Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 1/1/A, LVM Co. issues $200k in 10 year, 10% bonds to yield 12%. Provide LVM's net book value for the bonds on 12/31/G,

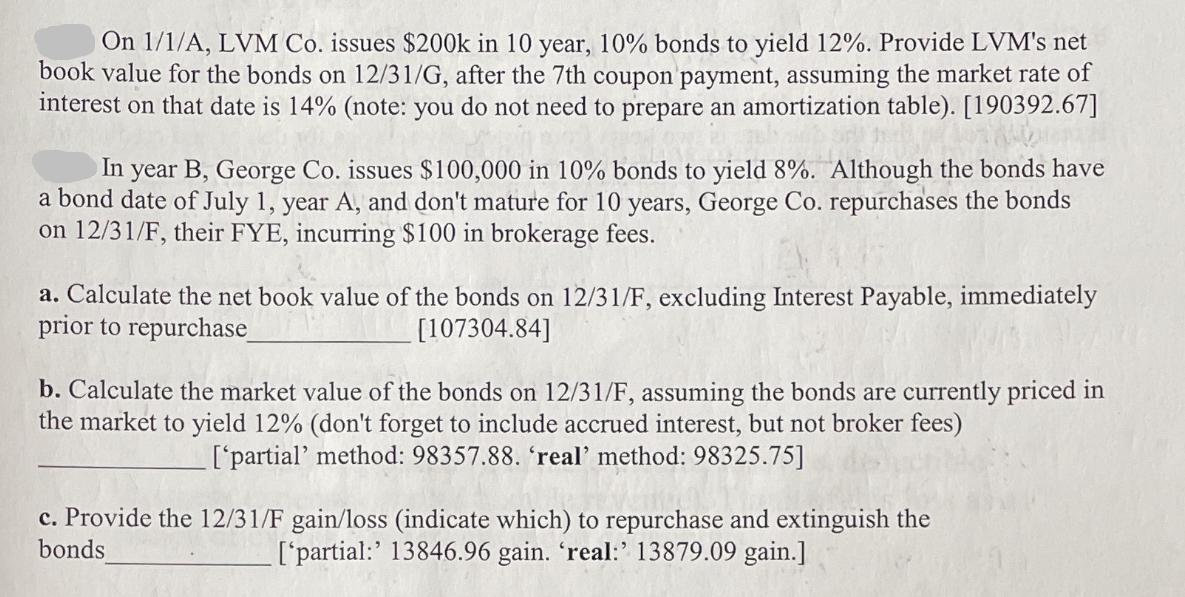

On 1/1/A, LVM Co. issues $200k in 10 year, 10% bonds to yield 12%. Provide LVM's net book value for the bonds on 12/31/G, after the 7th coupon payment, assuming the market rate of interest on that date is 14% (note: you do not need to prepare an amortization table). [190392.67] In year B, George Co. issues $100,000 in 10% bonds to yield 8%. Although the bonds have a bond date of July 1, year A, and don't mature for 10 years, George Co. repurchases the bonds on 12/31/F, their FYE, incurring $100 in brokerage fees. a. Calculate the net book value of the bonds on 12/31/F, excluding Interest Payable, immediately prior to repurchase_ [107304.84] b. Calculate the market value of the bonds on 12/31/F, assuming the bonds are currently priced in the market to yield 12% (don't forget to include accrued interest, but not broker fees) ['partial' method: 98357.88. 'real' method: 98325.75] c. Provide the 12/31/F gain/loss (indicate which) to repurchase and extinguish the bonds ['partial: 13846.96 gain. 'real:' 13879.09 gain.]

Step by Step Solution

★★★★★

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a Net Book Value of Bonds on 1231F The net book value of the bonds is the carrying value of the bonds on the companys books as of 1231F just before th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started