Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 1st July 2019, the Director Finance of Sapphire Fabrics Ltd., wishes to know the working capital requirement for the current year to arrange

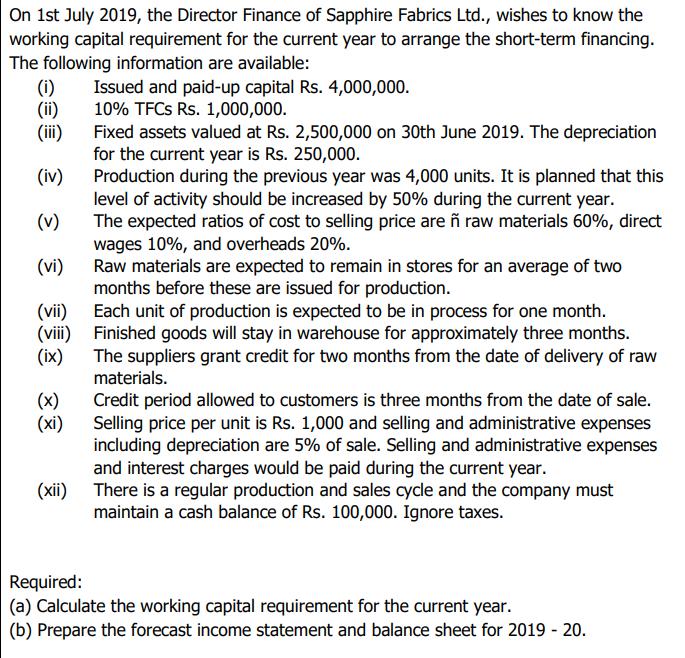

On 1st July 2019, the Director Finance of Sapphire Fabrics Ltd., wishes to know the working capital requirement for the current year to arrange the short-term financing. The following information are available: (i) (ii) (iii) (iv) (v) (vi) & (viii) Issued and paid-up capital Rs. 4,000,000. 10% TFCs Rs. 1,000,000. Fixed assets valued at Rs. 2,500,000 on 30th June 2019. The depreciation for the current year is Rs. 250,000. Production during the previous year was 4,000 units. It is planned that this level of activity should be increased by 50% during the current year. The expected ratios of cost to selling price are raw materials 60%, direct wages 10%, and overheads 20%. Raw materials are expected to remain in stores for an average of two months before these are issued for production. Each unit of production is expected to be in process for one month. Finished goods will stay in warehouse for approximately three months. (ix) The suppliers grant credit for two months from the date of delivery of raw materials. (xi) (xii) Credit period allowed to customers is three months from the date of sale. Selling price per unit is Rs. 1,000 and selling and administrative expenses including depreciation are 5% of sale. Selling and administrative expenses and interest charges would be paid during the current year. There is a regular production and sales cycle and the company must maintain a cash balance of Rs. 100,000. Ignore taxes. Required: (a) Calculate the working capital requirement for the current year. (b) Prepare the forecast income statement and balance sheet for 2019 - 20.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started