $180,000 $200,000 The above plant has a further 5-year life with nil residual value and is expected to be used evenly over that time. During the year ended 30 June 2022, all inventories on hand at 1 July 2021 are sold. Corporate tax rate is 30%. The following intragroup transactions take place after the acquisition: a) On 1 May 2022, Mission Ltd sells inventory costing $50,000 to Safe Ltd for $80,000. On 30 June 2022, only 70% of these goods have been sold by Safe Ltd. b) On 1 March 2023, Mission Ltd sells inventory to Safe Ltd costing $120,000 for $160,000. At 30 June 2023, 20% of this inventory is still held by Safe Ltd. c) On 1 January 2022, Safe Ltd sells a plant to Mission Ltd for $100,000. At the date of sale, Safe Ltd treats the plant as inventory and the plant has a carrying amount in the books of Safe Ltd of $80,000. The plant is being depreciated on a straight-line basis at 10% p.a. on cost and still on hand in Mission Ltd's books at 30 June 2023. d) Mission Ltd pays dividends for the period ended 30 June 2023. Financial information for the year ended 30 June 2023 includes the following: Safe Ltd $360,000 63,000 Mission Ltd Sales revenue Dividend revenue 190,000 Other revenue 40,000 20,000 Total revenue 463,000 210,000 Cost of sales 220,000 60,000 Other expenses Selling and administrative (including depreciation) Financial 30,000 10,000 40,000 20,000 Total expenses 290,000 90,000 Profit before tax Income tax expense Profit after tax 173,000 40,000 120,000 30,000 133,000 90,000 Retained earnings 1/7/14 60,000 100,000 193,000 190,000 Dividends paid (80,000) (63,000) Retained earnings 30/6/15 113,000 127,000 Required: For the year ended 30 June 2023, prepare the pre-acquisition elimination entries.

Step by Step Solution

★★★★★

3.33 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Answer Explanation Let us first calculate the value of assets taken over by Safe Ltd Share Capital of Mission Ltd 300000 Retained earnings 75000 Gener...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started