Answered step by step

Verified Expert Solution

Question

1 Approved Answer

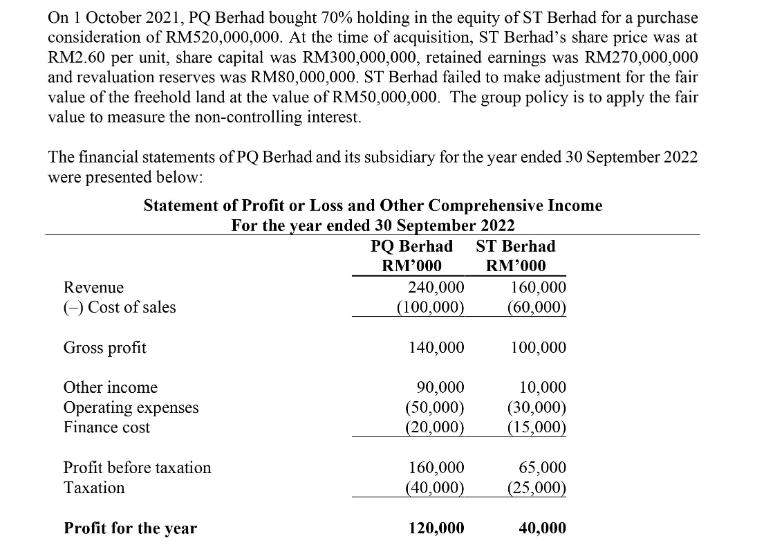

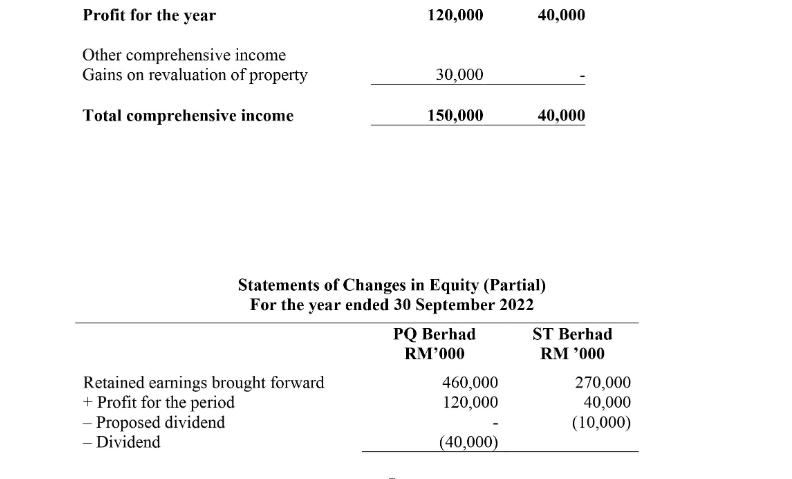

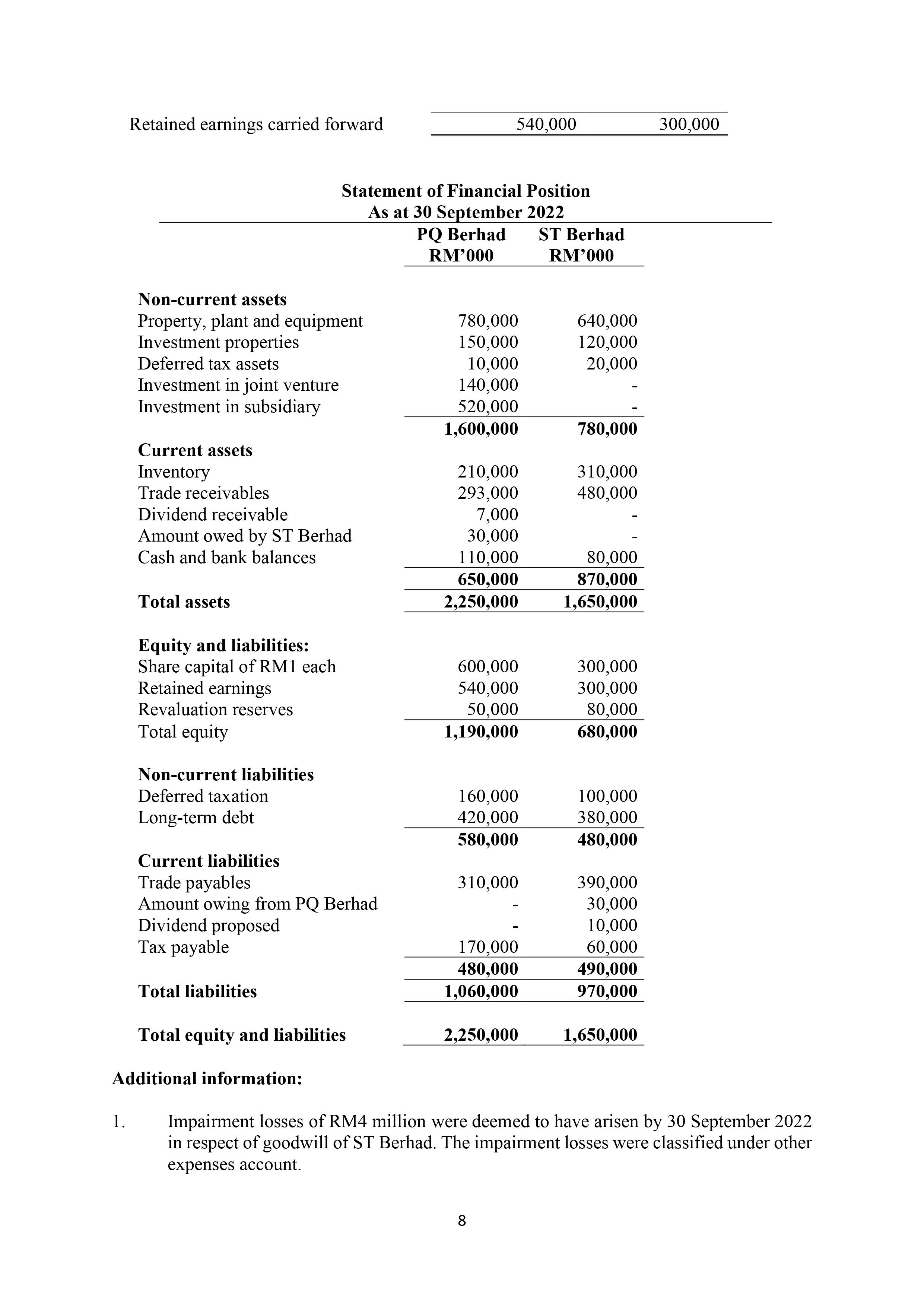

On 1 October 2021, PQ Berhad bought 70% holding in the equity of ST Berhad for a purchase consideration of RM520,000,000. At the time

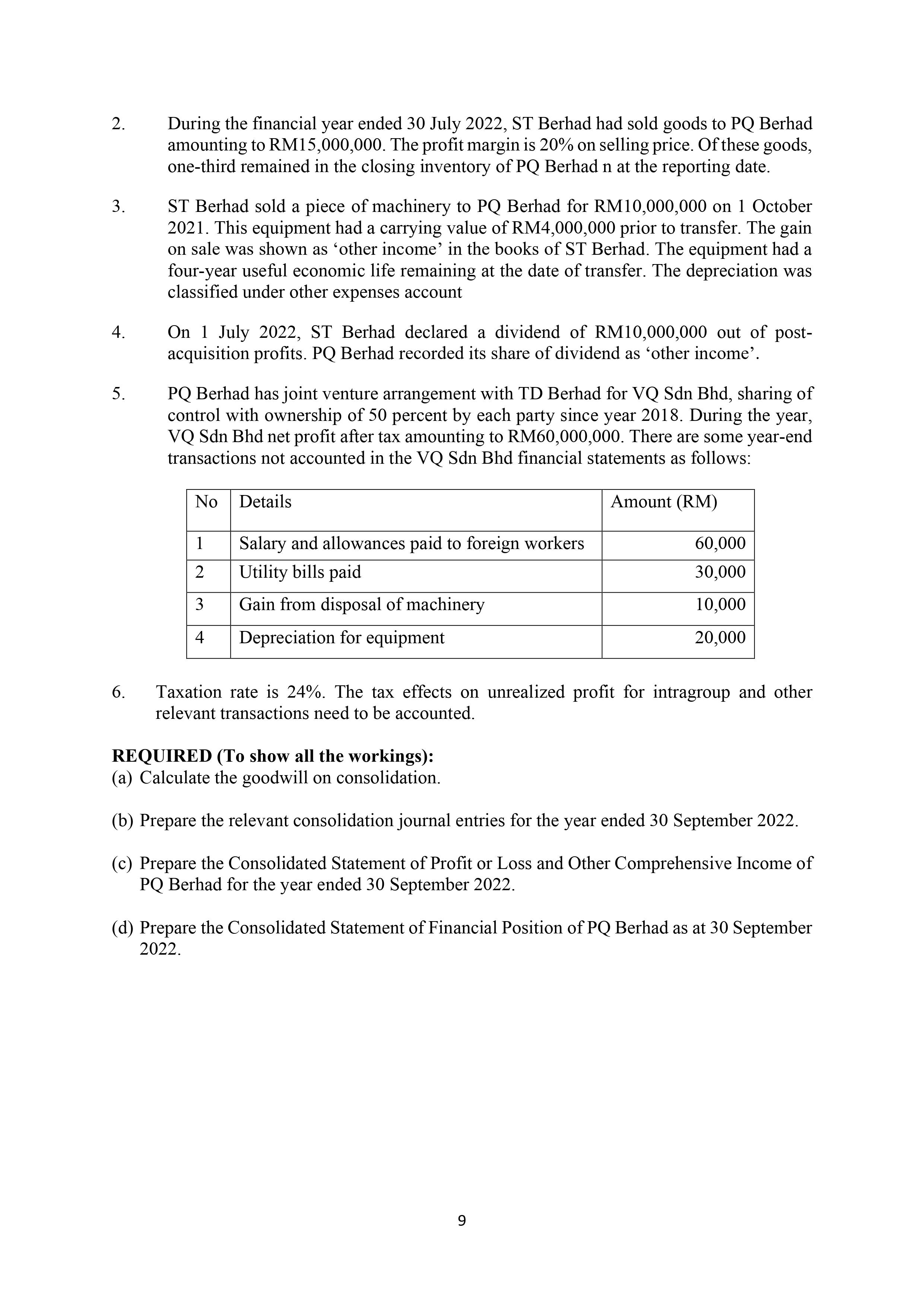

On 1 October 2021, PQ Berhad bought 70% holding in the equity of ST Berhad for a purchase consideration of RM520,000,000. At the time of acquisition, ST Berhad's share price was at RM2.60 per unit, share capital was RM300,000,000, retained earnings was RM270,000,000 and revaluation reserves was RM80,000,000. ST Berhad failed to make adjustment for the fair value of the freehold land at the value of RM50,000,000. The group policy is to apply the fair value to measure the non-controlling interest. The financial statements of PQ Berhad and its subsidiary for the year ended 30 September 2022 were presented below: Statement of Profit or Loss and Other Comprehensive Income For the year ended 30 September 2022 PQ Berhad RM'000 RM'000 ST Berhad Revenue 240,000 160,000 (-) Cost of sales (100,000) (60,000) Gross profit 140,000 100,000 Other income 90,000 10,000 Operating expenses (50,000) (30,000) Finance cost (20,000) (15,000) Profit before taxation 160,000 65,000 Taxation (40,000) (25,000) Profit for the year 120,000 40,000 Profit for the year 120,000 40,000 Other comprehensive income Gains on revaluation of property 30,000 Total comprehensive income 150,000 40,000 Statements of Changes in Equity (Partial) For the year ended 30 September 2022 PQ Berhad Retained earnings brought forward + Profit for the period - Proposed dividend - Dividend RM'000 ST Berhad RM '000 460,000 270,000 120,000 40,000 (10,000) (40,000) Retained earnings carried forward Non-current assets 540,000 300,000 Statement of Financial Position As at 30 September 2022 PQ Berhad ST Berhad RM'000 RM'000 Property, plant and equipment 780,000 640,000 Investment properties 150,000 120,000 Deferred tax assets 10,000 20,000 Investment in joint venture 140,000 Investment in subsidiary 520,000 1,600,000 780,000 Current assets Inventory 210,000 310,000 Trade receivables 293,000 480,000 Dividend receivable 7,000 Amount owed by ST Berhad 30,000 Cash and bank balances 110,000 80,000 650,000 870,000 Total assets 2,250,000 1,650,000 Equity and liabilities: Share capital of RM1 each 600,000 300,000 Retained earnings 540,000 300,000 Revaluation reserves 50,000 80,000 Total equity 1,190,000 680,000 Non-current liabilities Deferred taxation 160,000 100,000 Long-term debt 420,000 380,000 580,000 480,000 Current liabilities Trade payables 310,000 390,000 Amount owing from PQ Berhad 30,000 Dividend proposed 10,000 Tax payable 170,000 60,000 480,000 490,000 Total liabilities 1,060,000 970,000 Total equity and liabilities 2,250,000 1,650,000 Additional information: 1. Impairment losses of RM4 million were deemed to have arisen by 30 September 2022 in respect of goodwill of ST Berhad. The impairment losses were classified under other expenses account. 8 2. 3. 4. 5. During the financial year ended 30 July 2022, ST Berhad had sold goods to PQ Berhad amounting to RM15,000,000. The profit margin is 20% on selling price. Of these goods, one-third remained in the closing inventory of PQ Berhad n at the reporting date. ST Berhad sold a piece of machinery to PQ Berhad for RM10,000,000 on 1 October 2021. This equipment had a carrying value of RM4,000,000 prior to transfer. The gain on sale was shown as 'other income' in the books of ST Berhad. The equipment had a four-year useful economic life remaining at the date of transfer. The depreciation was classified under other expenses account On 1 July 2022, ST Berhad declared a dividend of RM10,000,000 out of post- acquisition profits. PQ Berhad recorded its share of dividend as 'other income'. PQ Berhad has joint venture arrangement with TD Berhad for VQ Sdn Bhd, sharing of control with ownership of 50 percent by each party since year 2018. During the year, VQ Sdn Bhd net profit after tax amounting to RM60,000,000. There are some year-end transactions not accounted in the VQ Sdn Bhd financial statements as follows: No Details Amount (RM) 1 Salary and allowances paid to foreign workers 60,000 2 Utility bills paid 30,000 3 Gain from disposal of machinery 10,000 4 Depreciation for equipment 20,000 6. Taxation rate is 24%. The tax effects on unrealized profit for intragroup and other relevant transactions need to be accounted. REQUIRED (To show all the workings): (a) Calculate the goodwill on consolidation. (b) Prepare the relevant consolidation journal entries for the year ended 30 September 2022. (c) Prepare the Consolidated Statement of Profit or Loss and Other Comprehensive Income of PQ Berhad for the year ended 30 September 2022. (d) Prepare the Consolidated Statement of Financial Position of PQ Berhad as at 30 September 2022. 6

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started