Answered step by step

Verified Expert Solution

Question

1 Approved Answer

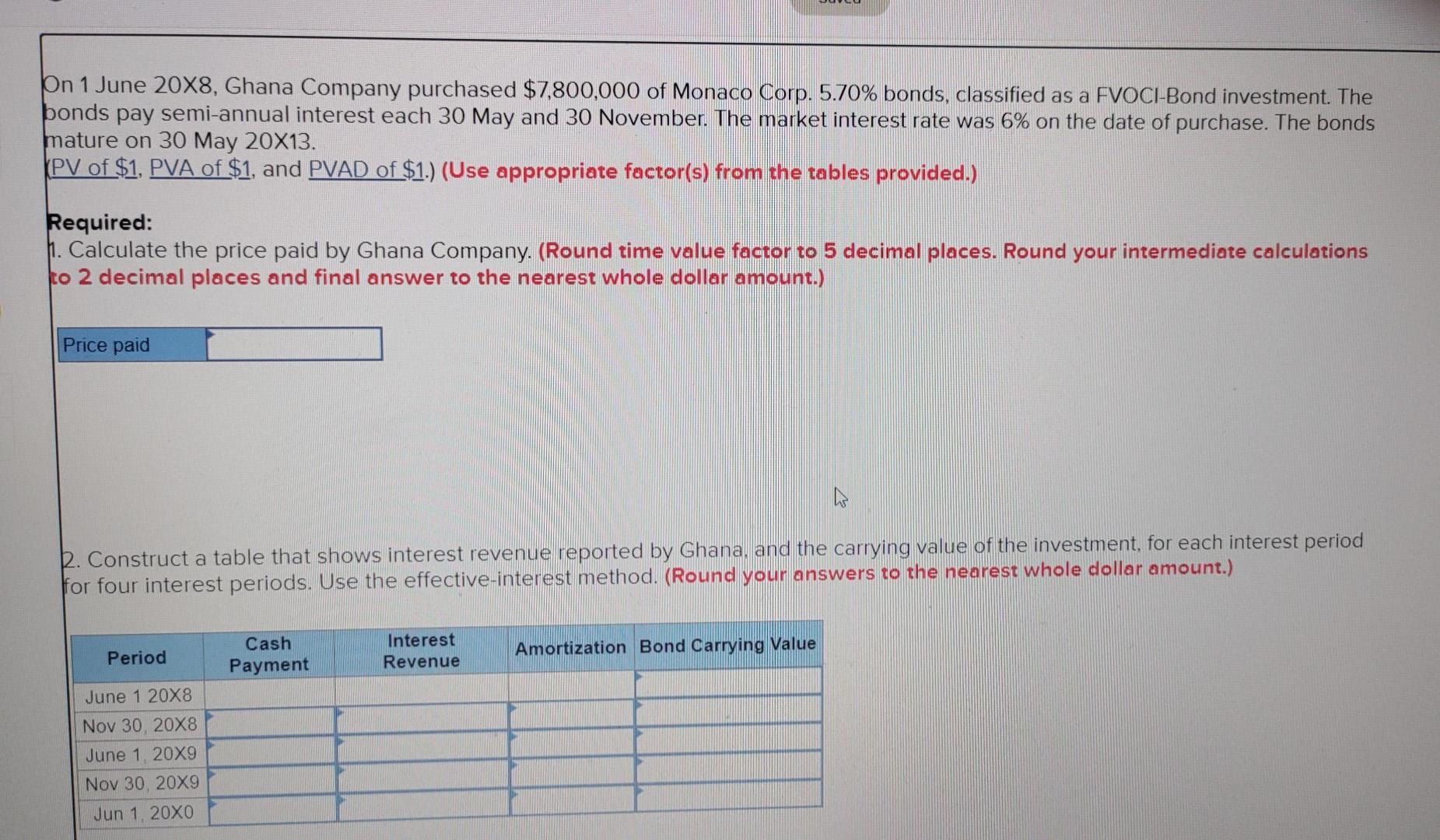

On 1 June 20X8, Ghana Company purchased $7,800,000 of Monaco Corp. 5.70% bonds, classified as a FVOCI-Bond investment. The bonds pay semi-annual interest each

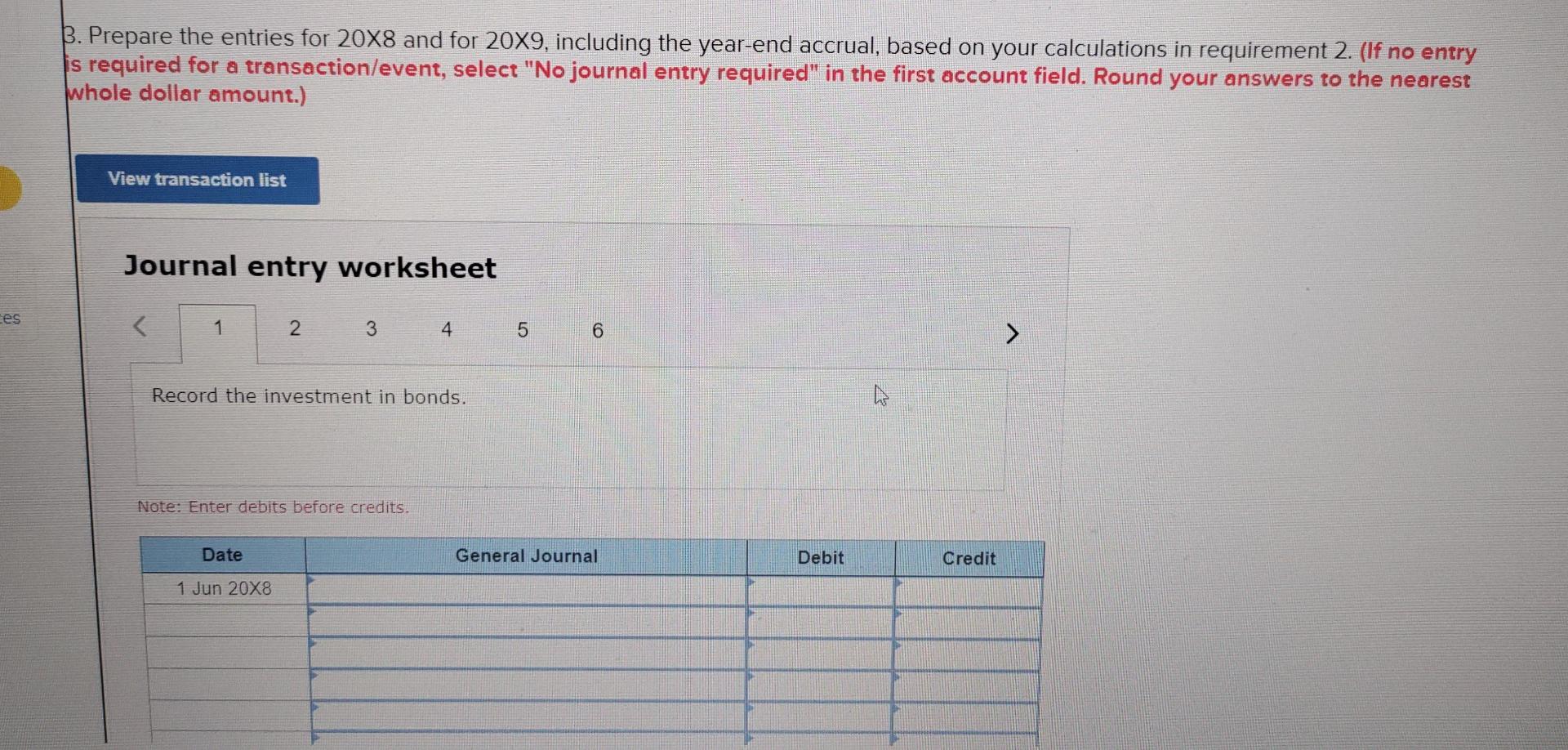

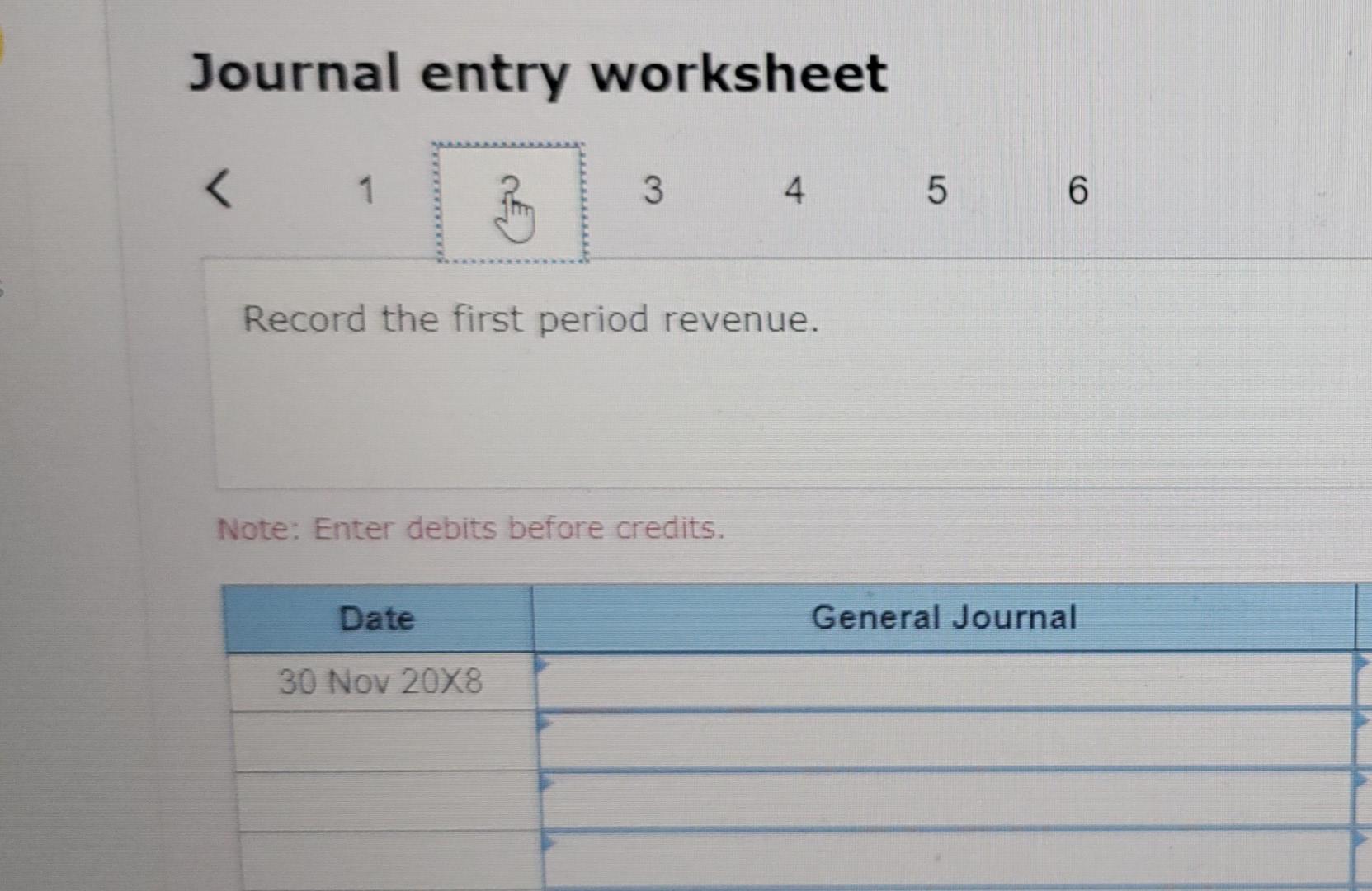

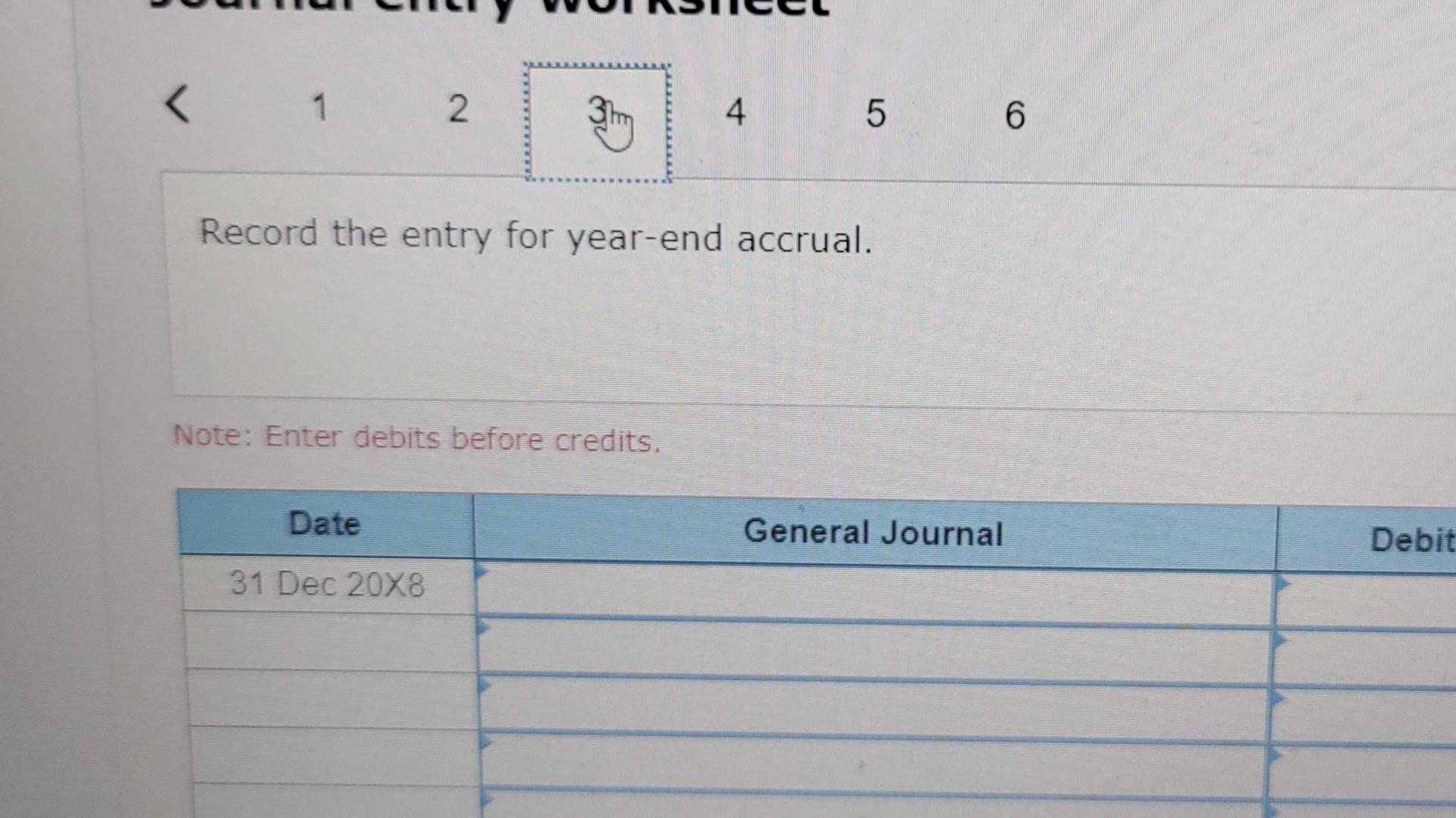

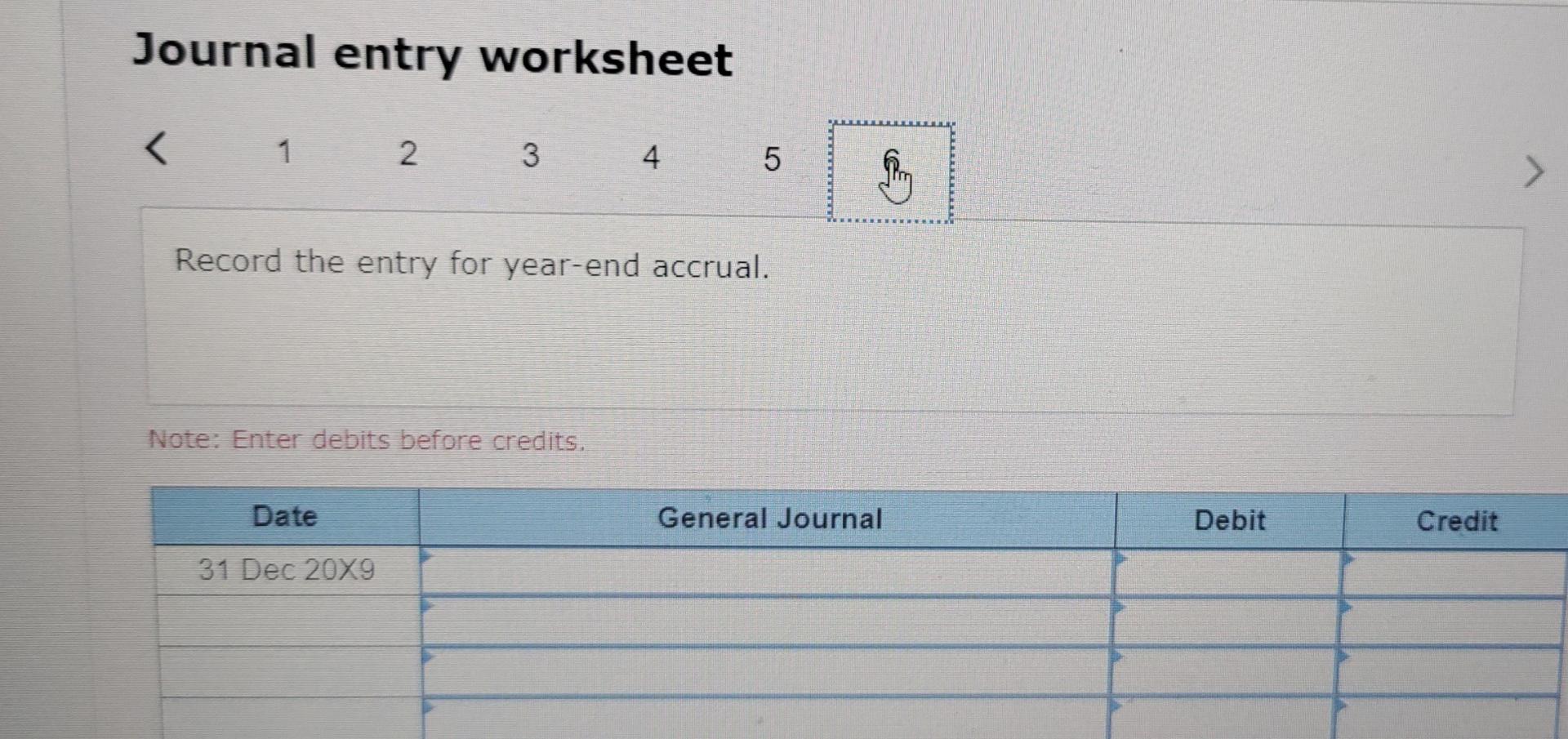

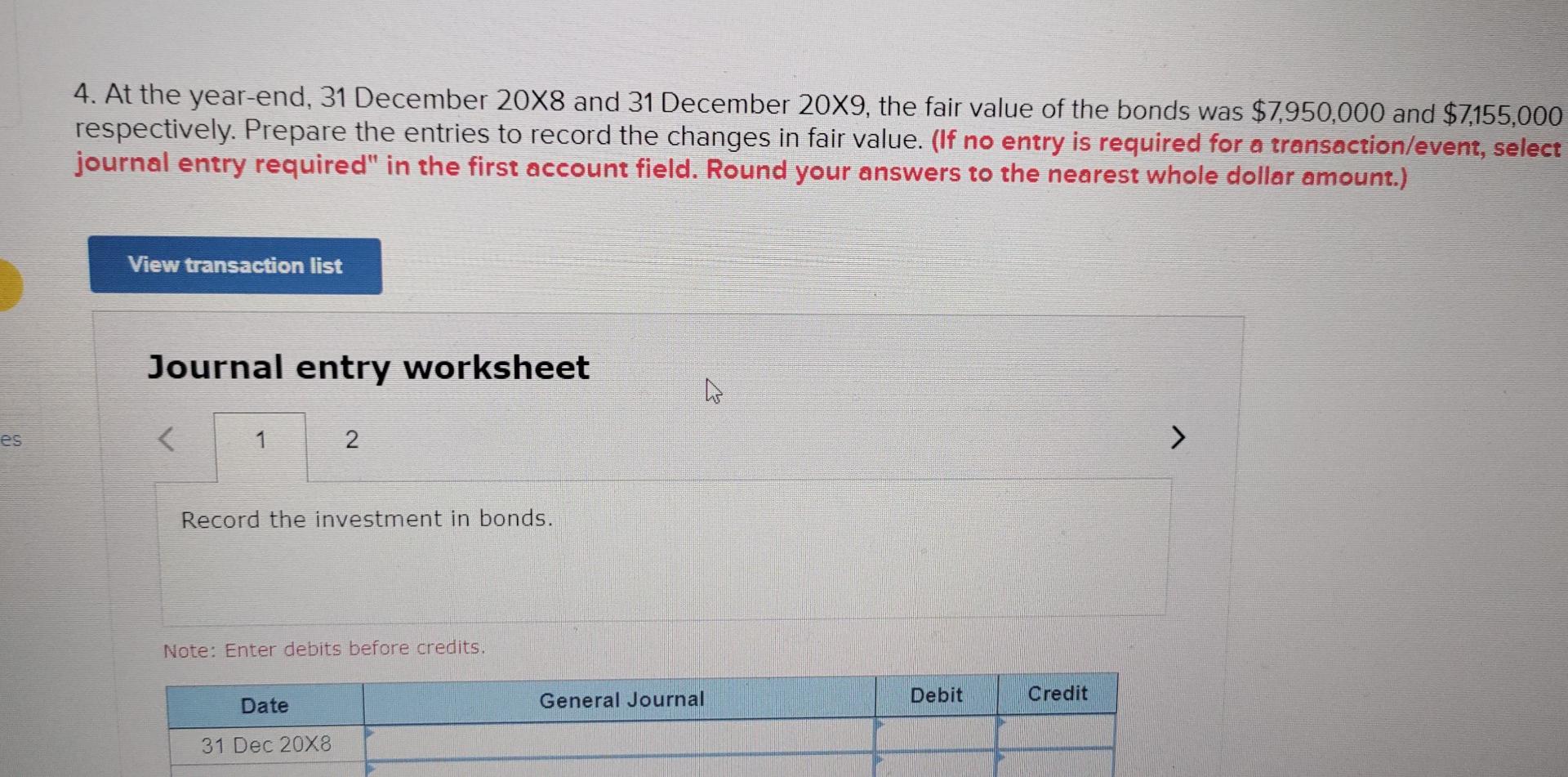

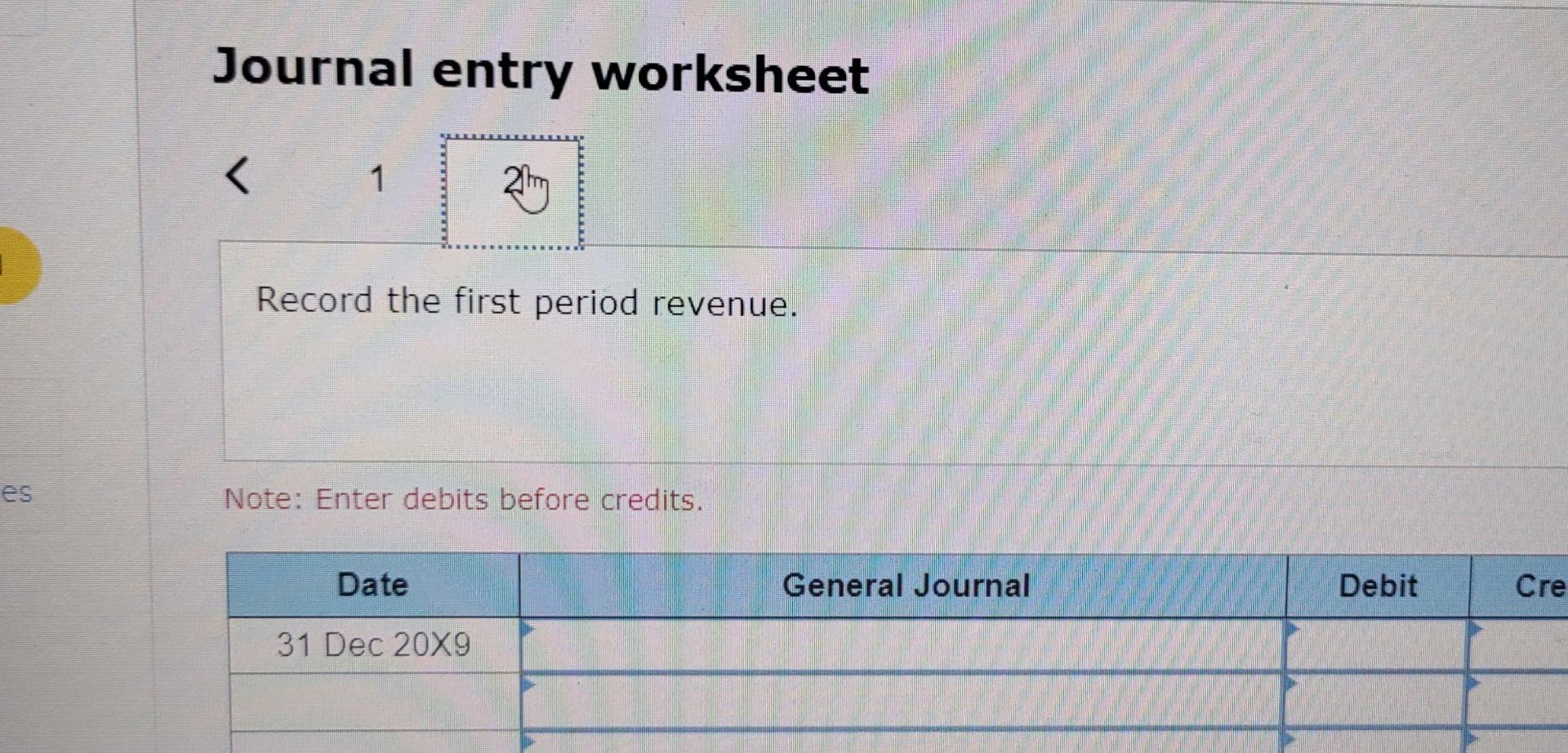

On 1 June 20X8, Ghana Company purchased $7,800,000 of Monaco Corp. 5.70% bonds, classified as a FVOCI-Bond investment. The bonds pay semi-annual interest each 30 May and 30 November. The market interest rate was 6% on the date of purchase. The bonds mature on 30 May 20X13. PV of $1, PVA of $1, and PVAD of $1.) (Use appropriate factor(s) from the tables provided.) Required: 1. Calculate the price paid by Ghana Company. (Round time value factor to 5 decimal places. Round your intermediate calculations to 2 decimal places and final answer to the nearest whole dollar amount.) Price paid 2. Construct a table that shows interest revenue reported by Ghana, and the carrying value of the investment, for each interest period for four interest periods. Use the effective-interest method. (Round your answers to the nearest whole dollar amount.) Period Cash Payment Interest Revenue Amortization Bond Carrying Value June 1 20X8 Nov 30, 20X8 June 1, 20X9 Nov 30, 20X9 Jun 1, 20X0 3. Prepare the entries for 20X8 and for 20X9, including the year-end accrual, based on your calculations in requirement 2. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your answers to the nearest whole dollar amount.) View transaction list Journal entry worksheet ces < 1 2 3 4 5 6 Record the investment in bonds. Note: Enter debits before credits. Date 1 Jun 20X8 General Journal Debit Credit Journal entry worksheet L 1 3 3 4 5 6 Record the first period revenue. Note: Enter debits before credits. Date 30 Nov 20X8 General Journal < 1 2 31m 4 5 6 Record the entry for year-end accrual. Note: Enter debits before credits. Date 31 Dec 20X8 General Journal Debit Record the investment in bonds. Note: Enter debits before credits. Date 30 May 20X9 General < 1 2 3 Record the investment in bonds. Note: Enter debits before credits. Date 30 May 20X9 5 6 General Journal Debit Credit Journal entry worksheet < 1 2 3 4pm 5 6 Record the investment in bonds. Note: Enter debits before credits. Date 30 May 20X9 General Journal Debit Journal entry worksheet < 1 2 2 3 4 6 Record the first period revenue. Note: Enter debits before credits. Date 30 Nov 20X9 General Journal Debit Cred Journal entry worksheet < 1 1 2 3 4 3 5 Record the entry for year-end accrual. Note: Enter debits before credits. Date 31 Dec 20X9 General Journal Debit Credit 7 es 4. At the year-end, 31 December 20X8 and 31 December 20X9, the fair value of the bonds was $7,950,000 and $7,155,000 respectively. Prepare the entries to record the changes in fair value. (If no entry is required for a transaction/event, select journal entry required" in the first account field. Round your answers to the nearest whole dollar amount.) View transaction list Journal entry worksheet > 1 2 Record the investment in bonds. Note: Enter debits before credits. Date 31 Dec 20X8 General Journal Debit Credit Journal entry worksheet < 1 21h Record the first period revenue. es Note: Enter debits before credits. Date 31 Dec 20X9 General Journal Debit Cre

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started