Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 1/1/23, BIGDEBT issued $9,500,000 face value bonds, dated 1/1/23, with a coupon rate (aka: stated rate) of 6%. The market rate of interest on

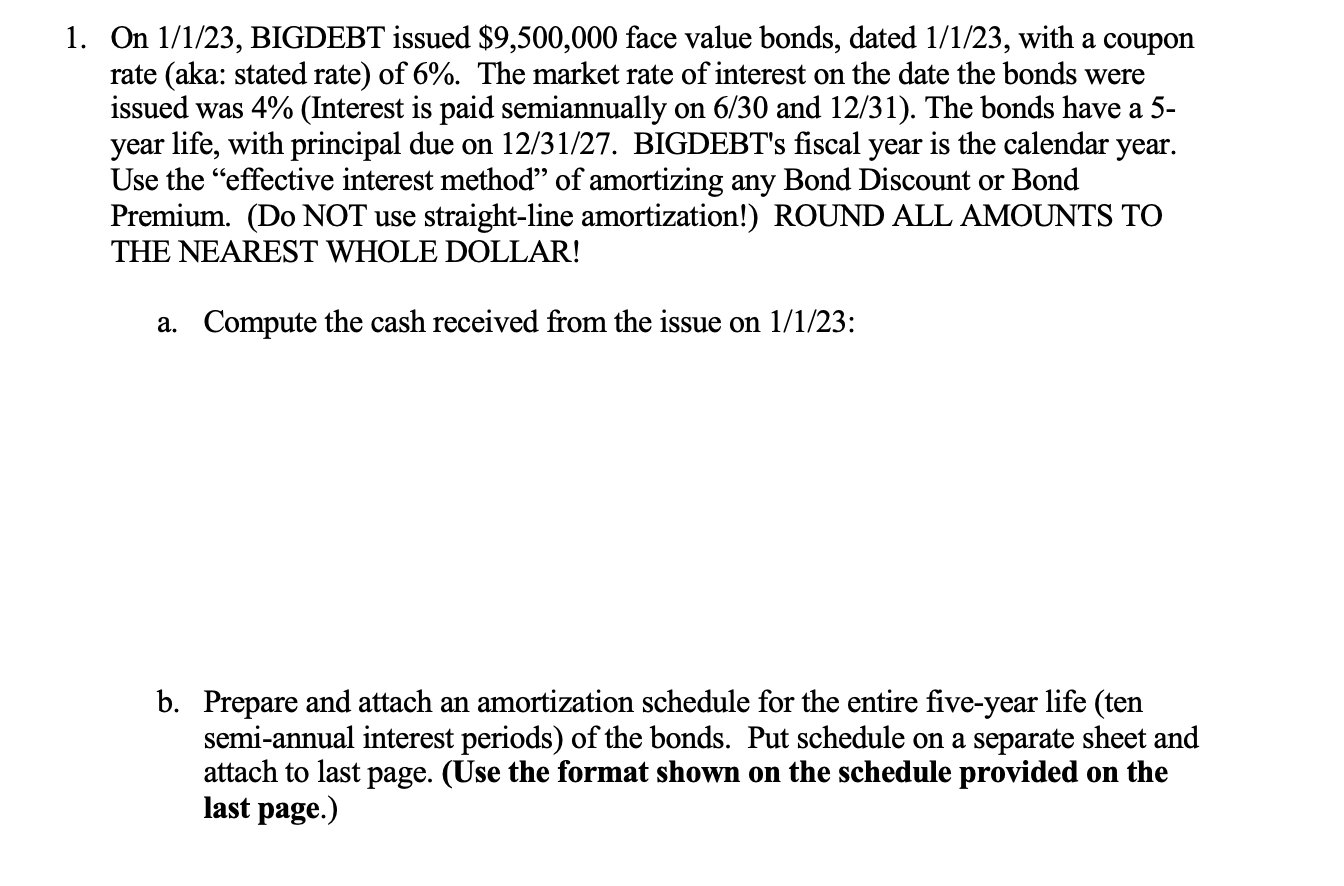

On 1/1/23, BIGDEBT issued $9,500,000 face value bonds, dated 1/1/23, with a coupon rate (aka: stated rate) of 6%. The market rate of interest on the date the bonds were issued was 4% (Interest is paid semiannually on 6/30 and 12/31). The bonds have a 5year life, with principal due on 12/31/27. BIGDEBT's fiscal year is the calendar year. Use the "effective interest method" of amortizing any Bond Discount or Bond Premium. (Do NOT use straight-line amortization!) ROUND ALL AMOUNTS TO THE NEAREST WHOLE DOLLAR! a. Compute the cash received from the issue on 1/1/23 : b. Prepare and attach an amortization schedule for the entire five-year life (ten semi-annual interest periods) of the bonds. Put schedule on a separate sheet and attach to last page. (Use the format shown on the schedule provided on the last page.)

On 1/1/23, BIGDEBT issued $9,500,000 face value bonds, dated 1/1/23, with a coupon rate (aka: stated rate) of 6%. The market rate of interest on the date the bonds were issued was 4% (Interest is paid semiannually on 6/30 and 12/31). The bonds have a 5year life, with principal due on 12/31/27. BIGDEBT's fiscal year is the calendar year. Use the "effective interest method" of amortizing any Bond Discount or Bond Premium. (Do NOT use straight-line amortization!) ROUND ALL AMOUNTS TO THE NEAREST WHOLE DOLLAR! a. Compute the cash received from the issue on 1/1/23 : b. Prepare and attach an amortization schedule for the entire five-year life (ten semi-annual interest periods) of the bonds. Put schedule on a separate sheet and attach to last page. (Use the format shown on the schedule provided on the last page.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started