Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 1 May 2015, your company acquired a machine at a cost of $300,000. This machine has an expected a useful life of 20

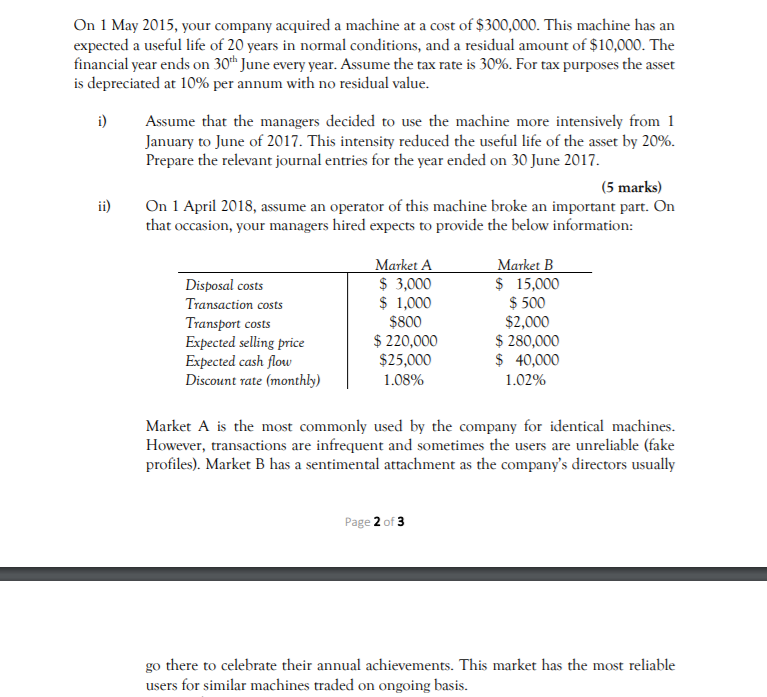

On 1 May 2015, your company acquired a machine at a cost of $300,000. This machine has an expected a useful life of 20 years in normal conditions, and a residual amount of $10,000. The financial year ends on 30th June every year. Assume the tax rate is 30%. For tax purposes the asset is depreciated at 10% per annum with no residual value. i) ii) Assume that the managers decided to use the machine more intensively from 1 January to June of 2017. This intensity reduced the useful life of the asset by 20%. Prepare the relevant journal entries for the year ended on 30 June 2017. (5 marks) On 1 April 2018, assume an operator of this machine broke an important part. On that occasion, your managers hired expects to provide the below information: Transport costs Market B $ 15,000 $ 500 $2,000 Market A Disposal costs $ 3,000 Transaction costs $ 1,000 $800 Expected selling price $220,000 $ 280,000 Expected cash flow Discount rate (monthly) $25,000 1.08% $ 40,000 1.02% Market A is the most commonly used by the company for identical machines. However, transactions are infrequent and sometimes the users are unreliable (fake profiles). Market B has a sentimental attachment as the company's directors usually Page 2 of 3 go there to celebrate their annual achievements. This market has the most reliable users for similar machines traded on ongoing basis.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

i To record the depreciation adjustment for the reduced useful life of the machine Date Account Titl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started