Question

On 1/18/20, Ellen L. Franklin, Staff Auditor, at Ernst and Olde, CPAs, analyzed her client's professional fees account (G/L balance of $450k) and completed the

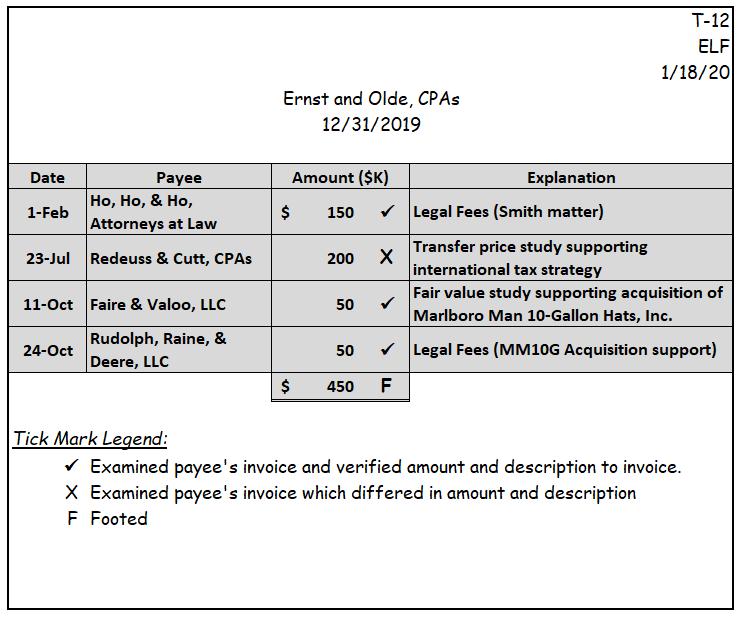

On 1/18/20, Ellen L. Franklin, Staff Auditor, at Ernst and Olde, CPAs, analyzed her client's professional fees account (G/L balance of $450k) and completed the work paper below. The client is Zippy Lines Incorporated, and the audit is for the year-ended December 31, 2019. Assume the spreadsheet (shaded portion, except the tick marks) was prepared by the client with the rest of the work paper being completed by Ellen.

As her senior, you are to identify and briefly explain four errors (there are more) in Ellen's work paper.

Professor's note: Please use bullets / numbering to clearly separate your responses.

T-12 ELF 1/18/20 Ernst and Olde, CPAS 12/31/2019 Date Payee Amount ($K) Explanation Ho, Ho, & Ho, Attorneys at Law 1-Feb $ 150 V Legal Fees (Smith matter) Transfer price study supporting international tax strategy 23-Jul Redeuss & Cutt, CPAS 200 Fair value study supporting acquisition of Marlboro Man 10-Gallon Hats, Inc. 11-Oct Faire & Valoo, LLC 50 Rudolph, Raine, & Deere, LLC 24-Oct 50 v Legal Fees (MM10G Acquisition support) $ 450 F Tick Mark Legend: V Examined payee's invoice and verified amount and description to invoice. X Examined payee's invoice which differed in amount and description F Footed

Step by Step Solution

3.57 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Below are the errors in Ellens work paper 1 Provision for audit fee for Ernst an...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started