Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 1 March 2020, Sunrise Ltd, a New Zealand entity, purchases AUD 1 200 000 of inventory from Suresh Incorporated, an AUD entity. The

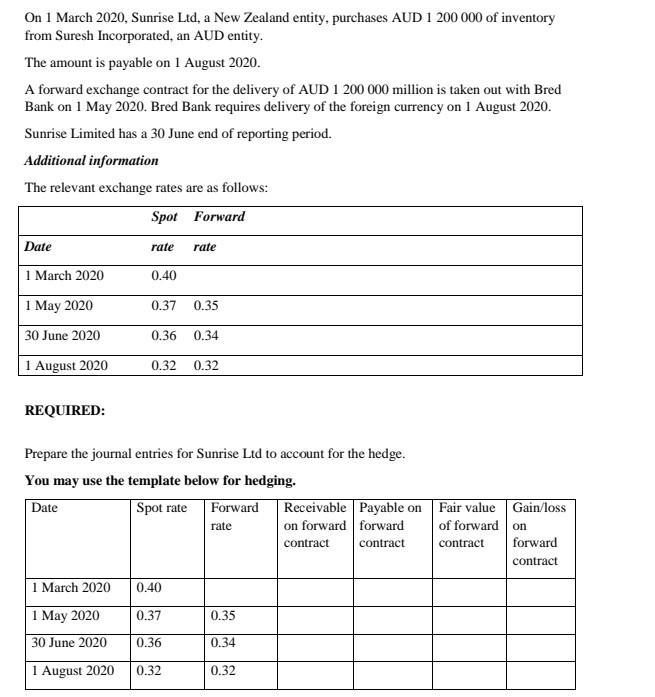

On 1 March 2020, Sunrise Ltd, a New Zealand entity, purchases AUD 1 200 000 of inventory from Suresh Incorporated, an AUD entity. The amount is payable on 1 August 2020. A forward exchange contract for the delivery of AUD 1 200 000 million is taken out with Bred Bank on 1 May 2020. Bred Bank requires delivery of the foreign currency on 1 August 2020. Sunrise Limited has a 30 June end of reporting period. Additional information The relevant exchange rates are as follows: Spot Forward Date rate rate 1 March 2020 0.40 1 May 2020 0.37 0.35 30 June 2020 0.36 0.34 1 August 2020 0.32 0.32 REQUIRED: Prepare the journal entries for Sunrise Ltd to account for the hedge. You may use the template below for hedging. Date Spot rate Forward Receivable Payable on on forward forward contract rate Gain/loss on forward contract contract 1 March 2020 0.40 1 May 2020 0.37 0.35 30 June 2020 0.36 0.34 1 August 2020 0.32 0.32 Fair value of forward contract

Step by Step Solution

★★★★★

3.45 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Explanation 312020 Inventory Accounts Payable To record purchase of inventory 5...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started