Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 1 September 2016, a company placed part of its assets with two fund managers. Manager P was given K950,000 and Manager Q was given

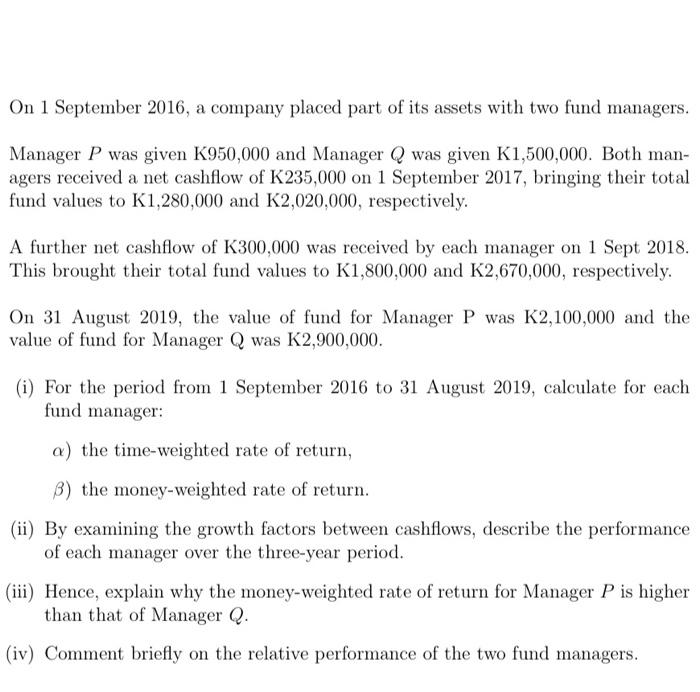

On 1 September 2016, a company placed part of its assets with two fund managers. Manager P was given K950,000 and Manager Q was given K1,500,000. Both man- agers received a net cashflow of K235,000 on 1 September 2017, bringing their total fund values to K1,280,000 and K2,020,000, respectively. A further net cashflow of K300,000 was received by each manager on 1 Sept 2018. This brought their total fund values to K1,800,000 and K2,670,000, respectively. On 31 August 2019, the value of fund for Manager P was K2,100,000 and the value of fund for Manager Q was K2,900,000. (i) For the period from 1 September 2016 to 31 August 2019, calculate for each fund manager: a) the time-weighted rate of return, 3) the money-weighted rate of return. (ii) By examining the growth factors between cashflows, describe the performance of each manager over the three-year period. (iii) Hence, explain why the money-weighted rate of return for Manager P is higher than that of Manager Q. (iv) Comment briefly on the relative performance of the two fund managers.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started