Answered step by step

Verified Expert Solution

Question

1 Approved Answer

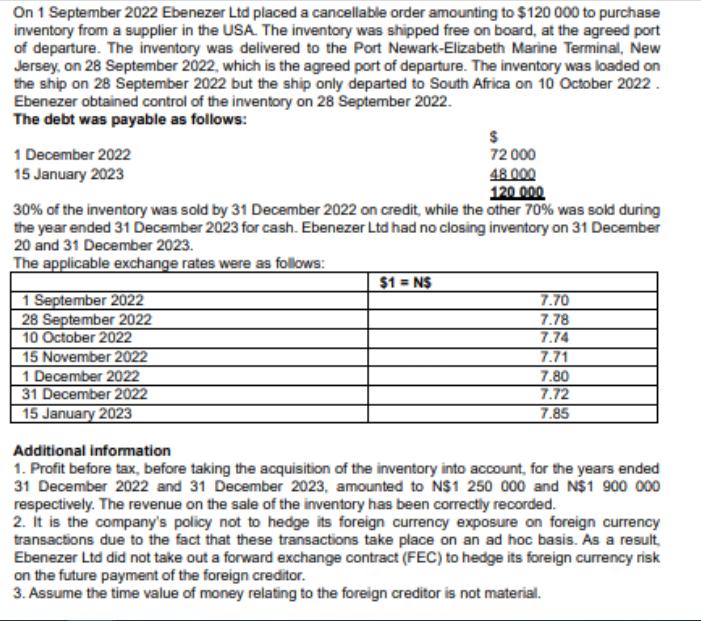

On 1 September 2022 Ebenezer Ltd placed a cancellable order amounting to $120 000 to purchase inventory from a supplier in the USA. The

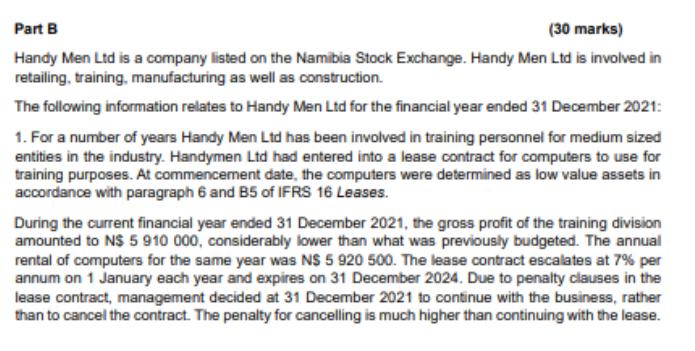

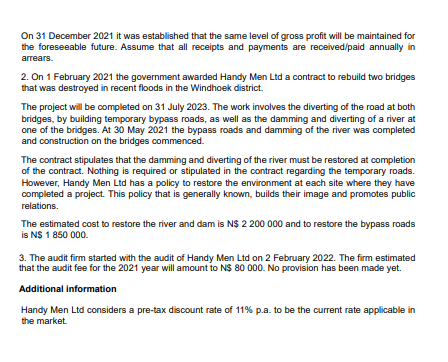

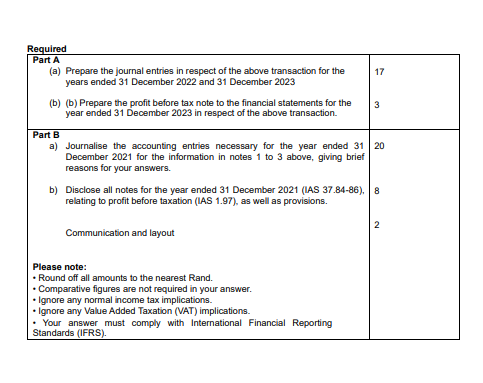

On 1 September 2022 Ebenezer Ltd placed a cancellable order amounting to $120 000 to purchase inventory from a supplier in the USA. The inventory was shipped free on board, at the agreed port of departure. The inventory was delivered to the Port Newark-Elizabeth Marine Terminal, New Jersey, on 28 September 2022, which is the agreed port of departure. The inventory was loaded on the ship on 28 September 2022 but the ship only departed to South Africa on 10 October 2022. Ebenezer obtained control of the inventory on 28 September 2022. The debt was payable as follows: $ 72 000 48.000 120 000 30% of the inventory was sold by 31 December 2022 on credit, while the other 70% was sold during the year ended 31 December 2023 for cash. Ebenezer Ltd had no closing inventory on 31 December 20 and 31 December 2023. The applicable exchange rates were as follows: 1 December 2022 15 January 2023 1 September 2022 28 September 2022 10 October 2022 15 November 2022 1 December 2022 31 December 2022 15 January 2023 $1 = NS 7.70 7.78 7.74 7.71 7.80 7.72 7.85 Additional information 1. Profit before tax, before taking the acquisition of the inventory into account, for the years ended 31 December 2022 and 31 December 2023, amounted to N$1 250 000 and N$1 900 000 respectively. The revenue on the sale of the inventory has been correctly recorded. 2. It is the company's policy not to hedge its foreign currency exposure on foreign currency transactions due to the fact that these transactions take place on an ad hoc basis. As a result, Ebenezer Ltd did not take out a forward exchange contract (FEC) to hedge its foreign currency risk on the future payment of the foreign creditor. 3. Assume the time value of money relating to the foreign creditor is not material. Part B (30 marks) Handy Men Ltd is a company listed on the Namibia Stock Exchange. Handy Men Ltd is involved in retailing, training, manufacturing as well as construction. The following information relates to Handy Men Ltd for the financial year ended 31 December 2021: 1. For a number of years Handy Men Ltd has been involved in training personnel for medium sized entities in the industry. Handymen Ltd had entered into a lease contract for computers to use for training purposes. At commencement date, the computers were determined as low value assets in accordance with paragraph 6 and B5 of IFRS 16 Leases. During the current financial year ended 31 December 2021, the gross profit of the training division amounted to N$ 5 910 000, considerably lower than what was previously budgeted. The annual rental of computers for the same year was N$ 5 920 500. The lease contract escalates at 7% per annum on 1 January each year and expires on 31 December 2024. Due to penalty clauses in the lease contract, management decided at 31 December 2021 to continue with the business, rather than to cancel the contract. The penalty for cancelling is much higher than continuing with the lease. On 31 December 2021 it was established that the same level of gross profit will be maintained for the foreseeable future. Assume that all receipts and payments are received/paid annually in arrears. 2. On 1 February 2021 the government awarded Handy Men Ltd a contract to rebuild two bridges that was destroyed in recent floods in the Windhoek district. The project will be completed on 31 July 2023. The work involves the diverting of the road at both bridges, by building temporary bypass roads, as well as the damming and diverting of a river at one of the bridges. At 30 May 2021 the bypass roads and damming of the river was completed and construction on the bridges commenced. The contract stipulates that the damming and diverting of the river must be restored at completion of the contract. Nothing is required or stipulated in the contract regarding the temporary roads. However, Handy Men Ltd has a policy to restore the environment at each site where they have completed a project. This policy that is generally known, builds their image and promotes public relations. The estimated cost to restore the river and dam is N$ 2 200 000 and to restore the bypass roads is N$ 1 850 000. 3. The audit firm started with the audit of Handy Men Ltd on 2 February 2022. The firm estimated that the audit fee for the 2021 year will amount to N$ 80 000. No provision has been made yet. Additional information Handy Men Ltd considers a pre-tax discount rate of 11% p.a. to be the current rate applicable in the market. Required Part A (a) Prepare the journal entries in respect of the above transaction for the years ended 31 December 2022 and 31 December 2023 (b) (b) Prepare the profit before tax note to the financial statements for the year ended 31 December 2023 in respect of the above transaction. Part B a) Journalise the accounting entries necessary for the year ended 31 20 December 2021 for the information in notes 1 to 3 above, giving brief reasons for your answers. Please note: Round off all amounts to the nearest Rand. Comparative figures are not required in your answer. 17 b) Disclose all notes for the year ended 31 December 2021 (IAS 37.84-86), 8 relating to profit before taxation (IAS 1.97), as well as provisions. Communication and layout Ignore any normal income tax implications. Ignore any Value Added Taxation (VAT) implications. 3 Your answer must comply with International Financial Reporting Standards (IFRS). 2

Step by Step Solution

★★★★★

3.45 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Ill provide stepbystep workings for the given information Lets address each part separately Part A a Journal entries for the years ended 31 December 2...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started