Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 1 June 2022, Tshenolo received written confirmation from a local government agency regarding a BWP1 million grant for the purchase of a new

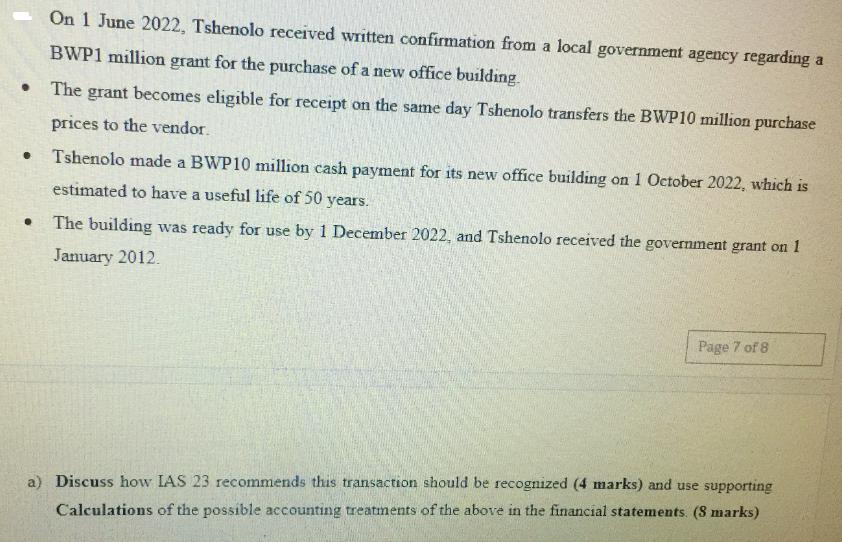

On 1 June 2022, Tshenolo received written confirmation from a local government agency regarding a BWP1 million grant for the purchase of a new office building. The grant becomes eligible for receipt on the same day Tshenolo transfers the BWP10 million purchase prices to the vendor. Tshenolo made a BWP10 million cash payment for its new office building on 1 October 2022, which is estimated to have a useful life of 50 years. The building was ready for use by 1 December 2022, and Tshenolo received the government grant on 1 January 2012. Page 7 of 8 a) Discuss how IAS 23 recommends this transaction should be recognized (4 marks) and use supporting Calculations of the possible accounting treatments of the above in the financial statements. (8 marks) On 1 June 2022, Tshenolo received written confirmation from a local government agency regarding a BWP1 million grant for the purchase of a new office building. The grant becomes eligible for receipt on the same day Tshenolo transfers the BWP10 million purchase prices to the vendor. Tshenolo made a BWP10 million cash payment for its new office building on 1 October 2022, which is estimated to have a useful life of 50 years. The building was ready for use by 1 December 2022, and Tshenolo received the government grant on 1 January 2012. Page 7 of 8 a) Discuss how IAS 23 recommends this transaction should be recognized (4 marks) and use supporting Calculations of the possible accounting treatments of the above in the financial statements. (8 marks)

Step by Step Solution

★★★★★

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Answer According to the information provided Tshenolo received a written confirmation for a BWP1 million grant on 1 June 2022 which is eligible for receipt once the BWP10 million purchase price for th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started