Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 16 September 1982 Matchstick Ltd acquired 50 hectares of rural land in Toowoomba. At the time the land was zoned agricultural, but the

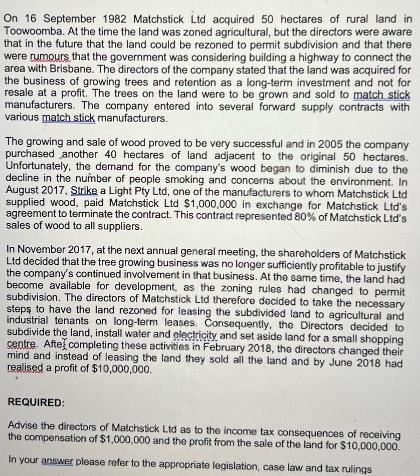

On 16 September 1982 Matchstick Ltd acquired 50 hectares of rural land in Toowoomba. At the time the land was zoned agricultural, but the directors were aware that in the future that the land could be rezoned to permit subdivision and that there were rumours that the government was considering building a highway to connect the area with Brisbane. The directors of the company stated that the land was acquired for the business of growing trees and retention as a long-term investment and not for resale at a profit. The trees on the land were to be grown and sold to match stick manufacturers. The company entered into several forward supply contracts with various match stick manufacturers. The growing and sale of wood proved to be very successful and in 2005 the company purchased another 40 hectares of land adjacent to the original 50 hectares. Unfortunately, the demand for the company's wood began to diminish due to the decline in the number of people smoking and concerns about the environment. In August 2017, Strike a Light Pty Ltd, one of the manufacturers to whom Matchstick Ltd supplied wood, paid Matchstick Ltd $1,000,000 in exchange for Matchstick Ltd's agreement to terminate the contract. This contract represented 80% of Matchstick Ltd's sales of wood to all suppliers. In November 2017, at the next annual general meeting, the shareholders of Matchstick Ltd decided that the tree growing business was no longer sufficiently profitable to justify the company's continued involvement in that business. At the same time, the land had become available for development, as the zoning rules had changed to permit subdivision. The directors of Matchstick Ltd therefore decided to take the necessary steps to have the land rezoned for leasing the subdivided land to agricultural and industrial tenants on long-term leases. Consequently, the Directors decided to subdivide the land, install water and electricity and set aside land for a small shopping centre. After completing these activities in February 2018, the directors changed their mind and instead of leasing the land they sold all the land and by June 2018 had realised a profit of $10,000,000. REQUIRED: Advise the directors of Matchstick Ltd as to the income tax consequences of receiving the compensation of $1,000,000 and the profit from the sale of the land for $10,000,000. In your answer please refer to the appropriate legislation, case law and tax rulings

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

I can provide a general assessment of the earnings tax effects for the directors of Matchstick Ltd based on the facts furnished Heres a standard evaluation Income Tax Consequences of Receiving 1000000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started