Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 1/1/2014, Otter Group purchased 60% (60000 shares) of Dolphin Ltd. for $50 per share, which was a $5 per share control premium. Buildings and

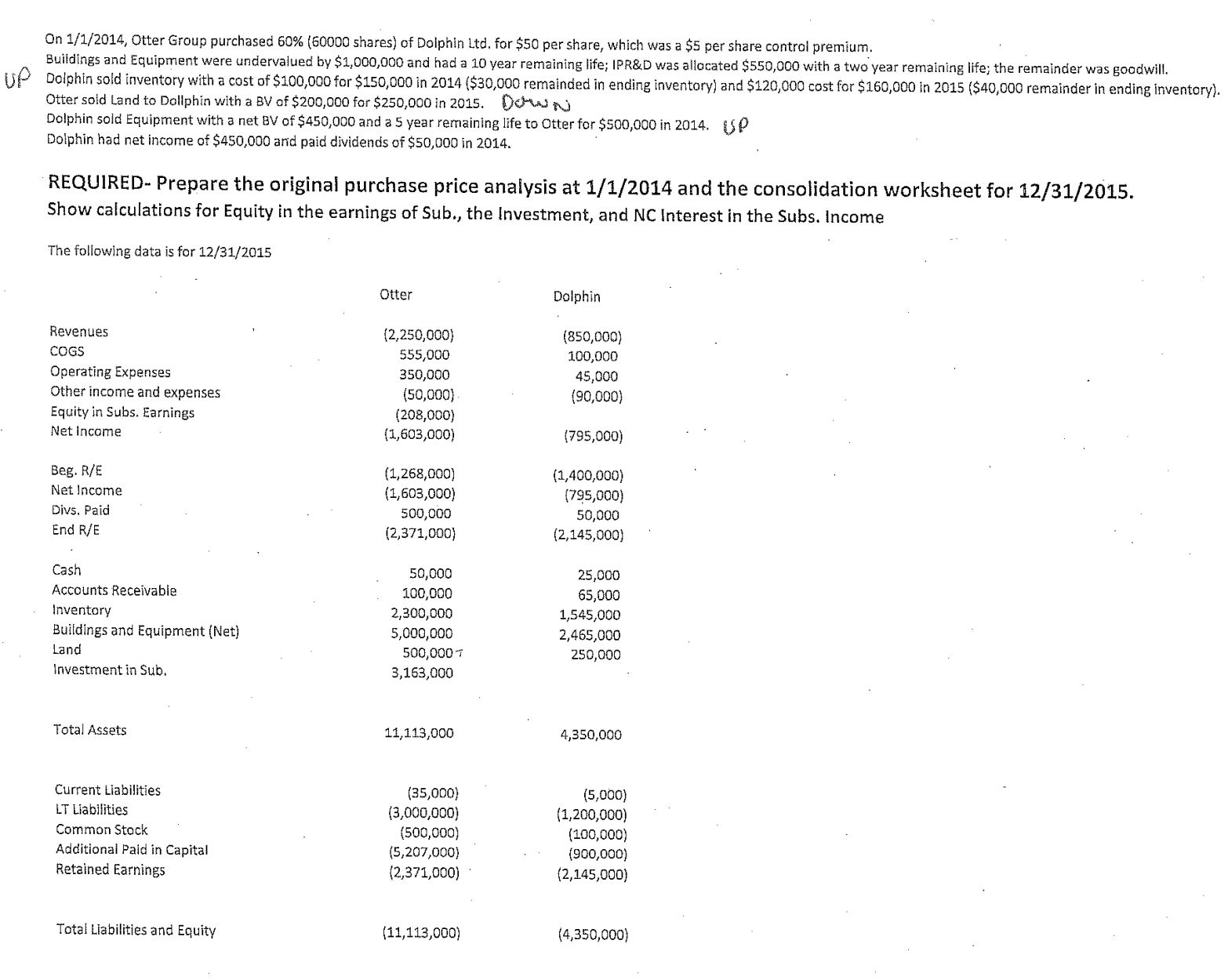

On 1/1/2014, Otter Group purchased 60\% (60000 shares) of Dolphin Ltd. for $50 per share, which was a $5 per share control premium. Buildings and Equipment were undervalued by $1,000,000 and had a 10 year remaining life; IPR\&D was allocated $550,000 with a two year remaining life; the remainder was goodwill. Dolphin sold inventory with a cost of $100,000 for $150,000 in 2014 (\$30,000 remainded in ending inventory) and $120,000 cost for $160,000 in 2015 (\$40,000 remainder in ending inventory). Otter sold Land to Dollphin with a BV of $200,000 for $250,000 in 2015 . Dow in Dolphin sold Equipment with a net BV of $450,000 and a 5 year remaining life to Otter for $500,000 in 2014. US Dolphin had net income of $450,000 arid paid dividends of $50,000 in 2014 . REQUIRED- Prepare the original purchase price analysis at 1/1/2014 and the consolidation worksheet for 12/31/2015. Show calculations for Equity in the earnings of Sub., the Investment, and NC Interest in the Subs. Income

On 1/1/2014, Otter Group purchased 60\% (60000 shares) of Dolphin Ltd. for $50 per share, which was a $5 per share control premium. Buildings and Equipment were undervalued by $1,000,000 and had a 10 year remaining life; IPR\&D was allocated $550,000 with a two year remaining life; the remainder was goodwill. Dolphin sold inventory with a cost of $100,000 for $150,000 in 2014 (\$30,000 remainded in ending inventory) and $120,000 cost for $160,000 in 2015 (\$40,000 remainder in ending inventory). Otter sold Land to Dollphin with a BV of $200,000 for $250,000 in 2015 . Dow in Dolphin sold Equipment with a net BV of $450,000 and a 5 year remaining life to Otter for $500,000 in 2014. US Dolphin had net income of $450,000 arid paid dividends of $50,000 in 2014 . REQUIRED- Prepare the original purchase price analysis at 1/1/2014 and the consolidation worksheet for 12/31/2015. Show calculations for Equity in the earnings of Sub., the Investment, and NC Interest in the Subs. Income Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started