Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 1.1.2015 an investor purchases 500 nominal of a 5-year index-linked bond which pays base coupons of 6 p.a. per 100 nominal of bond

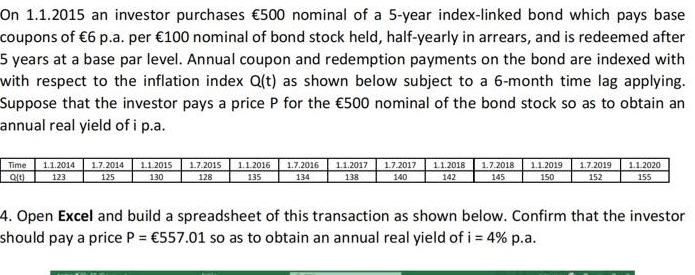

On 1.1.2015 an investor purchases 500 nominal of a 5-year index-linked bond which pays base coupons of 6 p.a. per 100 nominal of bond stock held, half-yearly in arrears, and is redeemed after 5 years at a base par level. Annual coupon and redemption payments on the bond are indexed with with respect to the inflation index Q(t) as shown below subject to a 6-month time lag applying. Suppose that the investor pays a price P for the 500 nominal of the bond stock so as to obtain an annual real yield of i p.a. Time 1.1.2014 1.7.2014 1.1.2015 Qt 123 125 130 1.7.2015 1.1.2016 1.7.2016 1.1.2017 1.7.2017 1.1.2018 1.7.2018 1.1.2019 1.7.2019 128 135 134 138 140 142 145 150 152 1.1.2020 155 4. Open Excel and build a spreadsheet of this transaction as shown below. Confirm that the investor should pay a price P = 557.01 so as to obtain an annual real yield of i= 4% p.a.

Step by Step Solution

★★★★★

3.46 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the price that the investor should pay for the 500 nominal of the bond stock we need to ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started