Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 2 December 1996, Belinda signed a contract to purchase a rental property in Tarragindi for $500,000. Belinda borrowed $400,000 to fund the purchase

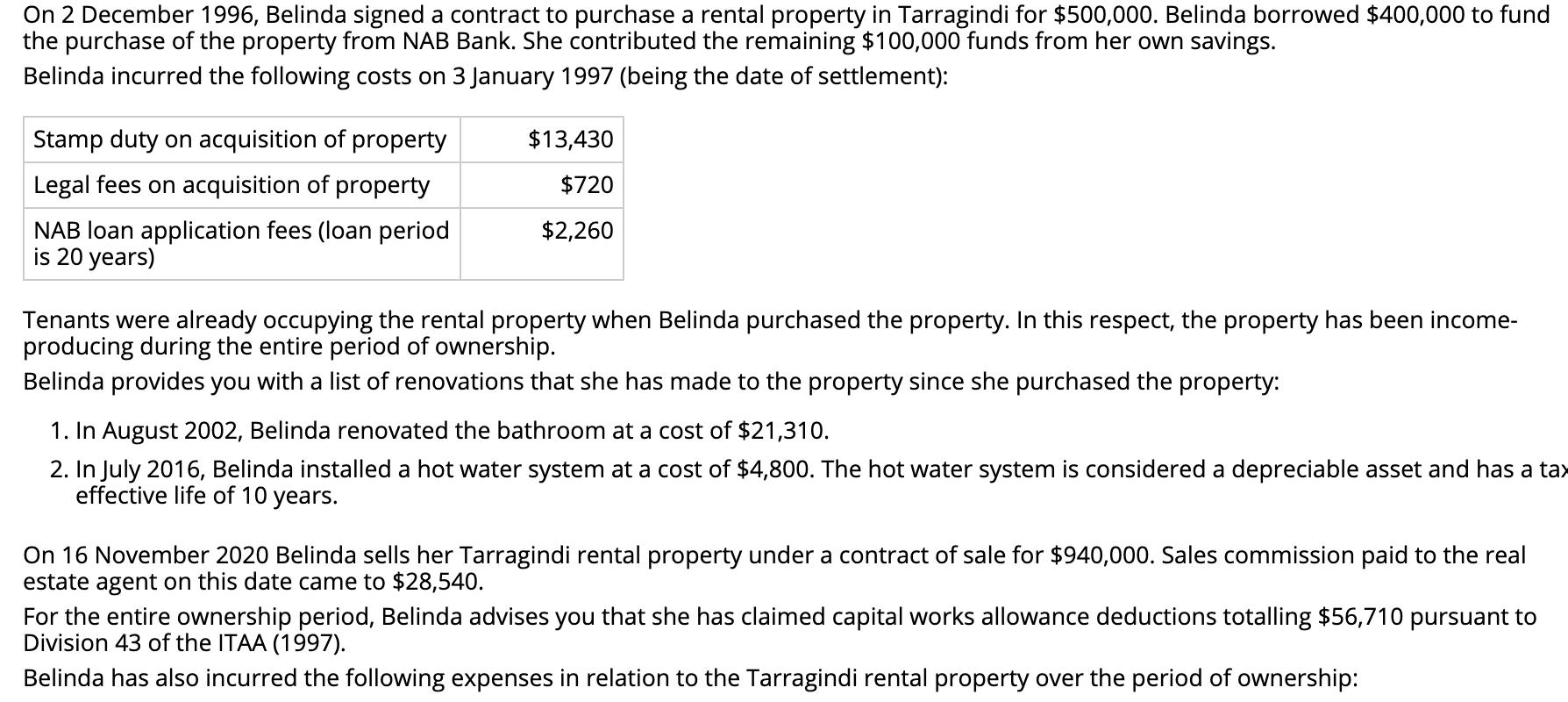

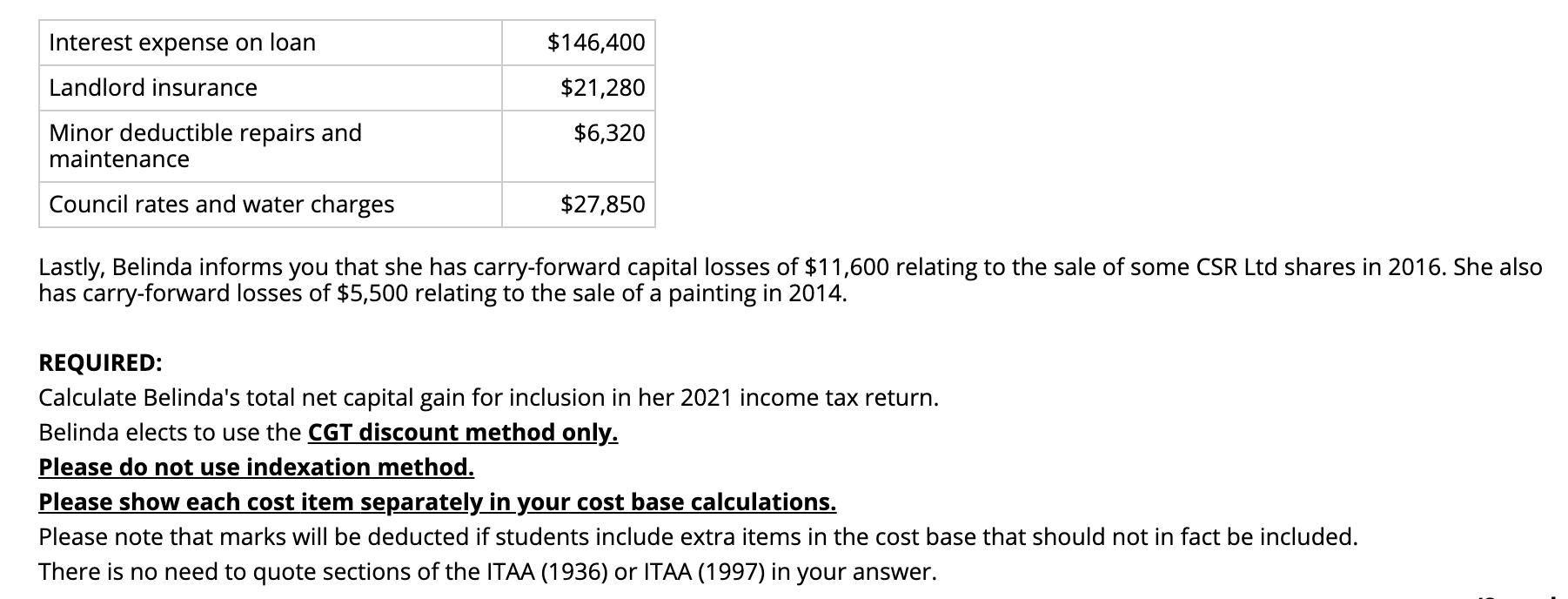

On 2 December 1996, Belinda signed a contract to purchase a rental property in Tarragindi for $500,000. Belinda borrowed $400,000 to fund the purchase of the property from NAB Bank. She contributed the remaining $100,000 funds from her own savings. Belinda incurred the following costs on 3 January 1997 (being the date of settlement): Stamp duty on acquisition of property Legal fees on acquisition of property NAB loan application fees (loan period is 20 years) $13,430 $720 $2,260 Tenants were already occupying the rental property when Belinda purchased the property. In this respect, the property has been income- producing during the entire period of ownership. Belinda provides you with a list of renovations that she has made to the property since she purchased the property: 1. In August 2002, Belinda renovated the bathroom at a cost of $21,310. 2. In July 2016, Belinda installed a hot water system at a cost of $4,800. The hot water system is considered a depreciable asset and has a tax effective life of 10 years. On 16 November 2020 Belinda sells her Tarragindi rental property under a contract of sale for $940,000. Sales commission paid to the real estate agent on this date came to $28,540. For the entire ownership period, Belinda advises you that she has claimed capital works allowance deductions totalling $56,710 pursuant to Division 43 of the ITAA (1997). Belinda has also incurred the following expenses in relation to the Tarragindi rental property over the period of ownership: Interest expense on loan Landlord insurance Minor deductible repairs and maintenance Council rates and water charges $146,400 $21,280 $6,320 $27,850 Lastly, Belinda informs you that she has carry-forward capital losses of $11,600 relating to the sale of some CSR Ltd shares in 2016. She also has carry-forward losses of $5,500 relating to the sale of a painting in 2014. REQUIRED: Calculate Belinda's total net capital gain for inclusion in her 2021 income tax return. Belinda elects to use the CGT discount method only. Please do not use indexation method. Please show each cost item separately in your cost base calculations. Please note that marks will be deducted if students include extra items in the cost base that should not in fact be included. There is no need to quote sections of the ITAA (1936) or ITAA (1997) in your answer.

Step by Step Solution

★★★★★

3.56 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Calculate belinder total net Capital gam 2nd Dec 1996 Rental protes Cost 1...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started