Answered step by step

Verified Expert Solution

Question

1 Approved Answer

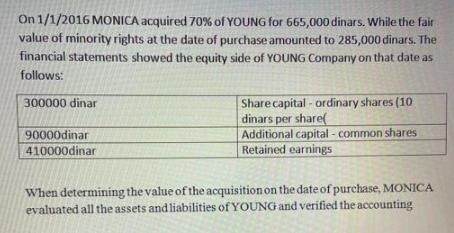

On 1/1/2016 MONICA acquired 70% of YOUNG for 665,000 dinars. While the fair value of minority rights at the date of purchase amounted to

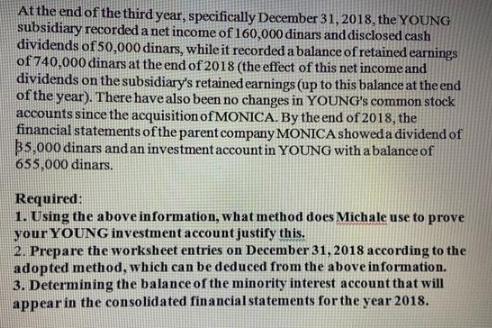

On 1/1/2016 MONICA acquired 70% of YOUNG for 665,000 dinars. While the fair value of minority rights at the date of purchase amounted to 285,000 dinars. The financial statements showed the equity side of YOUNG Company on that date as follows: 300000 dinar Share capital-ordinary shares (10 dinars per share( 90000dinar Additional capital - common shares Retained earnings 410000dinar When determining the value of the acquisition on the date of purchase, MONICA evaluated all the assets and liabilities of YOUNG and verified the accounting records. The fair value of assets and liabilities was equal to the book value, except for buildings (operational life of 5 years), the recorded value was less than 50,000 dinars and The patent that is not registered in the books of the subsidiary company (the shelf life is 10 years) with a value equal to the difference between the fair value and the book value of the subsidiary company (differences in the fair value and book value - meaning that the assets of the subsidiary proved a difference in the value of the patent). If you know that during the following three years of ownership, the subsidiary YOUNG sold goods to MONICA at a profit rate of 30%. While the parent company MONICA resells it to outside parties in the same year or at the latest in the following year (ie. the goods remaining in the stores are sold directly in the following year) as follows: Goods left in stock at the end of the year 10000 12000 18000 Sold price 60000 80000 90000 year 2016 2017 2018 At the end of the third year, specifically December 31, 2018, the YOUNG subsidiary recorded a net income of 160,000 dinars and disclosed cash dividends of 50,000 dinars, while it recorded a balance of retained earnings of 740,000 dinars at the end of 2018 (the effect of this net income and dividends on the subsidiary's retained earnings (up to this balance at the end of the year). There have also been no changes in YOUNG's common stock accounts since the acquisition of MONICA. By the end of 2018, the financial statements of the parent company MONICA showed a dividend of 35,000 dinars and an investment account in YOUNG with a balance of 655,000 dinars. Required: 1. Using the above information, what method does Michale use to prove your YOUNG investment account justify this. 2. Prepare the worksheet entries on December 31, 2018 according to the adopted method, which can be deduced from the above information. 3. Determining the balance of the minority interest account that will appear in the consolidated financial statements for the year 2018.

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Answers Consideration transferred Noncontrolling interest fair value Subsidiary fair value at acquis...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started