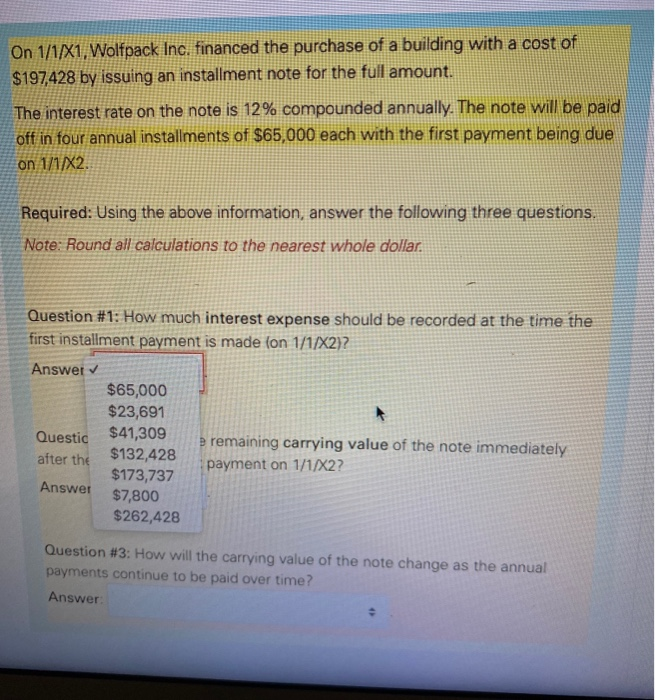

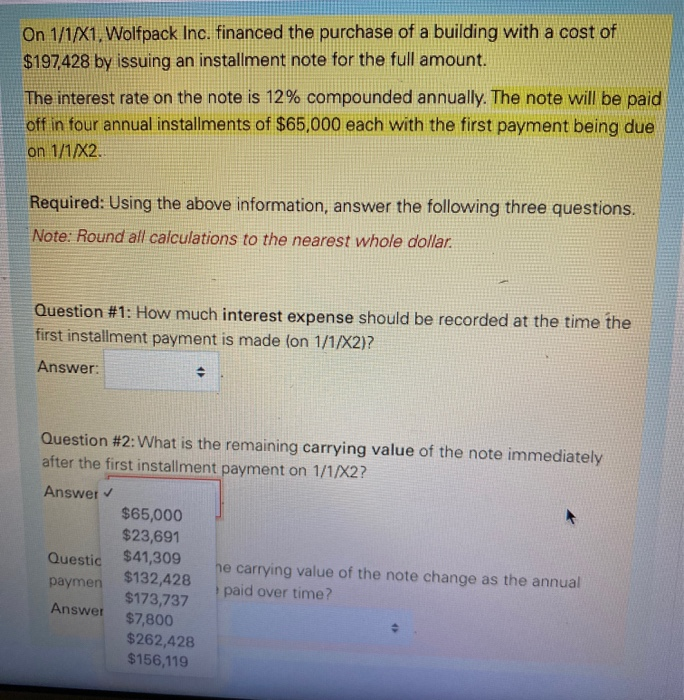

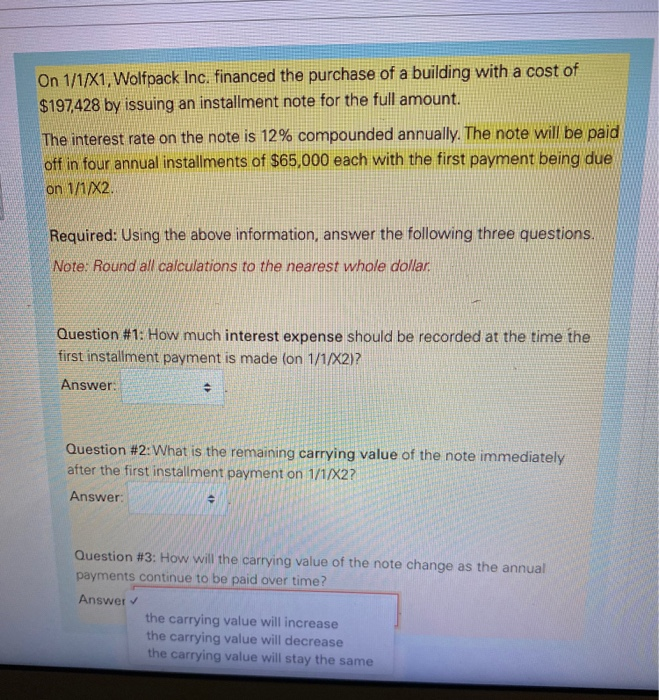

On 1/1/X1, Wolfpack Inc, financed the purchase of a building with a cost of $197,428 by issuing an installment note for the full amount. The interest rate on the note is 12% compounded annually. The note will be paid off in four annual installments of $65,000 each with the first payment being due on 1/1/X2. Required: Using the above information, answer the following three questions. Note: Round all calculations to the nearest whole dollar. Question #1: How much interest expense should be recorded at the time the first installment payment is made (on 1/1/X2)? Answer $65,000 $23,691 Questic $41,309 remaining carrying value of the note immediately after the $132,428 payment on 1/1/X2? $173,737 Answer $7,800 $262,428 Question #3: How will the carrying value of the note change as the annual payments continue to be paid over time? Answer On 1/1/X1, Wolfpack Inc. financed the purchase of a building with a cost of $197,428 by issuing an installment note for the full amount. The interest rate on the note is 12% compounded annually. The note will be paid off in four annual installments of $65,000 each with the first payment being due on 1/1/X2. Required: Using the above information, answer the following three questions. Note: Round all calculations to the nearest whole dollar. Question #1: How much interest expense should be recorded at the time the first installment payment is made (on 1/1/X2)? Answer: Question #2: What is the remaining carrying value of the note immediately after the first installment payment on 1/1/X2? Answer $65,000 $23,691 Questic $41,309 he carrying value of the note change as the annual paymen $132,428 paid over time? $173,737 Answer $7,800 $262,428 $156,119 On 1/1/X1, Wolfpack Inc. financed the purchase of a building with a cost of $197,428 by issuing an installment note for the full amount. The interest rate on the note is 12% compounded annually. The note will be paid off in four annual installments of $65,000 each with the first payment being due on 1/1/X2. Required: Using the above information, answer the following three questions. Note: Round all calculations to the nearest whole dollar Question #1: How much interest expense should be recorded at the time the first installment payment is made (on 1/1/X2)? Answer: Question #2: What is the remaining carrying value of the note immediately after the first installment payment on 1/1/X2? Answer: Question #3: How will the carrying value of the note change as the annual payments continue to be paid over time? Answer the carrying value will increase the carrying value will decrease the carrying value will stay the same