= On 1/1/X4, Phillip invested $1,100,000 in Sleeper's ordinary shares (35% owned). Sleeper reported: Assets $3,500,000 Liabilities 600,000 The book value of Sleeper's net

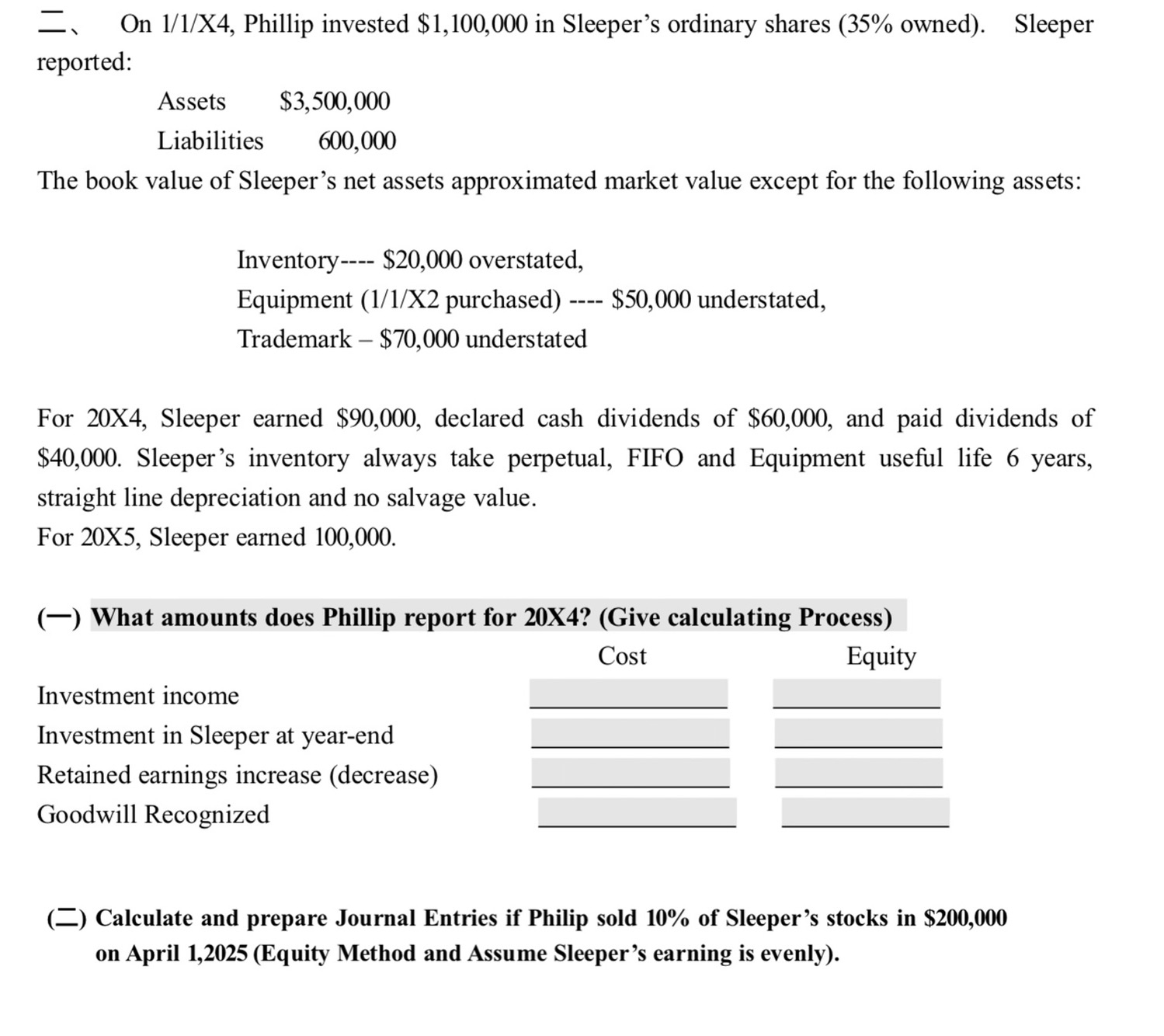

= On 1/1/X4, Phillip invested $1,100,000 in Sleeper's ordinary shares (35% owned). Sleeper reported: Assets $3,500,000 Liabilities 600,000 The book value of Sleeper's net assets approximated market value except for the following assets: Inventory $20,000 overstated, Equipment (1/1/X2 purchased). $50,000 understated, ---- Trademark $70,000 understated For 20X4, Sleeper earned $90,000, declared cash dividends of $60,000, and paid dividends of $40,000. Sleeper's inventory always take perpetual, FIFO and Equipment useful life 6 years, straight line depreciation and no salvage value. For 20X5, Sleeper earned 100,000. (-) What amounts does Phillip report for 20X4? (Give calculating Process) Investment income Investment in Sleeper at year-end Retained earnings increase (decrease) Goodwill Recognized Cost Equity (=) Calculate and prepare Journal Entries if Philip sold 10% of Sleeper's stocks in $200,000 on April 1,2025 (Equity Method and Assume Sleeper's earning is evenly).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Part 1 Amounts Phillip reports for 20X4 Investment Income Phillips share of Sleepers earnings for 20X4 Cost Initial investment cost plus Phillips shar...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started