Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 1/1/17, a lessee (tenant) signed a noncancellable net lease with a lessor to use the lessor's machinery. The following data pertain to this

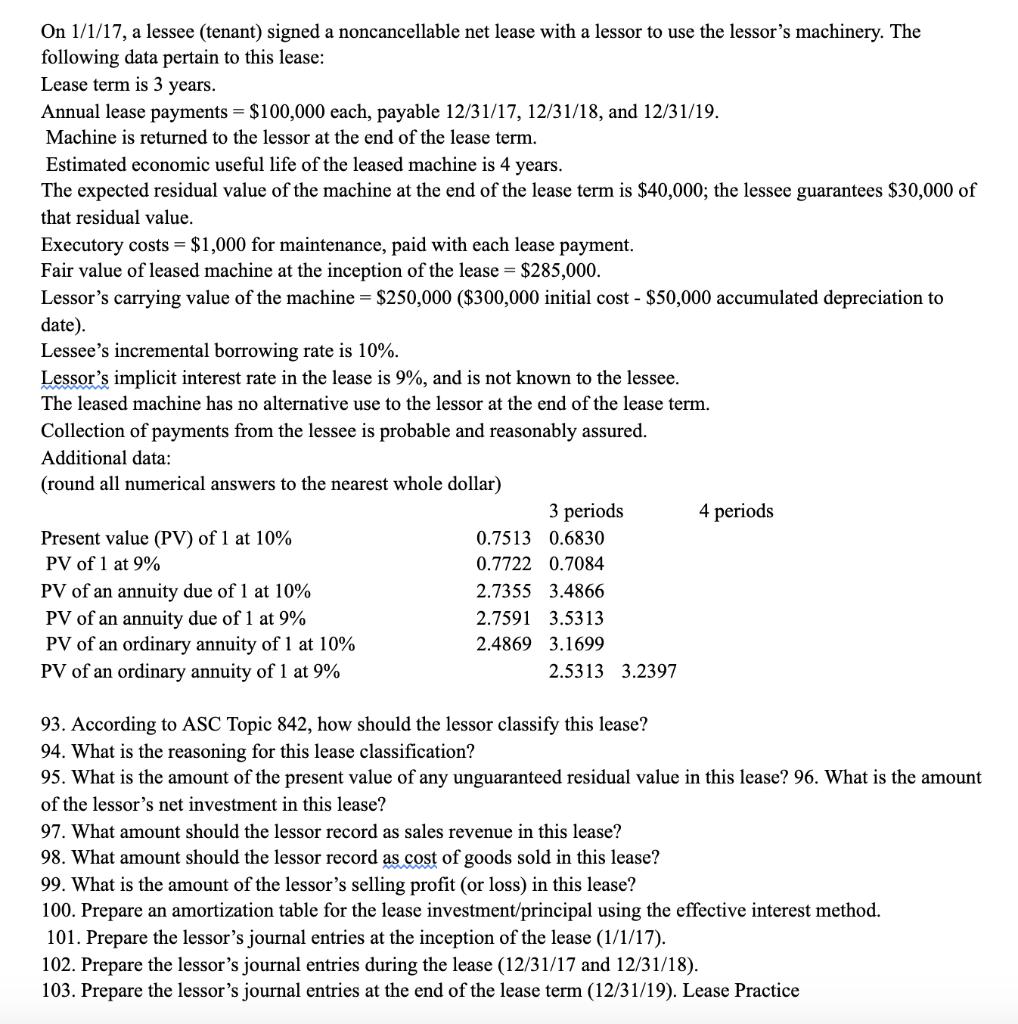

On 1/1/17, a lessee (tenant) signed a noncancellable net lease with a lessor to use the lessor's machinery. The following data pertain to this lease: Lease term is 3 years. Annual lease payments = $100,000 each, payable 12/31/17, 12/31/18, and 12/31/19. Machine is returned to the lessor at the end of the lease term. Estimated economic useful life of the leased machine is 4 years. The expected residual value of the machine at the end of the lease term is $40,000; the lessee guarantees $30,000 of that residual value. Executory costs = $1,000 for maintenance, paid with each lease payment. Fair value of leased machine at the inception of the lease = $285,000. Lessor's carrying value of the machine = $250,000 ($300,000 initial cost - $50,000 accumulated depreciation to date). Lessee's incremental borrowing rate is 10%. Lessor's implicit interest rate in the lease is 9%, and is not known to the lessee. The leased machine has no alternative use to the lessor at the end of the lease term. Collection of payments from the lessee is probable and reasonably assured. Additional data: (round all numerical answers to the nearest whole dollar) Present value (PV) of 1 at 10% PV of 1 at 9% PV of an annuity due of 1 at 10% PV of an annuity due of 1 at 9% PV of an ordinary annuity of 1 at 10% PV of an ordinary annuity of 1 at 9% 3 periods 0.7513 0.6830 0.7722 0.7084 2.7355 3.4866 2.7591 3.5313 2.4869 3.1699 2.5313 3.2397 4 periods 93. According to ASC Topic 842, how should the lessor classify this lease? 94. What is the reasoning for this lease classification? 95. What is the amount of the present value of any unguaranteed residual value in this lease? 96. What is the amount of the lessor's net investment in this lease? 97. What amount should the lessor record as sales revenue in this lease? 98. What amount should the lessor record as cost of goods sold in this lease? 99. What is the amount of the lessor's selling profit (or loss) in this lease? 100. Prepare an amortization table for the lease investment/principal using the effective interest method. 101. Prepare the lessor's journal entries at the inception of the lease (1/1/17). 102. Prepare the lessor's journal entries during the lease (12/31/17 and 12/31/18). 103. Prepare the lessor's journal entries at the end of the lease term (12/31/19). Lease Practice

Step by Step Solution

★★★★★

3.67 Rating (184 Votes )

There are 3 Steps involved in it

Step: 1

To answer your questions and prepare the required journal entries well follow the guidelines of ASC Topic 842 the Accounting Standards Codification ASC Topic 842 is the current lease accounting standa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started