Answered step by step

Verified Expert Solution

Question

1 Approved Answer

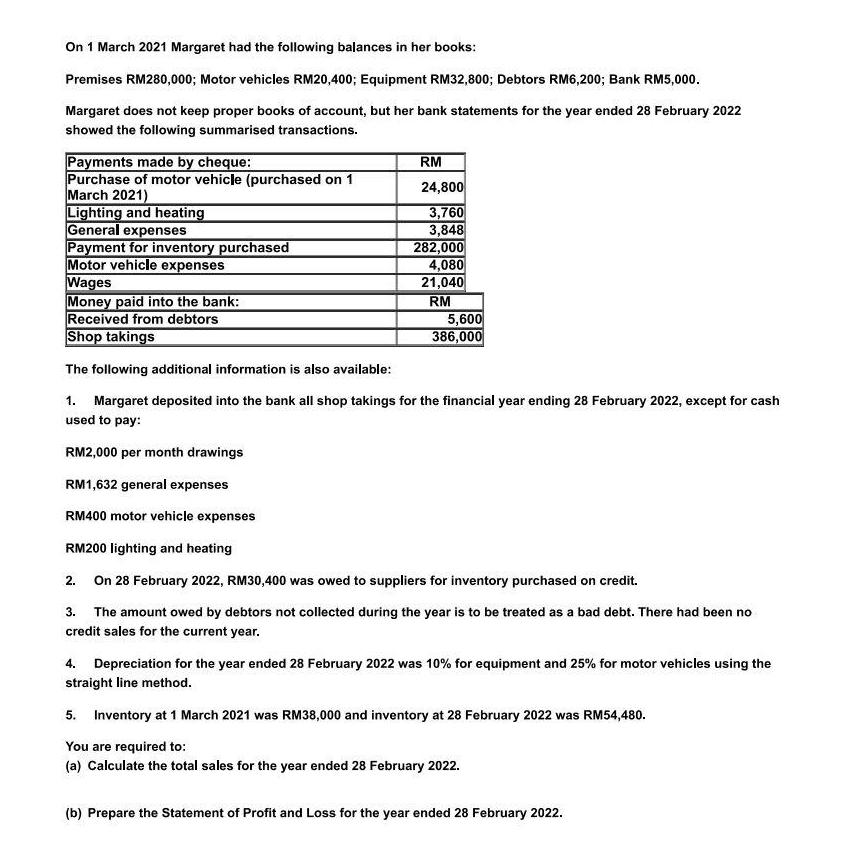

On 1 March 2021 Margaret had the following balances in her books: Premises RM280,000; Motor vehicles RM20,400; Equipment RM32,800; Debtors RM6,200; Bank RM5,000. Margaret

On 1 March 2021 Margaret had the following balances in her books: Premises RM280,000; Motor vehicles RM20,400; Equipment RM32,800; Debtors RM6,200; Bank RM5,000. Margaret does not keep proper books of account, but her bank statements for the year ended 28 February 2022 showed the following summarised transactions. Payments made by cheque: Purchase of motor vehicle (purchased on 1 March 2021) Lighting and heating General expenses Payment for inventory purchased Motor vehicle expenses Wages RM 24,800 3,760 3,848 282,000 4,080 21,040 RM Money paid into the bank: Received from debtors Shop takings The following additional information is also available: 1. Margaret deposited into the bank all shop takings for the financial year ending 28 February 2022, except for cash used to pay: RM2,000 per month drawings RM1,632 general expenses RM400 motor vehicle expenses RM200 lighting and heating 2. On 28 February 2022, RM30,400 was owed to suppliers for inventory purchased on credit. 5,600 386,000 3. The amount owed by debtors not collected during the year is to be treated as a bad debt. There had been no credit sales for the current year. 4. Depreciation for the year ended 28 February 2022 was 10% for equipment and 25% for motor vehicles using the straight line method. 5. Inventory at 1 March 2021 was RM38,000 and inventory at 28 February 2022 was RM54,480. You are required to: (a) Calculate the total sales for the year ended 28 February 2022. (b) Prepare the Statement of Profit and Loss for the year ended 28 February 2022.

Step by Step Solution

★★★★★

3.36 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the total sales for the year ended 28 February 2022 we need to add up the shop takings and the payments received from debtors This is cal...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started