Question

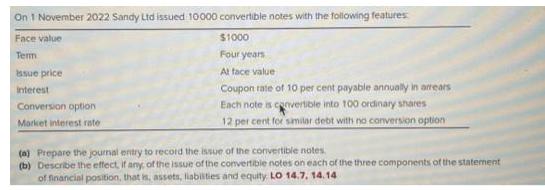

On 1 November 2022 Sandy Ltd issued 10000 convertible notes with the following features: Face value $1000 Term Four sue price interest Conversion option

On 1 November 2022 Sandy Ltd issued 10000 convertible notes with the following features: Face value $1000 Term Four sue price interest Conversion option Market interest rate years At face value Coupon rate of 10 per cent payable annually in arrears Each note is convertible into 100 ordinary shares 12 per cent for similar debt with no conversion option (a) Prepare the journal entry to record the issue of the convertible notes (b) Describe the effect, if any of the issue of the convertible notes on each of the three components of the statement of financial position, that is, assets, liabilities and equity LO 14.7, 14.14

Step by Step Solution

3.50 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

a To record the issue of the convertible notes we need to account for the cash received from the iss...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Reporting and Analysis

Authors: Flawrence Revsine, Daniel Collins, Bruce, Mittelstaedt, Leon

6th edition

9780077632182, 78025672, 77632184, 978-0078025679

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App