Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 10th March 2022 SS Inc. (an Australian listed firm that pays corporate tax rate of 30%) announced that it is conducting an off-market share

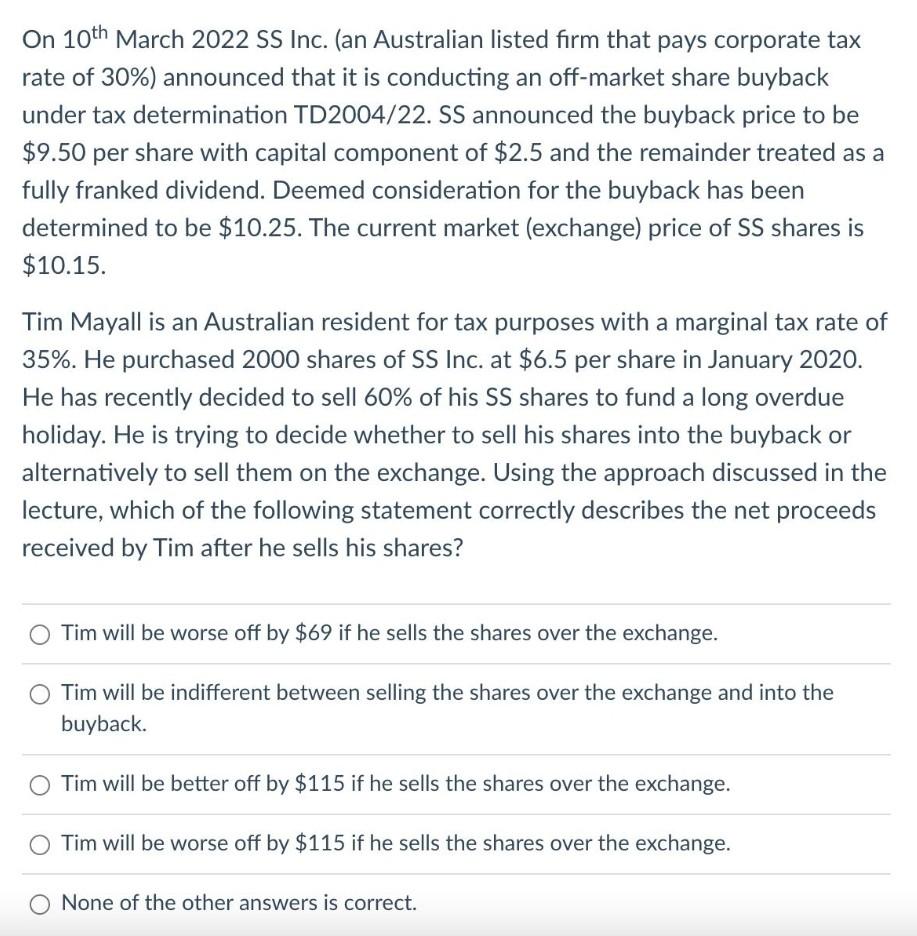

On 10th March 2022 SS Inc. (an Australian listed firm that pays corporate tax rate of 30%) announced that it is conducting an off-market share buyback under tax determination TD2004/22. SS announced the buyback price to be $9.50 per share with capital component of $2.5 and the remainder treated as a fully franked dividend. Deemed consideration for the buyback has been determined to be $10.25. The current market (exchange) price of SS shares is $10.15. Tim Mayall is an Australian resident for tax purposes with a marginal tax rate of 35%. He purchased 2000 shares of SS Inc. at $6.5 per share in January 2020. He has recently decided to sell 60% of his SS shares to fund a long overdue holiday. He is trying to decide whether to sell his shares into the buyback or alternatively to sell them on the exchange. Using the approach discussed in the lecture, which of the following statement correctly describes the net proceeds received by Tim after he sells his shares? Tim will be worse off by $69 if he sells the shares over the exchange. Tim will be indifferent between selling the shares over the exchange and into the buyback. Tim will be better off by $115 if he sells the shares over the exchange. Tim will be worse off by $115 if he sells the shares over the exchange. None of the other answers is correct. On 10th March 2022 SS Inc. (an Australian listed firm that pays corporate tax rate of 30%) announced that it is conducting an off-market share buyback under tax determination TD2004/22. SS announced the buyback price to be $9.50 per share with capital component of $2.5 and the remainder treated as a fully franked dividend. Deemed consideration for the buyback has been determined to be $10.25. The current market (exchange) price of SS shares is $10.15. Tim Mayall is an Australian resident for tax purposes with a marginal tax rate of 35%. He purchased 2000 shares of SS Inc. at $6.5 per share in January 2020. He has recently decided to sell 60% of his SS shares to fund a long overdue holiday. He is trying to decide whether to sell his shares into the buyback or alternatively to sell them on the exchange. Using the approach discussed in the lecture, which of the following statement correctly describes the net proceeds received by Tim after he sells his shares? Tim will be worse off by $69 if he sells the shares over the exchange. Tim will be indifferent between selling the shares over the exchange and into the buyback. Tim will be better off by $115 if he sells the shares over the exchange. Tim will be worse off by $115 if he sells the shares over the exchange. None of the other answers is correct

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started