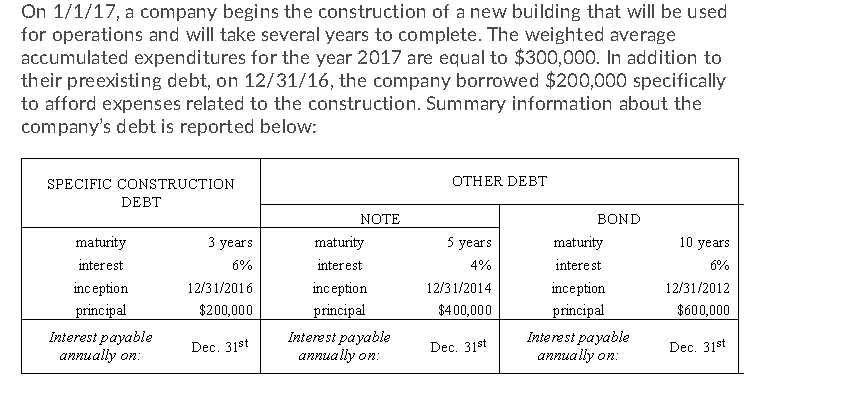

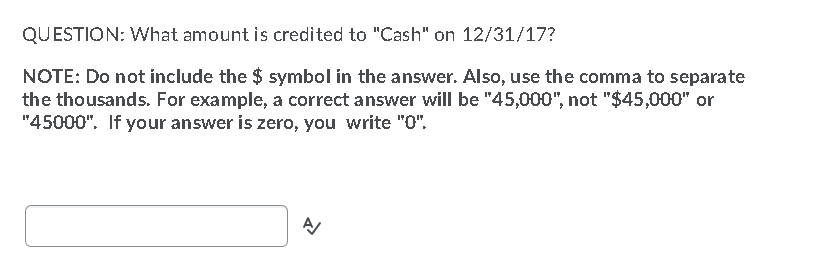

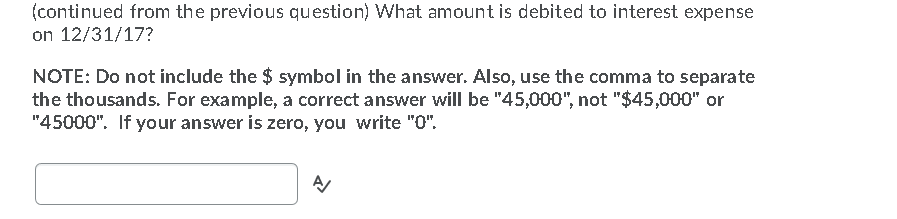

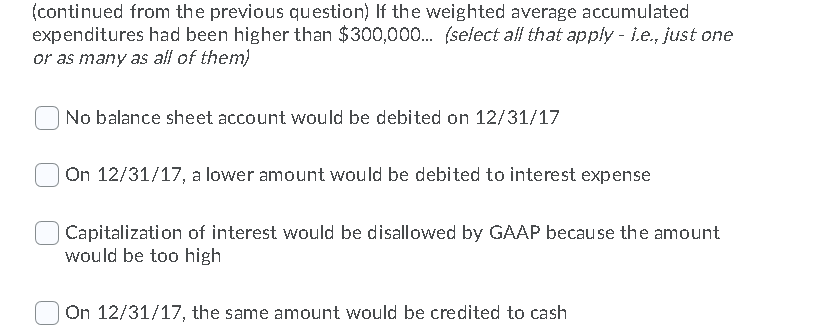

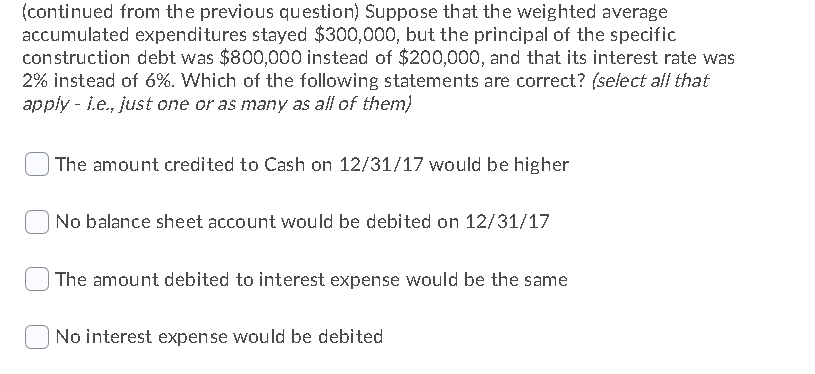

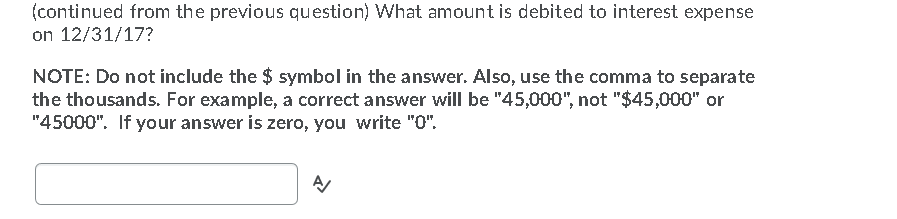

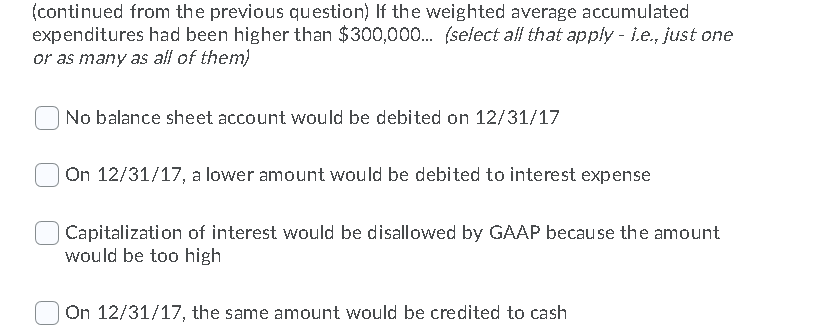

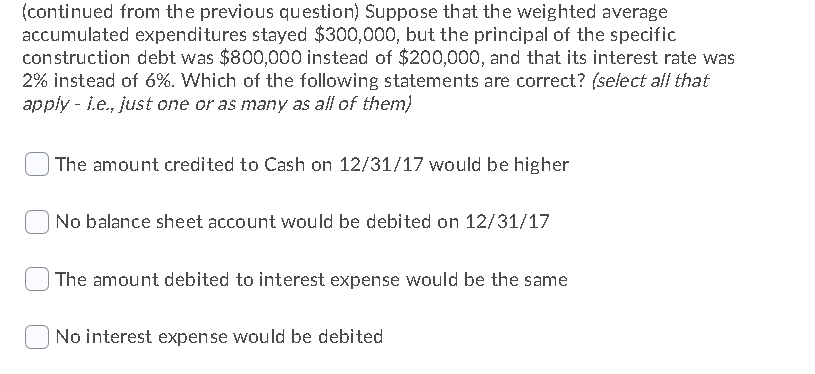

On 1/1/17, a company begins the construction of a new building that will be used for operations and will take several years to complete. The weighted average accumulated expenditures for the year 2017 are equal to $300,000. In addition to their preexisting debt, on 12/31/16, the company borrowed $200,000 specifically to afford expenses related to the construction. Summary information about the company's debt is reported below: OTHER DEBT SPECIFIC CONSTRUCTION DEBT maturity interest inception principal Interest payable annually on: 3 years 6% 12/31/2016 $200,000 NOTE maturity interest inception principal Interest payable annually on: 5 years 4% 12/31/2014 $400,000 BOND maturity interest inception principal 10 years 6% 12/31/2012 $600,000 Dec. 31st Dec. 31st Interest payable annually on: Dec. 31st QUESTION: What amount is credited to "Cash" on 12/31/17? NOTE: Do not include the $ symbol in the answer. Also, use the comma to separate the thousands. For example, a correct answer will be "45,000", not "$45,000" or "45000". If your answer is zero, you write "O". (continued from the previous question) What amount is debited to interest expense on 12/31/17? NOTE: Do not include the $ symbol in the answer. Also, use the comma to separate the thousands. For example, a correct answer will be "45,000", not "$45,000" or "45000". If your answer is zero, you write "O". (continued from the previous question) If the weighted average accumulated expenditures had been higher than $300,000... (select all that apply - i.e., just one or as many as all of them No balance sheet account would be debited on 12/31/17 On 12/31/17, a lower amount would be debited to interest expense Capitalization of interest would be disallowed by GAAP because the amount would be too high On 12/31/17, the same amount would be credited to cash (continued from the previous question) Suppose that the weighted average accumulated expenditures stayed $300,000, but the principal of the specific construction debt was $800,000 instead of $200,000, and that its interest rate was 2% instead of 6%. Which of the following statements are correct? (select all that apply - i.e., just one or as many as all of them) The amount credited to Cash on 12/31/17 would be higher No balance sheet account would be debited on 12/31/17 The amount debited to interest expense would be the same No interest expense would be debited