Answered step by step

Verified Expert Solution

Question

1 Approved Answer

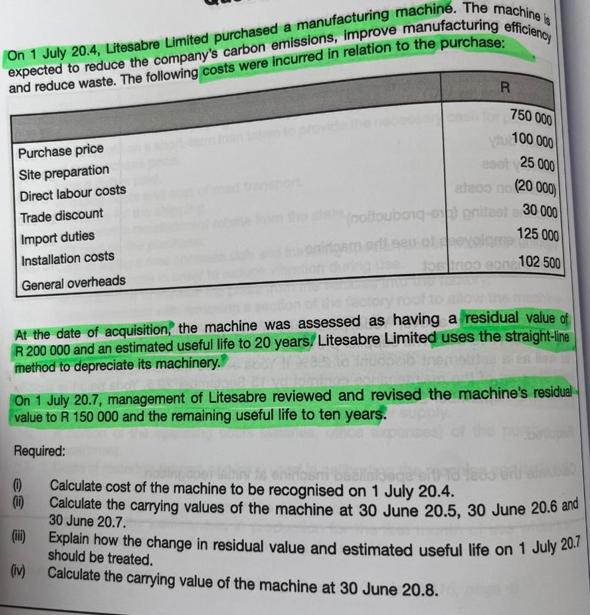

On 1 July 20.4, Litesabre Limited purchased a manufacturing machine. The machine is expected to reduce the company's carbon emissions, improve manufacturing efficiency and

On 1 July 20.4, Litesabre Limited purchased a manufacturing machine. The machine is expected to reduce the company's carbon emissions, improve manufacturing efficiency and reduce waste. The following costs were incurred in relation to the purchase: Purchase price Site preparation Direct labour costs Trade discount Import duties Installation costs General overheads R 750 000 ytu 100 000 25 000 atsoo no (20 000) 30 000 125 000 102 500 (1) (11) (iii) (iv) (noltoubong-nonitest At the date of acquisition, the machine was assessed as having a residual value of R 200 000 and an estimated useful life to 20 years/Litesabre Limited uses the straight-line method to depreciate its machinery. On 1 July 20.7, management of Litesabre reviewed and revised the machine's residual value to R 150 000 and the remaining useful life to ten years. Required: te chinosmi b ge bit to Calculate cost of the machine to be recognised on 1 July 20.4. Calculate the carrying values of the machine at 30 June 20.5, 30 June 20.6 and 30 June 20.7. Explain how the change in residual value and estimated useful life on 1 July 20.7 should be treated. Calculate the carrying value of the machine at 30 June 20.8.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Solutio n i Cost of the machine to be recognised on 1 July 204 Purchase price 750 000 Site preparation 100 000 Direct labour costs 25 000 Import dutie...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started