Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 1/1/2020 Big Sky Inc., issued $100,000,000, 8%, due 12/31/2022. The coupon payments are paid semi-annually (4%). are paid on June 30th & Dec

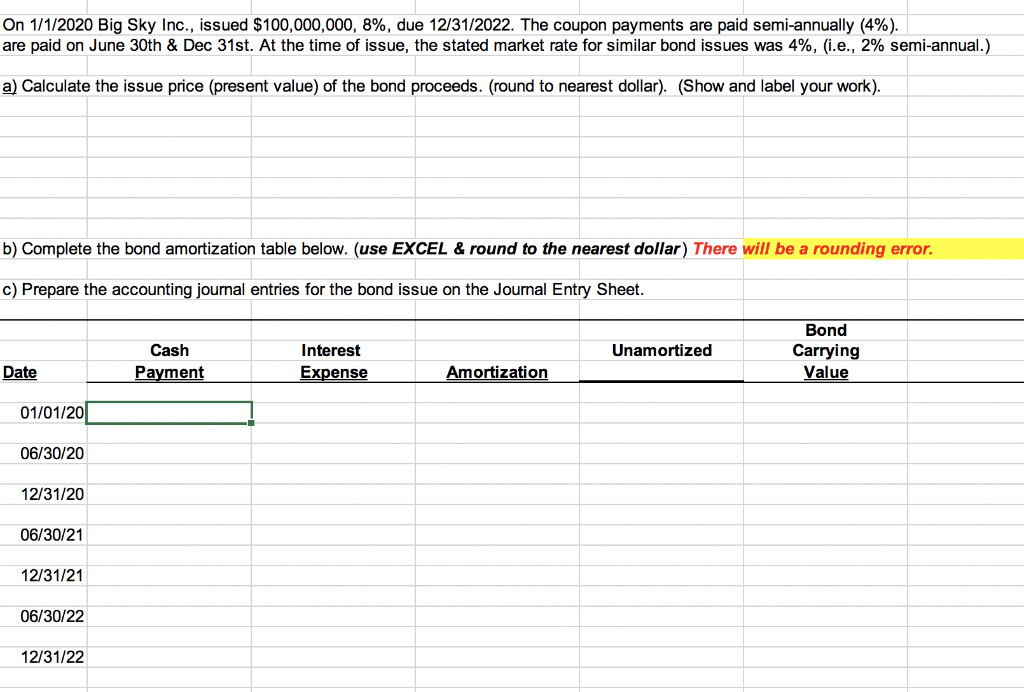

On 1/1/2020 Big Sky Inc., issued $100,000,000, 8%, due 12/31/2022. The coupon payments are paid semi-annually (4%). are paid on June 30th & Dec 31st. At the time of issue, the stated market rate for similar bond issues was 4%, (i.e., 2% semi-annual.) a) Calculate the issue price (present value) of the bond proceeds. (round to nearest dollar). (Show and label your work). b) Complete the bond amortization table below. (use EXCEL & round to the nearest dollar) There will be a rounding error. c) Prepare the accounting journal entries for the bond issue on the Journal Entry Sheet. Date Cash Payment Interest Expense Amortization 01/01/20 06/30/20 12/31/20 06/30/21 12/31/21 06/30/22 12/31/22 Unamortized Bond Carrying Value

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started