Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3) On 10th July 2019, Eazy Company, which is in food business, has signed a contract to Heaven Plantation, which is in orchard business,

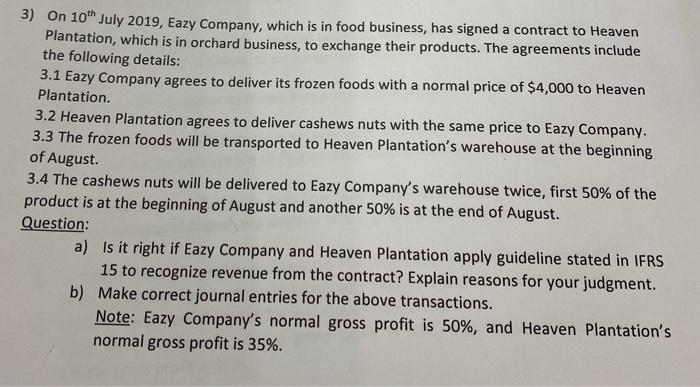

3) On 10th July 2019, Eazy Company, which is in food business, has signed a contract to Heaven Plantation, which is in orchard business, to exchange their products. The agreements include the following details: 3.1 Eazy Company agrees to deliver its frozen foods with a normal price of $4,000 to Heaven Plantation. 3.2 Heaven Plantation agrees to deliver cashews nuts with the same price to Eazy Company. 3.3 The frozen foods will be transported to Heaven Plantation's warehouse at the beginning of August. 3.4 The cashews nuts will be delivered to Eazy Company's warehouse twice, first 50% of the product is at the beginning of August and another 50% is at the end of August. Question: a) Is it right if Eazy Company and Heaven Plantation apply guideline stated in IFRS 15 to recognize revenue from the contract? Explain reasons for your judgment. b) Make correct journal entries for the above transactions. Note: Eazy Company's normal gross profit is 50%, and Heaven Plantation's normal gross profit is 35%.

Step by Step Solution

★★★★★

3.37 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

A Yes it is right if Eazy Company and Heaven Plantation apply the guidelines stated in IFRS 15 to recognize revenue from the contract The Internationa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started