Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 1 November 2019, Red Limited bought a property at cost of $16 million for cash. It entered into a two year rental contract

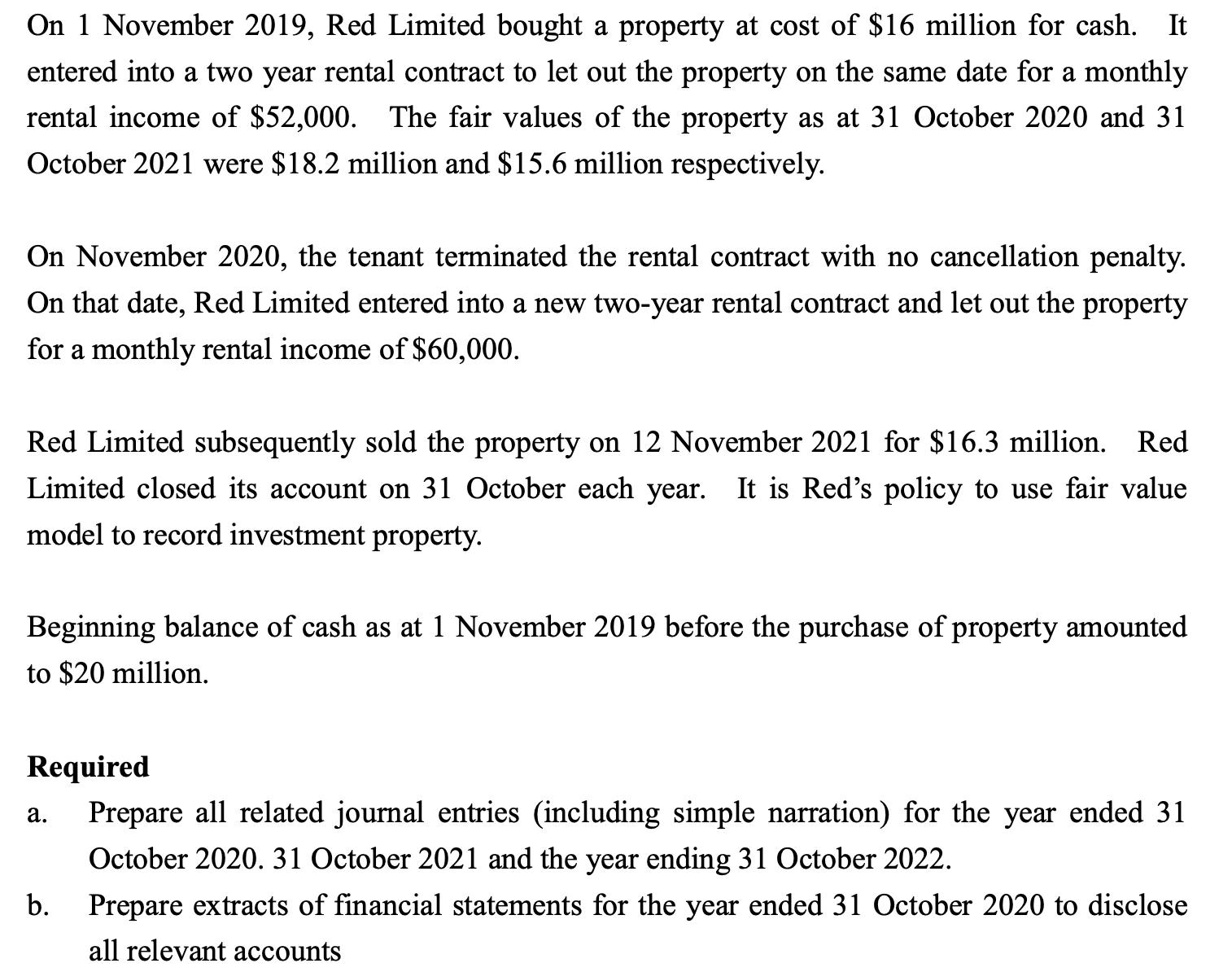

On 1 November 2019, Red Limited bought a property at cost of $16 million for cash. It entered into a two year rental contract to let out the property on the same date for a monthly rental income of $52,000. The fair values of the property as at 31 October 2020 and 31 October 2021 were $18.2 million and $15.6 million respectively. On November 2020, the tenant terminated the rental contract with no cancellation penalty. On that date, Red Limited entered into a new two-year rental contract and let out the property for a monthly rental income of $60,000. Red Limited subsequently sold the property on 12 November 2021 for $16.3 million. Red Limited closed its account on 31 October each year. It is Red's policy to use fair value model to record investment property. Beginning balance of cash as at 1 November 2019 before the purchase of property amounted to $20 million. Required Prepare all related journal entries (including simple narration) for the year ended 31 October 2020. 31 October 2021 and the year ending 31 October 2022. Prepare extracts of financial statements for the year ended 31 October 2020 to disclose all relevant accounts a. b.

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Answer Journal Entry For the Year Ended 31st October 2021 Date Account Title and Explanation Debit C...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started