Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 1 June 2017 Kannex bought 60% of Synergy paying $76,000 cash. The summarised Statements of Financial Position for the two companies as at

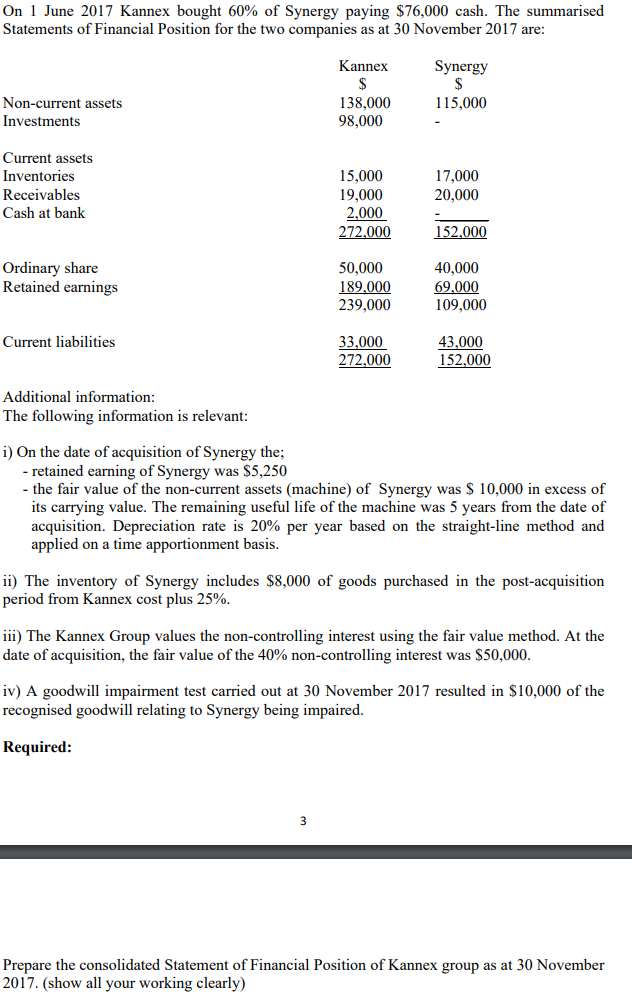

On 1 June 2017 Kannex bought 60% of Synergy paying $76,000 cash. The summarised Statements of Financial Position for the two companies as at 30 November 2017 are: Non-current assets Investments Kannex Synergy $ $ 138,000 115,000 98,000 Current assets Inventories 15,000 17,000 Receivables 19,000 20,000 Cash at bank 2,000 272,000 152,000 Ordinary share 50,000 40,000 Retained earnings 189,000 69,000 239,000 109,000 Current liabilities 33,000 43,000 272,000 152,000 Additional information: The following information is relevant: i) On the date of acquisition of Synergy the; - retained earning of Synergy was $5,250 - the fair value of the non-current assets (machine) of Synergy was $10,000 in excess of its carrying value. The remaining useful life of the machine was 5 years from the date of acquisition. Depreciation rate is 20% per year based on the straight-line method and applied on a time apportionment basis. ii) The inventory of Synergy includes $8,000 of goods purchased in the post-acquisition period from Kannex cost plus 25%. iii) The Kannex Group values the non-controlling interest using the fair value method. At the date of acquisition, the fair value of the 40% non-controlling interest was $50,000. iv) A goodwill impairment test carried out at 30 November 2017 resulted in $10,000 of the recognised goodwill relating to Synergy being impaired. Required: 3 Prepare the consolidated Statement of Financial Position of Kannex group as at 30 November 2017. (show all your working clearly)

Step by Step Solution

★★★★★

3.53 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Consolidated Statement of Financial Position of Kannex Group as at 30 November 2017 Working Investme...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started