Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 1/9/2009, the Arab Towers Public Shareholding Company acquired 70% of the Jordanian Asmat Company. On 1/11/2010, Arab Towers Company acquired an additional 10%

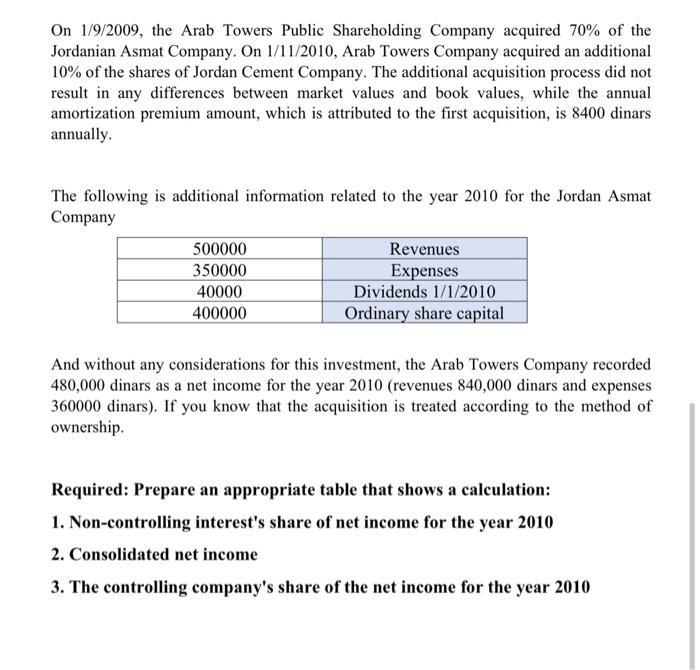

On 1/9/2009, the Arab Towers Public Shareholding Company acquired 70% of the Jordanian Asmat Company. On 1/11/2010, Arab Towers Company acquired an additional 10% of the shares of Jordan Cement Company. The additional acquisition process did not result in any differences between market values and book values, while the annual amortization premium amount, which is attributed to the first acquisition, is 8400 dinars annually. The following is additional information related to the year 2010 for the Jordan Asmat Company Revenues Expenses 500000 350000 40000 400000 Dividends 1/1/2010 Ordinary share capital And without any considerations for this investment, the Arab Towers Company recorded 480,000 dinars as a net income for the year 2010 (revenues 840,000 dinars and expenses 360000 dinars). If you know that the acquisition is treated according to the method of ownership. Required: Prepare an appropriate table that shows a calculation: 1. Non-controlling interest's share of net income for the year 2010 2. Consolidated net income 3. The controlling company's share of the net income for the year 2010

Step by Step Solution

★★★★★

3.42 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

2 Consolidated net Income Arab Towers Company net income 480000 revenue 840000 expenses 3...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started