Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 1/1/23, Mellow-Hello Inc. took on debt and the bond's features are: Maturity Value $612,000 Maturity Date 1/1/28 (in 5. years) Stated Interest 4% Market

On 1/1/23, Mellow-Hello Inc. took on debt and the bond's features are:

Maturity Value $612,000 Maturity Date 1/1/28 (in 5. years)

Stated Interest 4% Market Interest 8%

Interest Payments Annually starting 1/1/24

a) The selling price of the bond is (includes both principle and interest):

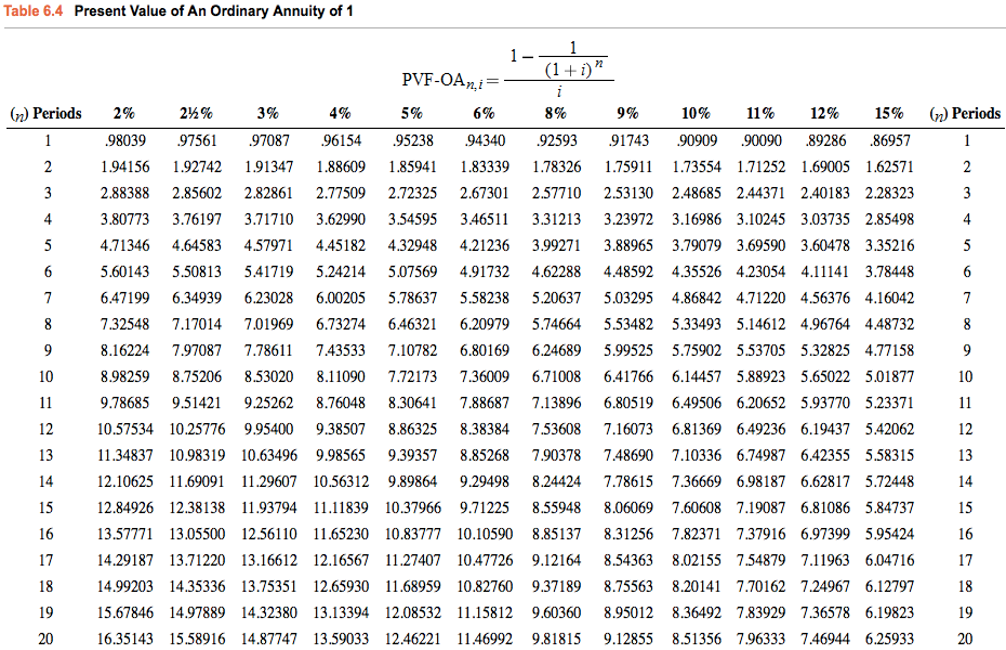

- Time value of money tables are at the end of this question.

b)Amortization Schedule for the 5 years. Round to the nearest whole dollar

| Date | Interest Paid | Interest Expense | Amortization | Carry Value |

| 1/1/23 |

| |||

| 1/1/24 |

| |||

| 1/1/25 |

| |||

| 1/1/26 |

| |||

| 1/1/27 |

| |||

| 1/1/28 |

|

c) What is the initial journal entry on 1/1/23 for this Bond? (2 points)

d)What is the journal entry on 1/1/24 for this Bond? (2 points)

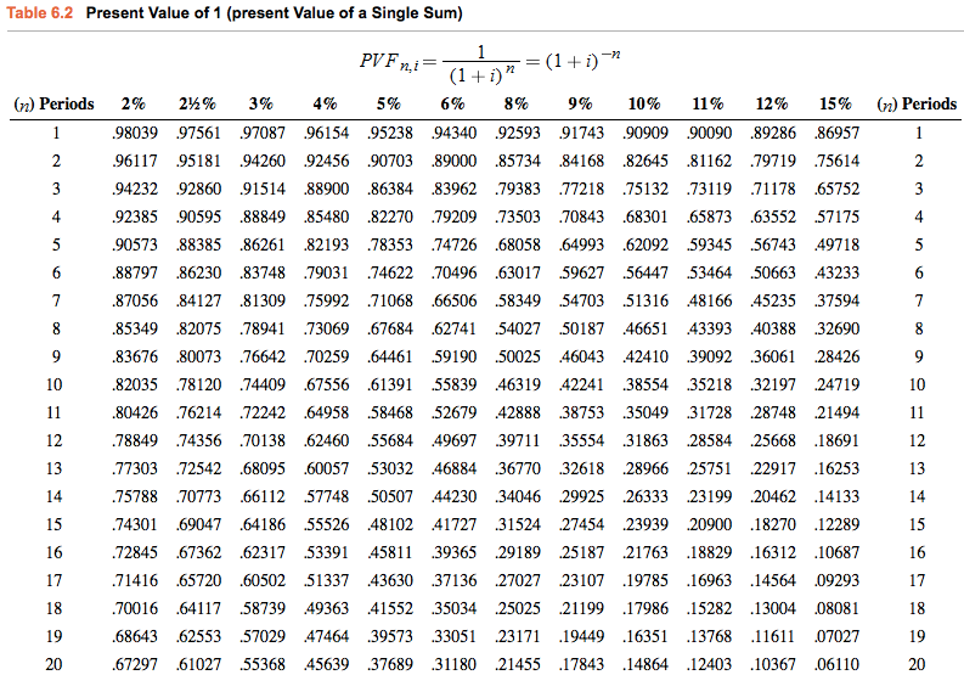

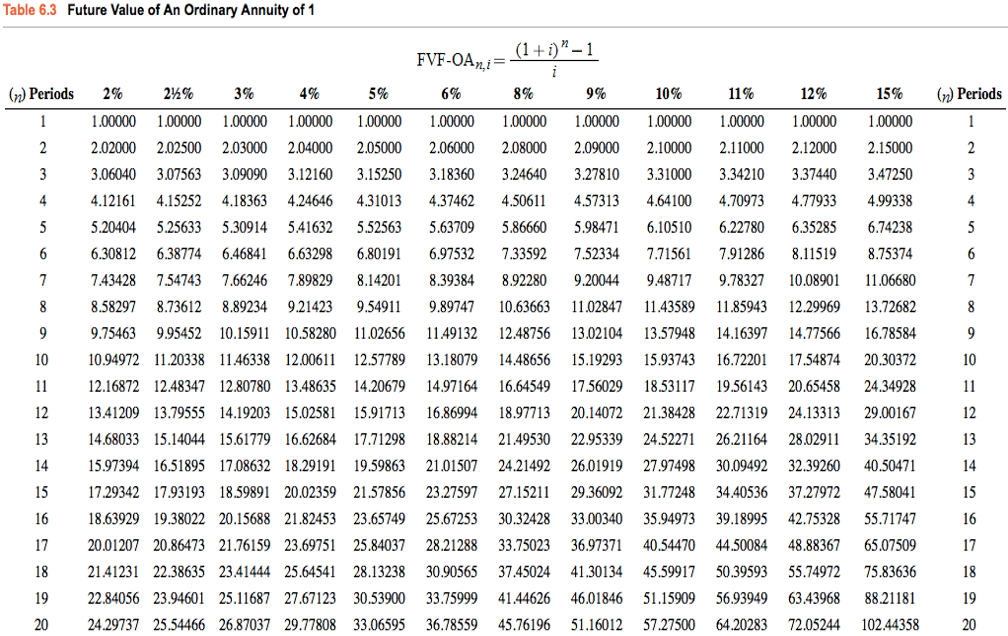

Please use these tables.

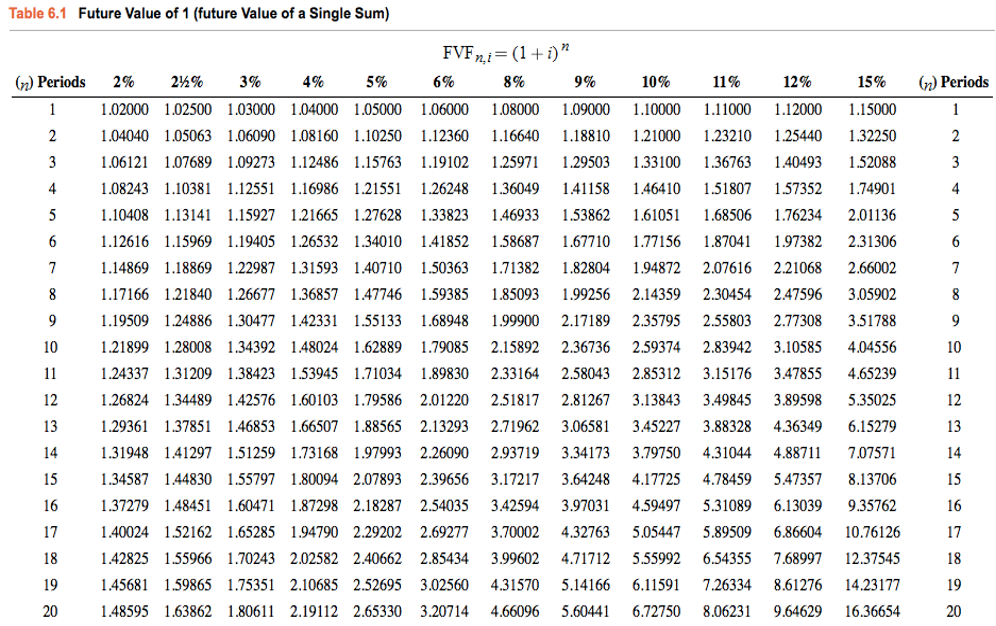

Table 6.1 Future Value of 1 (future Value of a Single Sum) FVFR (1+1)" (n) Periods 2% 2% 3% 1 2 4% 1.02000 1.02500 1.03000 1.04000 1.05000 1.04040 1.05063 1.06090 1.08160 1.10250 5% 6% 8% 9% 10% 11% 12% 15% (n) Periods 1.06000 1.08000 1.09000 1.12360 3 1.06121 1.07689 1.09273 1.12486 1.15763 1.19102 1.25971 1.29503 1.10000 1.11000 1.16640 1.18810 1.21000 1.23210 1.33100 1.12000 1.15000 1 1.25440 1.32250 2 1.36763 1.40493 1.52088 3 4 1.08243 1.10381 1.12551 1.16986 1.21551 1.26248 1.36049 1.41158 5 1.10408 1.13141 1.15927 1.21665 1.27628 1.33823 1.46933 1.46410 1.51807 1.57352 1.53862 1.61051 1.68506 1.76234 1.74901 4 2.01136 5 6 1.12616 1.15969 1.19405 1.26532 1.34010 1.41852 1.58687 1.67710 1.77156 1.87041 1.97382 2.31306 6 7 1.14869 1.18869 1.22987 1.31593 1.40710 1.50363 1.71382 8 9 10 11 1.17166 1.21840 1.26677 1.36857 1.47746 1.59385 1.19509 1.24886 1.30477 1.42331 1.55133 1.68948 1.21899 1.28008 1.34392 1.48024 1.62889 1.24337 1.31209 1.38423 1.53945 1.71034 1.85093 12 1.26824 1.34489 1.42576 1.60103 1.79586 2.01220 13 1.29361 1.37851 1.46853 1.66507 1.88565 2.13293 14 1.31948 1.41297 1.51259 1.73168 1.97993 2.26090 2.93719 15 16 1.34587 1.44830 1.55797 1.80094 2.07893 2.39656 1.37279 1.48451 1.60471 1.87298 2.18287 2.54035 3.17217 3.42594 17 18 19 1.40024 1.52162 1.65285 1.94790 2.29202 2.69277 1.42825 1.55966 1.70243 2.02582 2.40662 2.85434 1.45681 1.59865 1.75351 2.10685 2.52695 3.02560 4.31570 5.14166 6.11591 7.26334 1.82804 1.94872 2.07616 2.21068 2.66002 1.99256 2.14359 2.30454 2.47596 3.05902 1.99900 2.17189 2.35795 2.55803 2.77308 3.51788 1.79085 2.15892 2.36736 2.59374 2.83942 3.10585 4.04556 1.89830 2.33164 2.58043 2.85312 3.15176 3.47855 2.51817 2.81267 3.13843 3.49845 3.89598 2.71962 3.06581 3.45227 3.88328 4.36349 6.15279 3.34173 3.79750 4.31044 3.64248 4.17725 4.78459 3.97031 4.59497 5.31089 3.70002 4.32763 5.05447 5.89509 3.99602 4.71712 5.55992 6.54355 7 8 9 10 4.65239 11 5.35025 12 13 4.88711 7.07571 14 5.47357 8.13706 6.13039 9.35762 6.86604 10.76126 15 16 17 7.68997 12.37545 18 8.61276 14.23177 19 20 1.48595 1.63862 1.80611 2.19112 2.65330 3.20714 4.66096 5.60441 6.72750 8.06231 9.64629 16.36654 20

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started