On 1 November 2016, Ahmad and Ganeswaran entered into a joint venture for a clothing business. Ganeswaran contributed $7,000 to fund the business, while

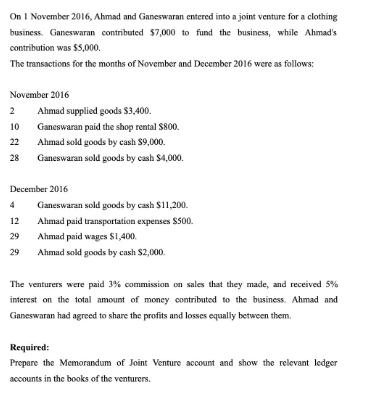

On 1 November 2016, Ahmad and Ganeswaran entered into a joint venture for a clothing business. Ganeswaran contributed $7,000 to fund the business, while Ahmad's contribution was $5,000. The transactions for the months of November and December 2016 were as follows: November 2016 2 Ahmad supplied goods $3,400. 10 Ganeswaran paid the shop rental $800. Ahmad sold goods by cash $9,000. 22 28 Ganeswaran sold goods by cash $4,000. December 2016 12 29 29 Ganeswaran sold goods by cash $11,200. Ahmad paid transportation expenses $500. Ahmad paid wages $1,400. Ahmad sold goods by cash $2,000. The venturers were paid 3% commission on sales that they made, and received 5% interest on the total amount of money contributed to the business. Ahmad and Ganeswaran had agreed to share the profits and losses equally between them. Required: Prepare the Memorandum of Joint Venture account and show the relevant ledger accounts in the books of the venturers.

Step by Step Solution

3.51 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

MEMORANDUM OF JOINT VENTURE DEBIT CREDIT SALES 26200 TO GOODS SUPPLIED 3400 TO RENT EXPENSE 800 TO T...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started