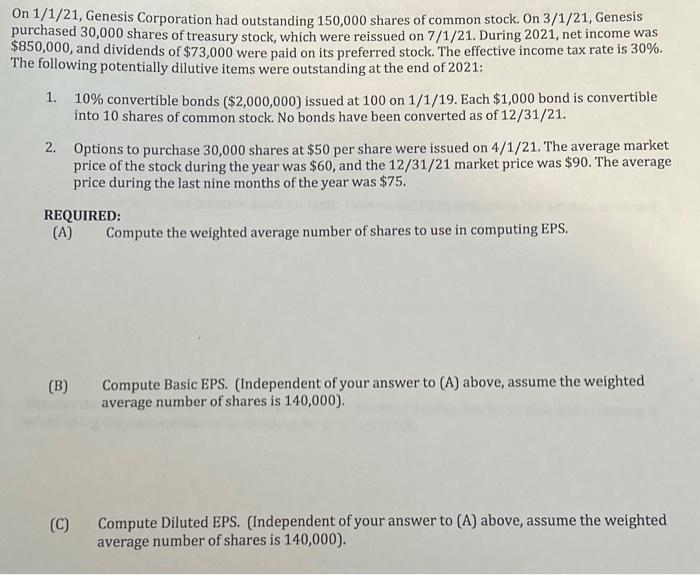

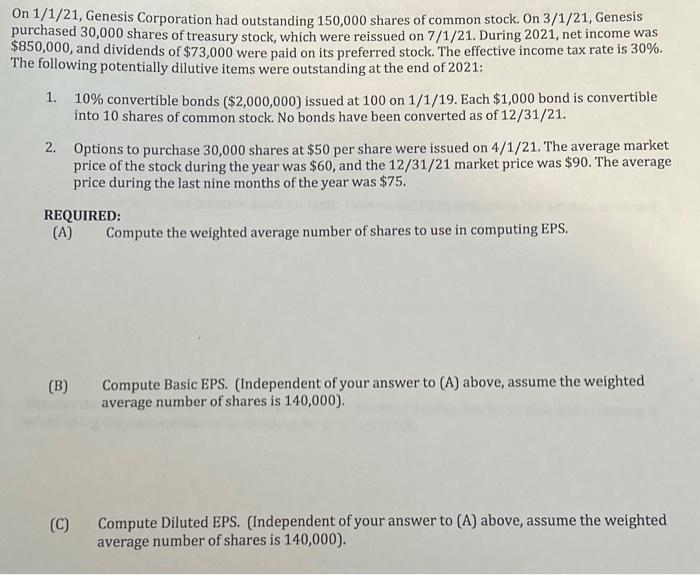

On 1/1/21, Genesis Corporation had outstanding 150,000 shares of common stock. On 3/1/21, Genesis purchased 30,000 shares of treasury stock, which were reissued on 7/1/21. During 2021 , net income was $850,000, and dividends of $73,000 were paid on its preferred stock. The effective income tax rate is 30%. The following potentially dilutive items were outstanding at the end of 2021: 1. 10% convertible bonds ($2,000,000) issued at 100 on 1/1/19. Each $1,000 bond is convertible into 10 shares of common stock. No bonds have been converted as of 12/31/21. 2. Options to purchase 30,000 shares at $50 per share were issued on 4/1/21. The average market price of the stock during the year was $60, and the 12/31/21 market price was $90. The average price during the last nine months of the year was $75. REQUIRED: (A) Compute the weighted average number of shares to use in computing EPS. (B) Compute Basic EPS. (Independent of your answer to (A) above, assume the weighted average number of shares is 140,000 ). (C) Compute Diluted EPS. (Independent of your answer to (A) above, assume the weighted average number of shares is 140,000 ). On 1/1/21, Genesis Corporation had outstanding 150,000 shares of common stock. On 3/1/21, Genesis purchased 30,000 shares of treasury stock, which were reissued on 7/1/21. During 2021 , net income was $850,000, and dividends of $73,000 were paid on its preferred stock. The effective income tax rate is 30%. The following potentially dilutive items were outstanding at the end of 2021: 1. 10% convertible bonds ($2,000,000) issued at 100 on 1/1/19. Each $1,000 bond is convertible into 10 shares of common stock. No bonds have been converted as of 12/31/21. 2. Options to purchase 30,000 shares at $50 per share were issued on 4/1/21. The average market price of the stock during the year was $60, and the 12/31/21 market price was $90. The average price during the last nine months of the year was $75. REQUIRED: (A) Compute the weighted average number of shares to use in computing EPS. (B) Compute Basic EPS. (Independent of your answer to (A) above, assume the weighted average number of shares is 140,000 ). (C) Compute Diluted EPS. (Independent of your answer to (A) above, assume the weighted average number of shares is 140,000 )