Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 1 October 2021, the owner of the USS Enterprise, Mr Kirk, decides that he will boldly go and keep his records on a

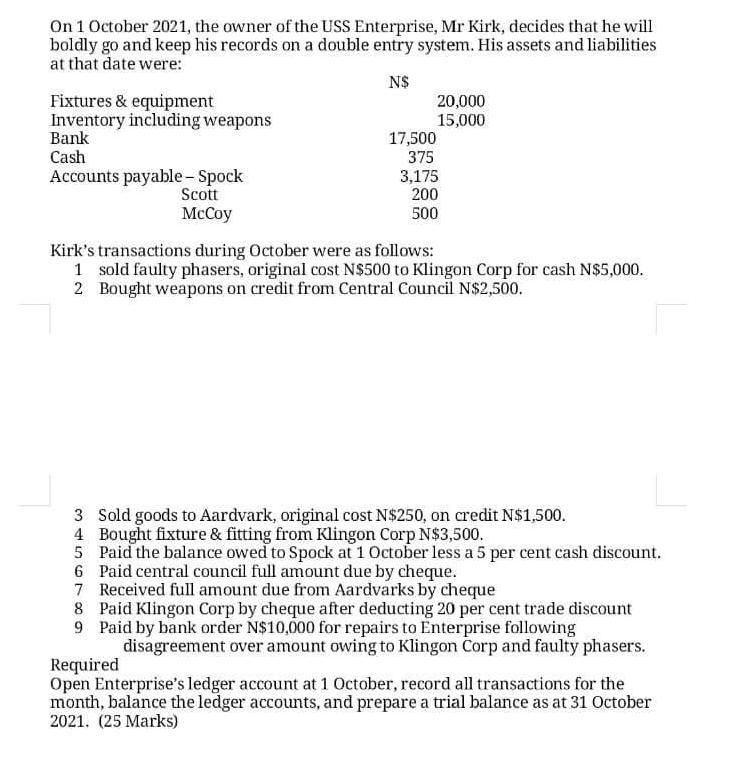

On 1 October 2021, the owner of the USS Enterprise, Mr Kirk, decides that he will boldly go and keep his records on a double entry system. His assets and liabilities at that date were: N$ Fixtures & equipment Inventory including weapons Bank Cash Accounts payable - Spock Scott McCoy 20,000 15,000 17,500 375 3,175 200 500 Kirk's transactions during October were as follows: 1 sold faulty phasers, original cost N$500 to Klingon Corp for cash N$5,000. 2 Bought weapons on credit from Central Council N$2,500. 3 Sold goods to Aardvark, original cost N$250, on credit N$1,500. Bought fixture & fitting from Klingon Corp N$3,500. 4 5 Paid the balance owed to Spock at 1 October less a 5 per cent cash discount. 6 Paid central council full amount due by cheque. 7 Received full amount due from Aardvarks by cheque 8 Paid Klingon Corp by cheque after deducting 20 per cent trade discount 9 Paid by bank order N$10,000 for repairs to Enterprise following disagreement over amount owing to Klingon Corp and faulty phasers. Required Open Enterprise's ledger account at 1 October, record all transactions for the month, balance the ledger accounts, and prepare a trial balance as at 31 October 2021. (25 Marks)

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Dr Particulars To Balance bd To Sales To Balance cd Dr Particulars To Belarce byd Dr Particulars To ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started