Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 1 October 2020, Thanh Dat Co purchased 90 million of Dat Phuong Co. 150 million $1 equity shares. The acquisition was accomplished through a

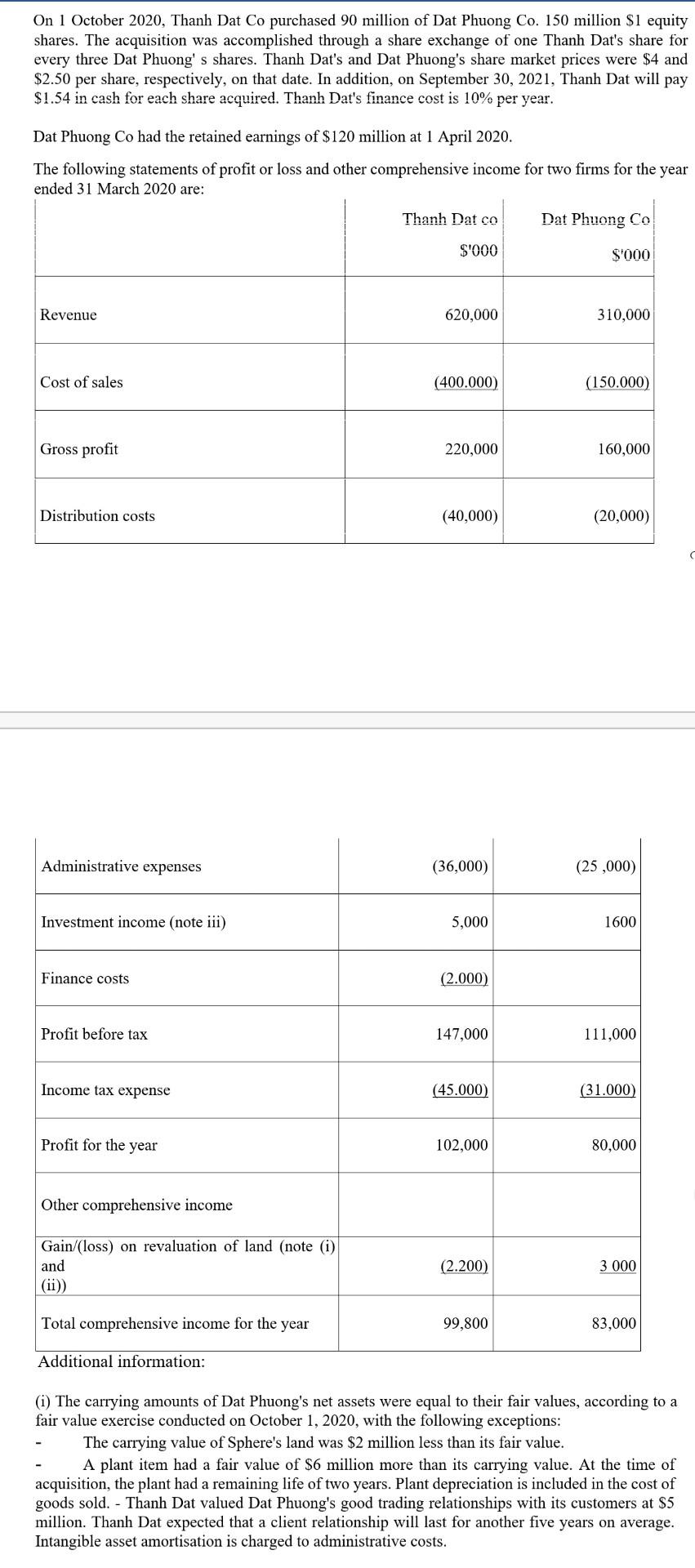

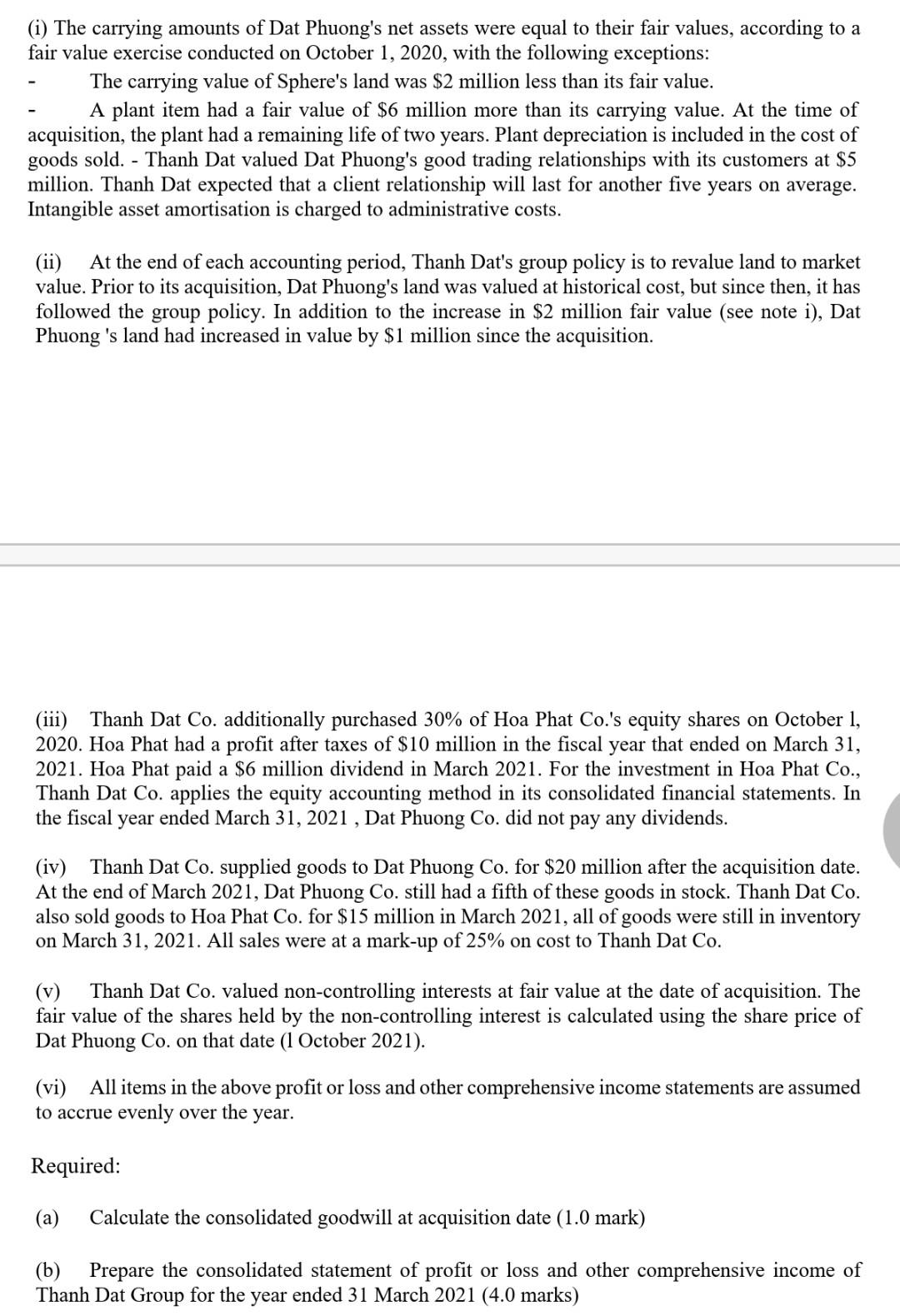

On 1 October 2020, Thanh Dat Co purchased 90 million of Dat Phuong Co. 150 million $1 equity shares. The acquisition was accomplished through a share exchange of one Thanh Dat's share for every three Dat Phuong's shares. Thanh Dat's and Dat Phuong's share market prices were $4 and $2.50 per share, respectively, on that date. In addition, on September 30, 2021, Thanh Dat will pay $1.54 in cash for each share acquired. Thanh Dat's finance cost is 10% per year. Dat Phuong Co had the retained earnings of $120 million at 1 April 2020. The following statements of profit or loss and other comprehensive income for two firms for the year ended 31 March 2020 are: Thanh Dat co Dat Phuong Ca $'000 $'000 Revenue 620,000 310,000 Cost of sales (400.000) (150.000) Gross profit 220,000 160,000 Distribution costs (40,000) (20,000) Administrative expenses (36,000) (25,000) Investment income (note iii) 5,000 1600 Finance costs (2.000) Profit before tax 147,000 111,000 Income tax expense (45.000 (31.000) Profit for the year 102,000 80,000 Other comprehensive income Gain/(loss) on revaluation of land (note (i) and (ii)) (2.200) 3 000 Total comprehensive income for the year 99,800 83,000 Additional information: (i) The carrying amounts of Dat Phuong's net assets were equal to their fair values, according to a fair value exercise conducted on October 1, 2020, with the following exceptions: The carrying value of Sphere's land was $2 million less than its fair value. A plant item had a fair value of $6 million more than its carrying value. At the time of acquisition, the plant had a remaining life of two years. Plant depreciation is included in the cost of goods sold. - Thanh Dat valued Dat Phuong's good trading relationships with its customers at $5 million. Thanh Dat expected that a client relationship will last for another five years on average. Intangible asset amortisation is charged to administrative costs. (i) The carrying amounts of Dat Phuong's net assets were equal to their fair values, according to a fair value exercise conducted on October 1, 2020, with the following exceptions: The carrying value of Sphere's land was $2 million less than its fair value. A plant item had a fair value of $6 million more than its carrying value. At the time of acquisition, the plant had a remaining life of two years. Plant depreciation is included in the cost of goods sold. - Thanh Dat valued Dat Phuong's good trading relationships with its customers at $5 million. Thanh Dat expected that a client relationship will last for another five years on average. Intangible asset amortisation is charged to administrative costs. (ii) At the end of each accounting period, Thanh Dat's group policy is to revalue land to market value. Prior to its acquisition, Dat Phuong's land was valued at historical cost, but since then, it has followed the group policy. In addition to the increase in $2 million fair value (see note i), Dat Phuong 's land had increased in value by $1 million since the acquisition. (iii) Thanh Dat Co. additionally purchased 30% of Hoa Phat Co.'s equity shares on October 1, 2020. Hoa Phat had a profit after taxes of $10 million in the fiscal year that ended on March 31, 2021. Hoa Phat paid a $6 million dividend in March 2021. For the investment in Hoa Phat Co., Thanh Dat Co. applies the equity accounting method in its consolidated financial statements. In the fiscal year ended March 31, 2021 , Dat Phuong Co. did not pay any dividends. (iv) Thanh Dat Co. supplied goods to Dat Phuong Co. for $20 million after the acquisition date. At the end of March 2021, Dat Phuong Co. still had a fifth of these goods in stock. Thanh Dat Co. also sold goods to Hoa Phat Co. for $15 million in March 2021, all of goods were still in inventory on March 31, 2021. All sales were at a mark-up of 25% on cost to Thanh Dat Co. Thanh Dat Co. valued non-controlling interests at fair value at the date of acquisition. The fair value of the shares held by the non-controlling interest is calculated using the share price of Dat Phuong Co. on that date (1 October 2021). (vi) All items in the above profit or loss and other comprehensive income statements are assumed to accrue evenly over the year. Required: (a) Calculate the consolidated goodwill at acquisition date (1.0 mark) (b) Prepare the consolidated statement of profit or loss and other comprehensive income of Thanh Dat Group for the year ended 31 March 2021 (4.0 marks) On 1 October 2020, Thanh Dat Co purchased 90 million of Dat Phuong Co. 150 million $1 equity shares. The acquisition was accomplished through a share exchange of one Thanh Dat's share for every three Dat Phuong's shares. Thanh Dat's and Dat Phuong's share market prices were $4 and $2.50 per share, respectively, on that date. In addition, on September 30, 2021, Thanh Dat will pay $1.54 in cash for each share acquired. Thanh Dat's finance cost is 10% per year. Dat Phuong Co had the retained earnings of $120 million at 1 April 2020. The following statements of profit or loss and other comprehensive income for two firms for the year ended 31 March 2020 are: Thanh Dat co Dat Phuong Ca $'000 $'000 Revenue 620,000 310,000 Cost of sales (400.000) (150.000) Gross profit 220,000 160,000 Distribution costs (40,000) (20,000) Administrative expenses (36,000) (25,000) Investment income (note iii) 5,000 1600 Finance costs (2.000) Profit before tax 147,000 111,000 Income tax expense (45.000 (31.000) Profit for the year 102,000 80,000 Other comprehensive income Gain/(loss) on revaluation of land (note (i) and (ii)) (2.200) 3 000 Total comprehensive income for the year 99,800 83,000 Additional information: (i) The carrying amounts of Dat Phuong's net assets were equal to their fair values, according to a fair value exercise conducted on October 1, 2020, with the following exceptions: The carrying value of Sphere's land was $2 million less than its fair value. A plant item had a fair value of $6 million more than its carrying value. At the time of acquisition, the plant had a remaining life of two years. Plant depreciation is included in the cost of goods sold. - Thanh Dat valued Dat Phuong's good trading relationships with its customers at $5 million. Thanh Dat expected that a client relationship will last for another five years on average. Intangible asset amortisation is charged to administrative costs. (i) The carrying amounts of Dat Phuong's net assets were equal to their fair values, according to a fair value exercise conducted on October 1, 2020, with the following exceptions: The carrying value of Sphere's land was $2 million less than its fair value. A plant item had a fair value of $6 million more than its carrying value. At the time of acquisition, the plant had a remaining life of two years. Plant depreciation is included in the cost of goods sold. - Thanh Dat valued Dat Phuong's good trading relationships with its customers at $5 million. Thanh Dat expected that a client relationship will last for another five years on average. Intangible asset amortisation is charged to administrative costs. (ii) At the end of each accounting period, Thanh Dat's group policy is to revalue land to market value. Prior to its acquisition, Dat Phuong's land was valued at historical cost, but since then, it has followed the group policy. In addition to the increase in $2 million fair value (see note i), Dat Phuong 's land had increased in value by $1 million since the acquisition. (iii) Thanh Dat Co. additionally purchased 30% of Hoa Phat Co.'s equity shares on October 1, 2020. Hoa Phat had a profit after taxes of $10 million in the fiscal year that ended on March 31, 2021. Hoa Phat paid a $6 million dividend in March 2021. For the investment in Hoa Phat Co., Thanh Dat Co. applies the equity accounting method in its consolidated financial statements. In the fiscal year ended March 31, 2021 , Dat Phuong Co. did not pay any dividends. (iv) Thanh Dat Co. supplied goods to Dat Phuong Co. for $20 million after the acquisition date. At the end of March 2021, Dat Phuong Co. still had a fifth of these goods in stock. Thanh Dat Co. also sold goods to Hoa Phat Co. for $15 million in March 2021, all of goods were still in inventory on March 31, 2021. All sales were at a mark-up of 25% on cost to Thanh Dat Co. Thanh Dat Co. valued non-controlling interests at fair value at the date of acquisition. The fair value of the shares held by the non-controlling interest is calculated using the share price of Dat Phuong Co. on that date (1 October 2021). (vi) All items in the above profit or loss and other comprehensive income statements are assumed to accrue evenly over the year. Required: (a) Calculate the consolidated goodwill at acquisition date (1.0 mark) (b) Prepare the consolidated statement of profit or loss and other comprehensive income of Thanh Dat Group for the year ended 31 March 2021 (4.0 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started